U.S.-listed crypto ETFs are flashing pink throughout the board, with one notable exception.

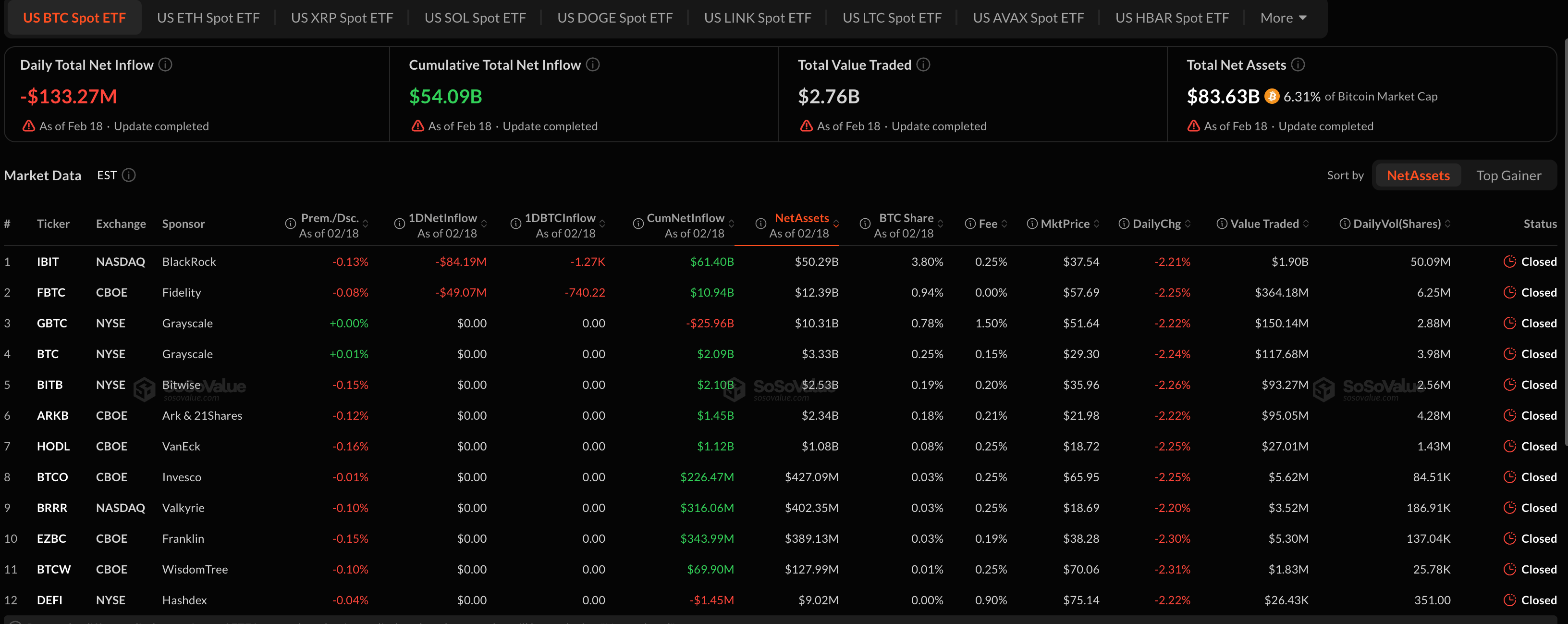

Bitcoin spot ETFs noticed $133.3 million in every day web outflows as of Feb. 18, led by BlackRock’s IBIT, which shed $84.2 million, and Constancy’s FBTC, which misplaced $49 million. Complete web property throughout bitcoin funds stand at $83.6 billion, roughly 6.3% of bitcoin’s market cap, however current flows recommend establishments are trimming publicity fairly than including on dips.

