Ethereum rallied previous $3,700 earlier on Aug. 5 as whale and institutional accumulation intensified. Can it get well again above $3,800 by the top of the week?

Abstract

- Ethereum stays 148% above its year-to-date low regardless of latest volatility.

- New whale wallets have scooped up over $3 billion in two days.

- Macro uncertainty and ETF outflows proceed to cap upside momentum for ETH.

In response to knowledge from crypto.information Ethereum (ETH), the main altcoin by market cap, rose 5.7% to an intraday excessive of $3,730 on Tuesday, Aug. 5, earlier than settling again at $3,650 at press time. Its value is at present 148% above its year-to-date low.

The latest surge comes simply weeks after Ethereum tried to interrupt above the $4,000 mark in late July however was rejected close to $3,900 attributable to macro headwinds that ate into institutional threat urge for food and a notable decline in whole worth locked throughout its ecosystem.

ETH is seeing renewed whale accumulation and institutional inflows

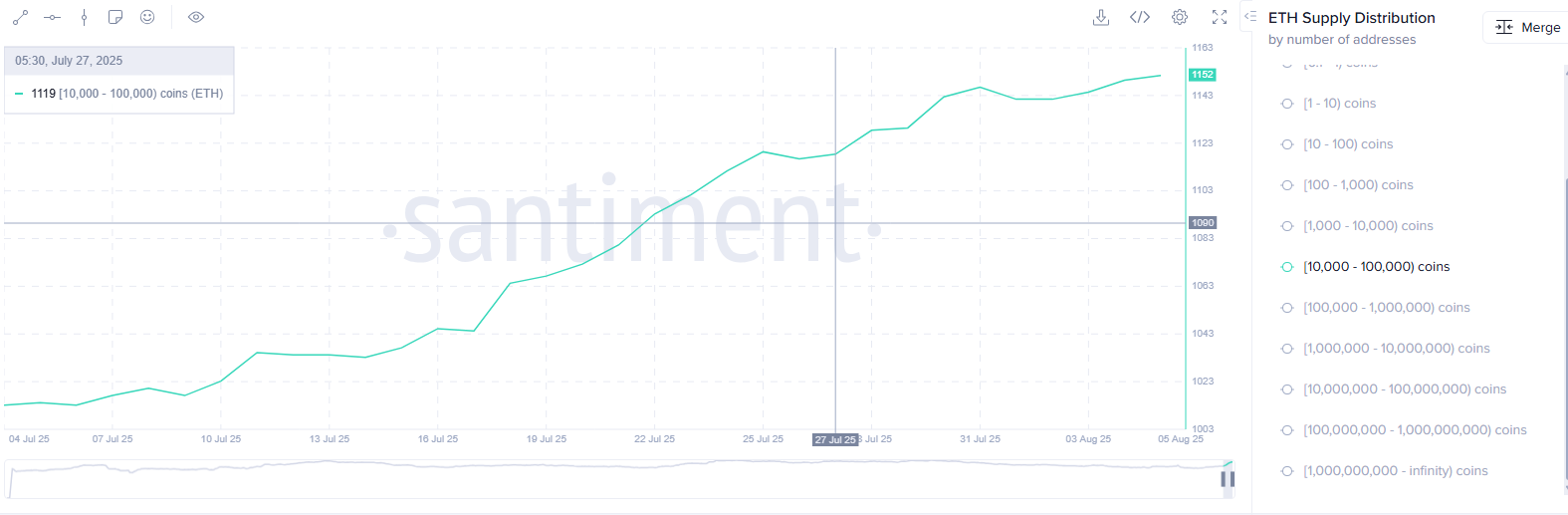

Ethereum’s rebound this week seems carefully tied to renewed accumulation by whales and enormous entities. In response to knowledge from Santiment, the variety of wallets holding greater than 10,000 ETH has grown noticeably over the previous few days, indicating that giant holders are positioning for potential upside.

