Yesterday, Dec. 10, BlackRock’s Ethereum ETF (ETHA) made an enormous splash, touchdown within the high 4 ETF launches of 2024, in keeping with Nate Geraci, President of the ETF Retailer. With a each day internet influx of round $81.6574 million, ETHA has seen constant progress over the previous 12 days, making it a key participant within the extremely aggressive cryptocurrency panorama.

Yesterday’s knowledge confirmed that whole internet inflows for spot Ethereum ETFs reached about $305.74 million. Of this, BlackRock’s ETHA accounted for an enormous chunk of change – $81.65 million – whereas Constancy’s ETF (FETH) led the pack with $202 million.

Make that 8 straight days of inflows into iShares Ethereum ETF…

Over $1bil whole.

High 4 ETF launch of 2024 (out of approx 675 ETFs). https://t.co/5LKWrDdfjw

— Nate Geraci (@NateGeraci) December 11, 2024

As BlackRock’s ETHA continues to achieve floor, its success displays broader tendencies within the cryptocurrency funding area. Ethereum-focused funding merchandise noticed record-breaking inflows this week, reaching a complete of $1.2 billion and exceeding earlier highs set in July.

Will BlackRock launch Solana (SOL) ETF, although?

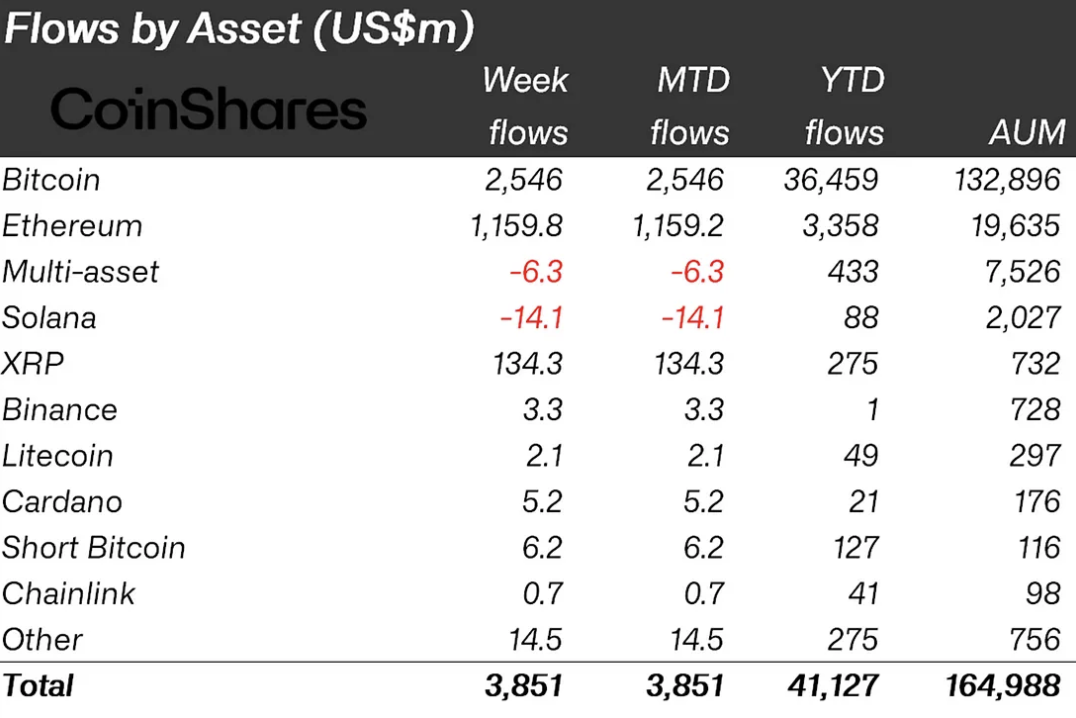

This has led to a drop in Solana, which has seen $14 million in outflows for 2 weeks working, in keeping with CoinShares analyst James Butterfill.

BlackRock’s general efficiency has additionally been fairly spectacular. Its Bitcoin ETF, IBIT, is now equal to the mixed measurement of fifty European-based ETFs, which reveals that its affect extends past simply Ethereum investments.

In the meantime, ETHA is within the high 4 for ETF launches, simply behind leaders like IBIT and FBTC. It has sturdy momentum and will shut the hole earlier than the top of the 12 months and are available in third amongst all ETFs.

BlackRock’s Ethereum ETF has carved out a definite area in a aggressive market, giving buyers a strategy to achieve publicity to Ethereum’s progress. With its regular inflows and rising visibility, ETHA is shaping as much as be a robust contender within the panorama of digital asset investing.