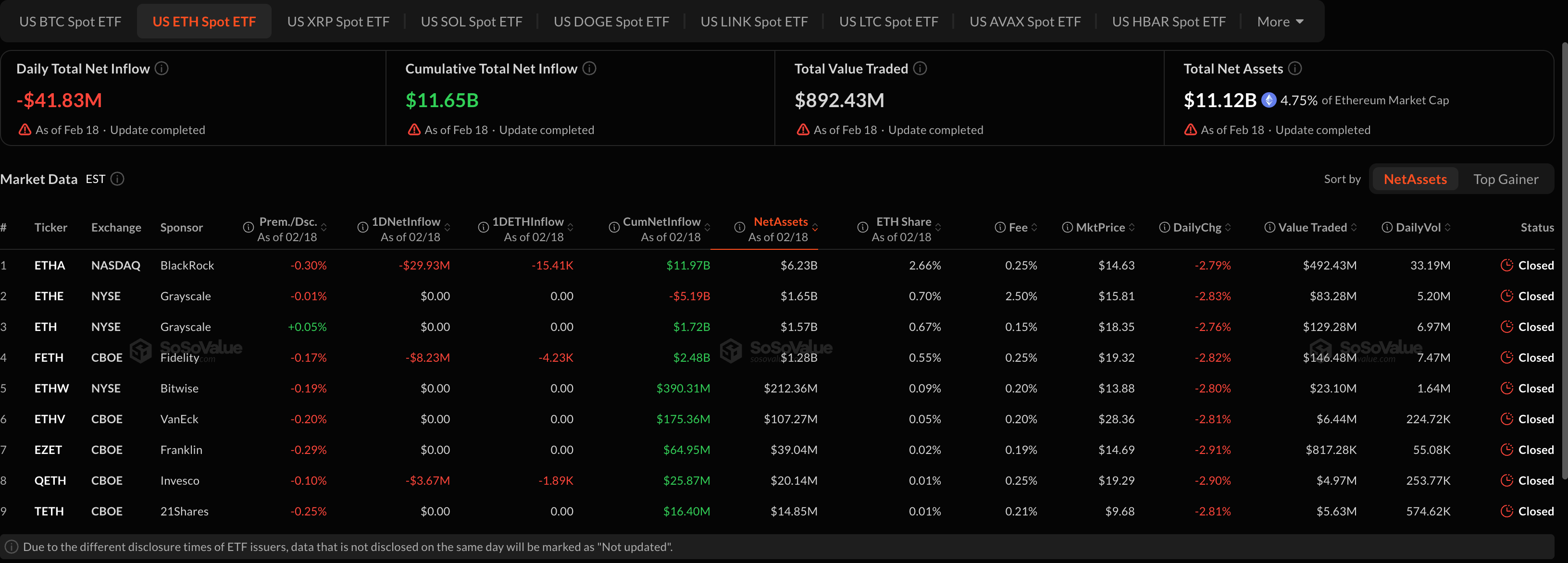

Ethereum merchandise adopted an analogous sample. U.S. $ETH spot ETFs recorded $41.8 million in web outflows on the day, with BlackRock’s ETHA shedding practically $30 million. Complete web property throughout ether funds sit at $11.1 billion, about 4.8% of $ETH’s market cap.

The regular bleed comes as ether trades beneath $2,000 and struggles to construct momentum regardless of broader expectations of price cuts later this yr.