Supply: Santiment

In the meantime, on Aug. 4, two newly created addresses acquired almost 40,000 ETH price roughly $142 million, in accordance with knowledge from Lookonchain. The shopping for development intensified on Aug. 5, when three further wallets accrued one other 63,837 ETH valued at round $236 million.

In whole, Lookonchain experiences that 14 recent whale wallets have collectively accrued over 856,000 ETH, price almost $3.16 billion, over simply two days.

This scale of accumulation, notably from new wallets, typically alerts rising conviction from high-net-worth people or institutional actors. These patrons usually take longer-term positions and accumulate forward of anticipated value appreciation. Their exercise can also be carefully watched by retail merchants, who typically interpret such strikes as a bullish sign.

You may additionally like: Chainlink unveils Information Streams for U.S. equities and ETFs

Along with whale shopping for, institutional curiosity in Ethereum can also be gaining momentum. There was a noticeable uptick in treasuries and structured merchandise centered on ETH.

Some of the distinguished developments is the expansion of the Strategic Ethereum Reserve (SER), which tracks institutional Ethereum holdings throughout main funds, treasuries, and asset managers.

Simply six weeks in the past, the SER’s whole belongings underneath administration stood beneath $3 billion. That determine has now surged to over $10.8 billion, and the reserve controls 2.45% of ETH’s whole provide, up from simply 1% in June.

Contributing to this surge, SharpLink, a Nasdaq-listed gaming agency and one of many prime holders throughout the SER, added 18,680 ETH price roughly $66.63 million to the reserve on Aug. 4. This transfer alerts that company treasuries proceed to see Ethereum as a strategic long-term asset.

What’s subsequent for ETH?

Regardless of the numerous whale accumulation and renewed institutional shopping for, Ethereum nonetheless lacks the momentum wanted to decisively break above the $3,800–$3,900 resistance zone.

Whereas recent capital has re-entered the market via new whale wallets and treasury allocations, these inflows have but to translate right into a broad shift in market sentiment.

Final week, Ethereum-focused ETFs noticed outflows totaling $129 million, which signifies that mainstream buyers are nonetheless hesitant, and macroeconomic uncertainty, starting from commerce struggle dangers to issues over the U.S. labor market, continues to weigh on threat belongings.

With out a clear narrative or short-term catalyst, the present rally stays susceptible to reversal.

