ETH treasuries stands out as the most impactful reserves, as company shopping for holds almost 5% of the whole provide. ETH could not solely present passive revenue, but additionally governance rights to DAT corporations.

Digital asset treasuries (DAT) that accumulate ETH stands out as the most impactful entities. Towards the top of 2025, DAT corporations maintain almost 5% of the ETH provide, a a lot greater share in comparison with different forms of treasuries.

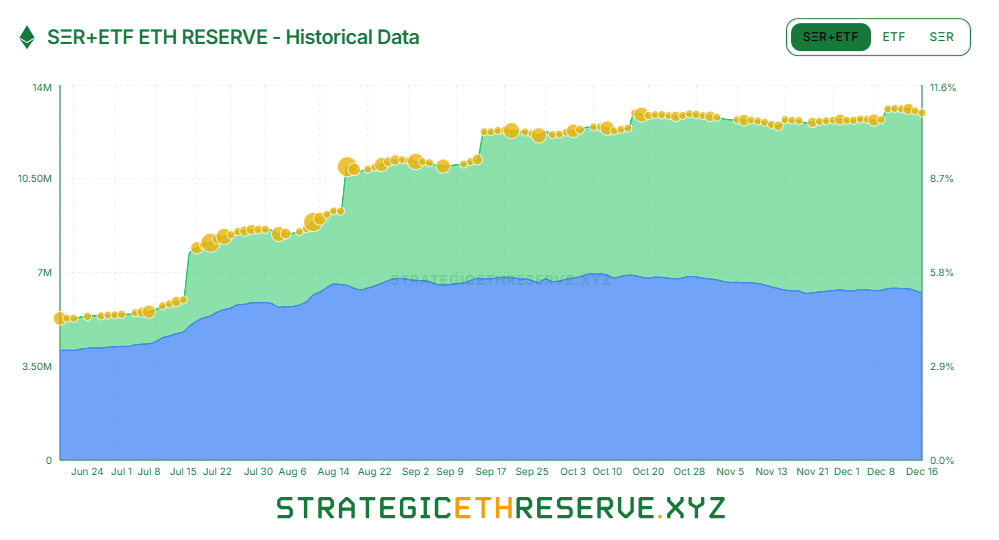

ETH treasuries are rising extra slowly, however could develop into extremely influential because the tokens are used for liquid staking. | Supply: Strategic ETH reserve

The treasuries management 4.7% of the provision, with extra progress anticipated within the coming months. Round 70% of that offer is within the reserves of Bitmine (BMNR). The main treasury itself goals to carry 5% of all ETH in circulation.

Bitmine stays the important thing ETH reserve purchaser

Bitmine stays essentially the most common purchaser up to now few weeks. The corporate logged 5 vital ETH purchases up to now month, increasing its treasury by 13.2%.

On the similar time, legacy treasuries are being offered. Standing, an organization that held one of many largest ICOs in 2017, offered 6.2% of its treasury, although nonetheless retaining 11.2K ETH.

Bitmine now holds a few of the largest concentrated treasuries of ETH, or round 3.78% of the provision. The treasury firm is forward of trade and whale wallets in relation to staking, liquid staking, or different wrapped types of ETH.

For now, Bitmine holds the ETH passively, however the firm just lately shared that staking could start in 2026. Bitmine shared plans to construct a US-focused staking community, operating a high-profile validator. As a validator, Bitmine could attract an excellent greater stake of ETH below its affect.

Solana stakers could type the same set of validators, although at a smaller scale in comparison with ETH. Validators can then acquire affect and supply extra passive revenue.

Not like different treasuries, ETH and SOL treasuries can have utility, whereas additionally supporting community safety.

ETH crashes under $3,000 as market stays fearful

ETH is among the least unstable treasury property. Regardless of this, within the quick time period, ETH is pressured by promoting and bearish expectations.

After the newest week of market weak spot, ETH dipped below $3,000 once more up to now few days. The token sank to a one-week low of $2,942.40.

Regardless of accumulation by whales, ETH can be feeling promoting strain from ETFs, in addition to older holders. Just lately, BlackRock deposited over $220M in ETH to Coinbase Prime, doubtlessly including to the promoting strain.

One other large-scale whale absolutely exited his spot place of over 10K ETH. The promoting offset the latest Bitmine addition of $140M in ETH purchases. Whereas shopping for the dip exhibits long-term confidence, within the quick time period, sellers are able to crashing the value and inflicting liquidations. ETH nonetheless trades with a fearful sentiment, as crypto use instances and utility are getting re-evaluated.