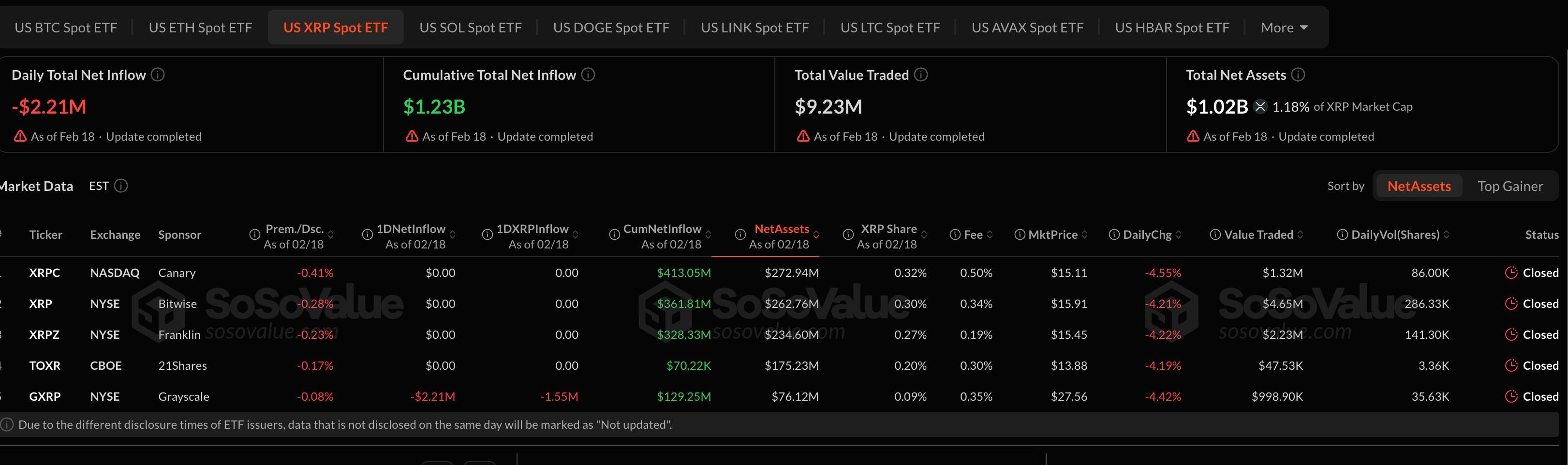

$XRP ETFs additionally slipped into unfavourable territory, posting $2.2 million in every day outflows. Complete web property throughout $XRP funds are simply over $1 billion, or roughly 1.2% of $XRP’s market cap. Worth motion in $XRP has mirrored the cautious tone, with the token down over 4% on the day.

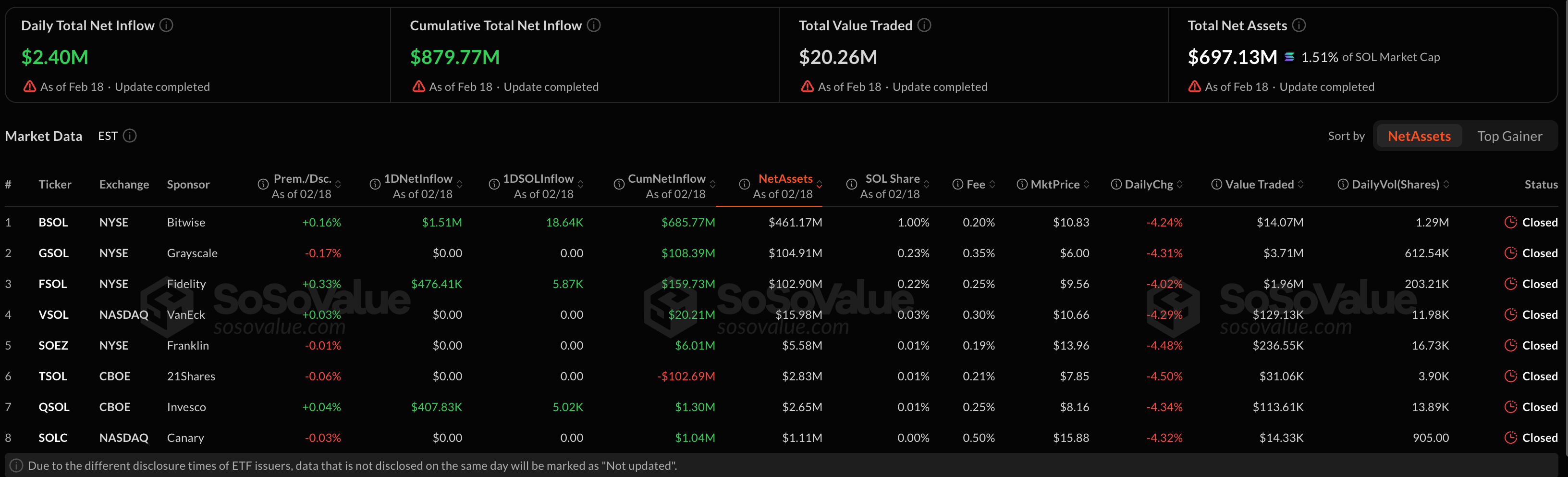

Solana, nonetheless, stood out.

U.S. SOL spot ETFs recorded $2.4 million in web inflows, pushing cumulative inflows to almost $880 million. Bitwise’s BSOL led with $1.5 million in contemporary capital. Whereas modest in absolute phrases, the influx contrasts sharply with the broader risk-off positioning throughout bitcoin and ether merchandise.

Elsewhere, smaller altcoin ETFs akin to LINK noticed marginal inflows, however the total image stays one in every of selective publicity fairly than broad-based accumulation.

The divergence suggests traders are rotating inside crypto fairly than exiting completely. With macroeconomic uncertainty lingering and the greenback firming, ETF flows provide a real-time learn on the place institutional conviction stays and the place it’s fading.