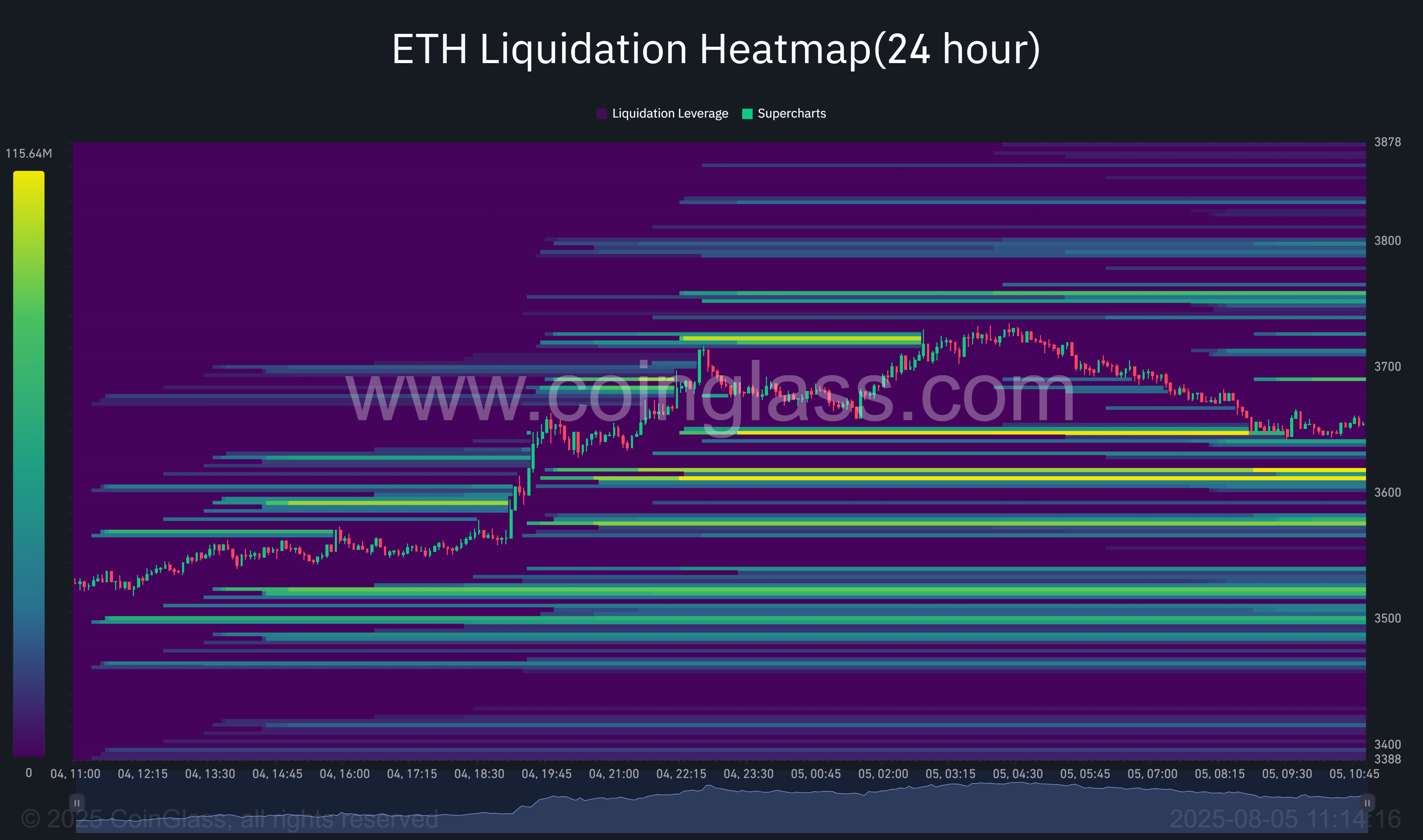

Information from CoinGlass means that Ethereum is buying and selling precariously near a dense cluster of lengthy liquidation ranges between $3,620 and $3,660. This zone, illuminated by high-intensity bands on the 24-hour heatmap, represents a big focus of overleveraged lengthy positions that might be compelled out if ETH slips additional.

ETH Liquidation map : Supply: CoinGlass

This setup introduces a short-term draw back threat. If Ethereum fails to carry above the $3,650 mark, a transfer into the $3,620–$3,660 pocket may set off cascading liquidations.

Such a situation would possible intensify promoting strain, pushing ETH nearer to secondary liquidity swimming pools close to $3,580 and even $3,540, the place further lengthy positions are susceptible. These ranges act as liquidity magnets, which means value might gravitate towards them to “harvest” open positions earlier than rebounding.

Conversely, if bulls handle to defend the present assist zone and spark a short-term rebound, Ethereum might goal brief liquidation clusters close to $3,730–$3,780.

But some market watchers count on Ethereum’s restoration to $4,000, supported by bullish technicals.

$ETH weekly chart is giving BTFD vibes.

Good assist retest, and now patrons have stepped in.

Ship ETH above $4,000 now. 🚀 pic.twitter.com/A2GDBxTPIo

— Ted (@TedPillows) August 4, 2025

Learn extra: Bitpanda eyes market growth because it hits file profitability

Disclosure: This content material is supplied by a 3rd occasion. Neither crypto.information nor the writer of this text endorses any product talked about on this web page. Customers ought to conduct their very own analysis earlier than taking any motion associated to the corporate.