$Ethereum has adopted a really totally different path from Bitcoin — extra risky, extra narrative-driven, and infrequently extra aggressive on each the upside and draw back. As 2026 approaches, $ETH is as soon as once more sitting at a technically essential space, elevating a well-recognized query: is Ethereum organising for an additional main cycle transfer, or coming into an extended consolidation section?

To reply that, we have to have a look at Ethereum’s long-term value habits, not simply short-term noise.

Ethereum’s Lengthy-Time period Worth Construction: Respecting the Development

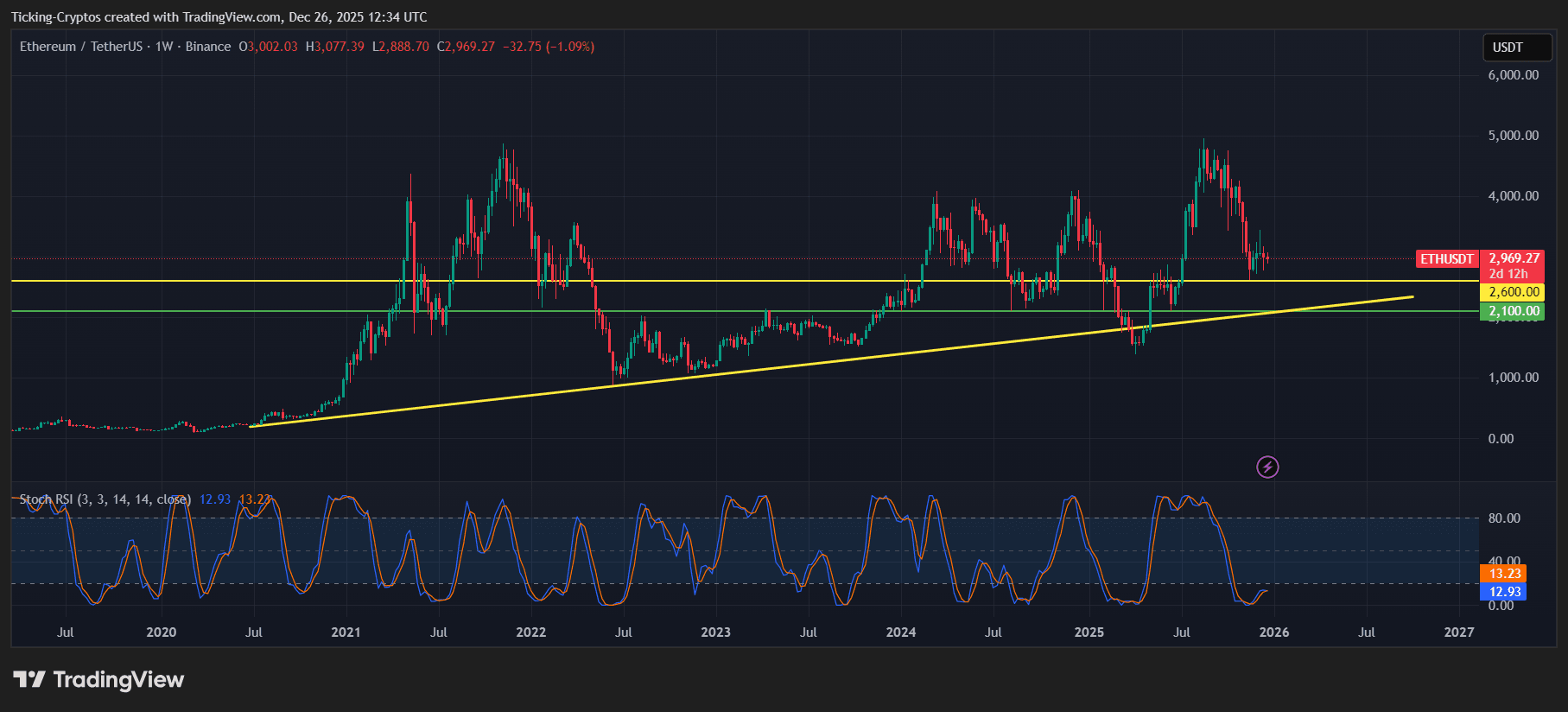

On the weekly ETH chart, one factor stands out clearly: Ethereum continues to respect its long-term ascending trendline, regardless of a number of main crashes through the years.

Traditionally:

- ETH rallies are typically sharper than Bitcoin’s

- Corrections are additionally deeper and quicker

- Lengthy-term trendlines have repeatedly acted as accumulation zones

ETH/USDT 1W – TradingView

Each time Ethereum has revisited its long-term help construction, it has both bounced strongly or entered a chronic consolidation earlier than the following growth section.

Ethereum By way of Bull and Bear Cycles

Ethereum’s cycle habits exhibits a transparent sample:

- Explosive upside throughout bull markets, usually outperforming Bitcoin

- Heavy drawdowns throughout bear markets, typically exceeding 70 p.c

- Lengthy restoration phases the place ETH builds construction earlier than breaking out once more

This makes Ethereum extra delicate to market sentiment, liquidity, and narrative shifts — particularly round upgrades, scaling, and ecosystem development.

The place Ethereum Stands Heading Into 2026

Technically, Ethereum is approaching 2026 whereas sitting:

- Close to a long-term rising help line

- Beneath main historic resistance zones

- In a cooling momentum atmosphere after a powerful growth section

This mixture usually indicators a choice zone, the place value both reclaims larger ranges or drifts right into a broader vary.

Volatility compression at these ranges has traditionally preceded giant ETH strikes.

Ethereum Worth Prediction for 2026: Bullish vs Bearish Situations

Bullish State of affairs

If liquidity improves and threat urge for food returns:

- Ethereum may reclaim key resistance ranges

- A breakout above long-term ranges may set off renewed upside

- ETH could as soon as once more outperform Bitcoin in a risk-on atmosphere

On this situation, 2026 would resemble a continuation 12 months inside a bigger cycle fairly than a market prime.

Bearish State of affairs

If macro strain and tightening liquidity persist:

- Ethereum may stay range-bound for a lot of the 12 months

- Lengthy-term help zones can be examined extra incessantly

- Sideways value motion may dominate earlier than a later breakout

Traditionally, Ethereum has spent total years consolidating earlier than main upside strikes.

What Historical past Suggests About Ethereum in 2026

Wanting again at earlier cycles:

- Ethereum hardly ever collapses with out first breaking long-term construction

- Most main ETH rallies began after lengthy intervals of frustration

- Lengthy-term holders sometimes accumulate throughout boring, sideways phases

This implies that 2026 could also be much less about chasing hype and extra about positioning forward of the following structural transfer.