TL;DR

- Ethereum holds $4,100 help whereas falling wedge and Wyckoff setup trace at sturdy upside potential.

- Worth compression close to 20-week MA builds, with eyes on $3,550–$3,750 as key dip zone.

- ETH This autumn rallies in 2017 and 2020 recommend seasonal power might repeat in late 2025.

Pullback Checks Assist as Compression Builds

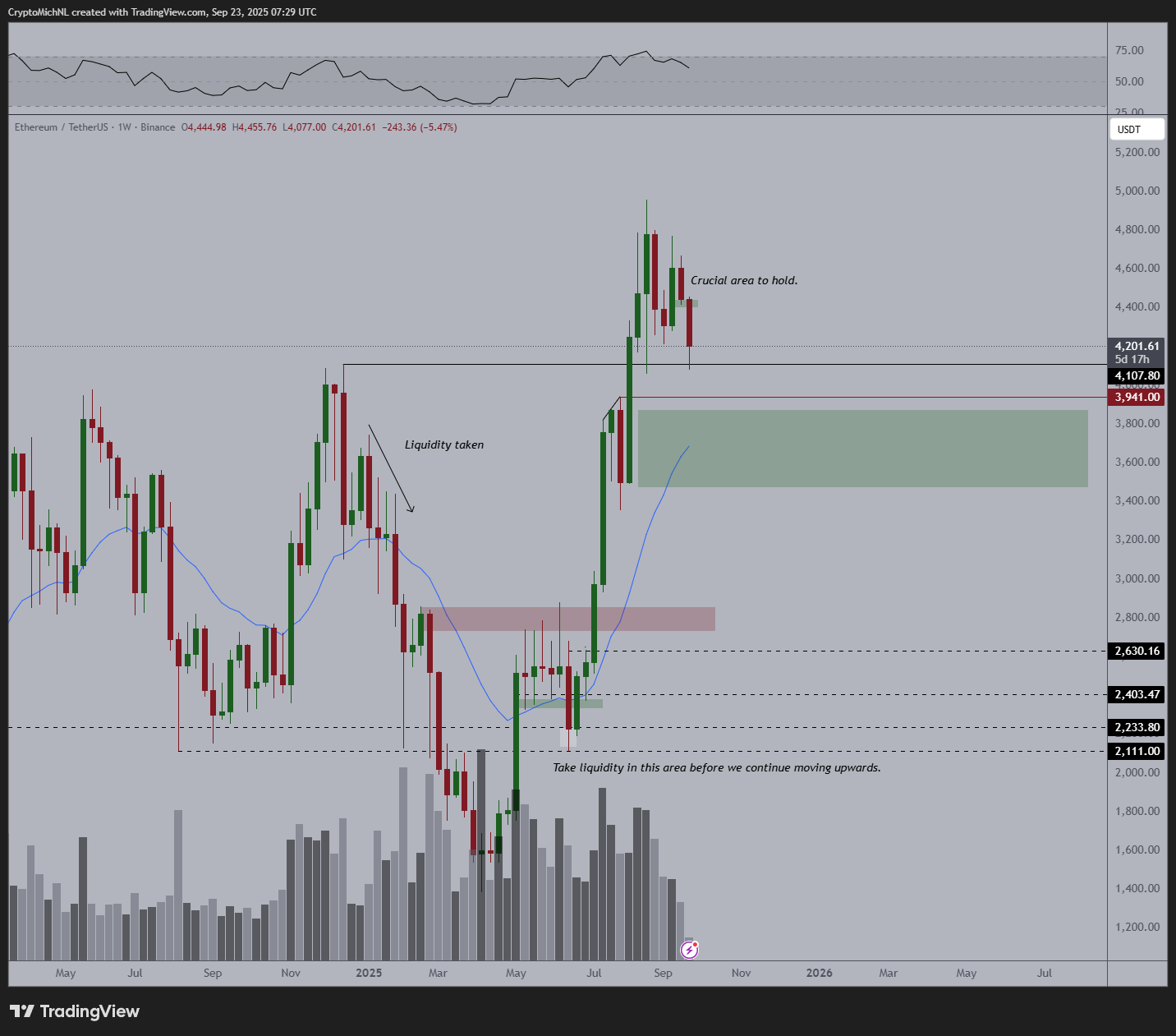

Ethereum (ETH) is buying and selling close to $4,200 after a pointy decline from latest highs near $4,950. The correction places the asset down almost 20% from its peak. Regardless of the drop, some market contributors are watching key value ranges as potential areas of curiosity.

Michaël van de Poppe, a market analyst, notes that Ethereum might enter a sideways interval. He factors out that the 20-week transferring common is now approaching the value, and compression is forming.

He said, “I don’t know whether or not we’ll dip as deep as $3,550–$3,750,” leaving open the likelihood for a transfer into that vary however not confirming it. The zone between $3,550 and $3,750 is marked as potential help, near the rising 20-week MA.

On the weekly timeframe chart, ETH’s value retains holding above $4,100 as a important zone. Just under lies a wider help space that rests between $3,550 and $3,750, aligning with a former breakout space and the 20-week transferring common. A inexperienced help field additionally seems decrease on the chart as a historic consolidation space round $2,800.

Previous strikes present that ETH has responded to those ranges. Labels corresponding to “liquidity taken” at $3,900 and “take liquidity on this space” close to $2,800 recommend that if the value revisits these ranges, reactions might comply with. Decrease quantity in latest weeks helps the concept that value could also be making ready for a extra directional transfer.

Chart Buildings Level to a Setup

One other sample on the chart comes from Dealer Tardigrade, who factors to a falling wedge. The setup is evident, with the asset trending inside two downward traces. The falling wedge is close to its apex, and the value is testing earlier breakout ranges. The chart features a doable transfer towards $6,800 if it breaks above the wedge.

Individually, Merlijn The Dealer makes use of the Wyckoff mannequin to explain ETH’s motion. The mannequin exhibits that Ether might have accomplished its Spring, Check, and Signal of Energy phases. It’s now in what’s labeled because the Final Level of Assist, a place within the construction the place stronger upward motion typically begins. “That is the place Ethereum accelerates into 5 digits,” he wrote, pointing to the subsequent section of the cycle.

This autumn Setup Resembles Earlier Cycles

Ethereum has had a powerful fourth-quarter efficiency throughout previous bull runs. In 2017, it gained over 140% in This autumn. In 2020, these returns have been above 100%. This yr, ETH noticed a drop of -45.41% in Q1 however recovered in Q2 (+36.48%) and Q3 (+79.55%).

Crypto Rand referred to those figures and requested,

GM guys! Is $ETH on the brink of carry out like in 2017 and 2020? pic.twitter.com/JaIv9ogrEZ

— Rand (@crypto_rand) September 23, 2025

The latest rebound and historic This autumn power have led to comparisons with these cycles. Whereas no final result is assured, merchants are watching to see if the same pattern develops.