By Omkar Godbole (All occasions ET except indicated in any other case)

Transfer over crypto-USD pairs. As bitcoin BTC$92,864.00 and the broader market consolidate on current positive aspects, this can be the best time to deal with cross pairs, particularly the ether-bitcoin (ETH/BTC) ratio.

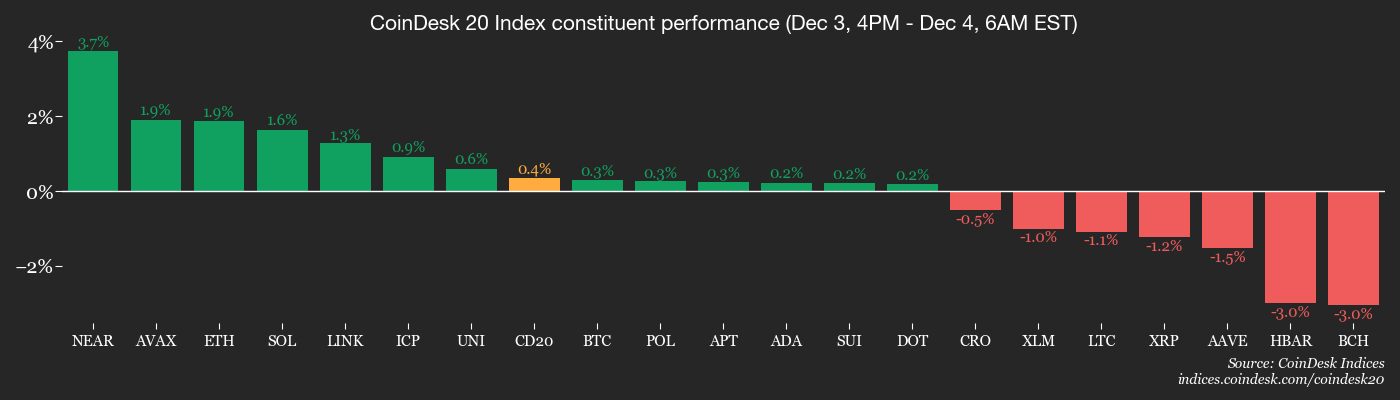

Ether ETH$3,179.71 has gained greater than 4% over the previous 24 hours, approaching $3,200, whereas bitcoin BTC$92,864.00 stays little modified above $93,000. The CoinDesk 20 and CoinDesk 80 indices have risen about 1%.

Ether’s momentum has lifted the ETH/BTC ratio by 4%, cementing the bullish technical breakout above the descending trendline from August highs. The sample, mentioned within the technical evaluation part, signifies an impending ether bull run towards BTC.

This outlook is strengthened by constructive elementary developments, together with the Fusaka improve rolled out on Wednesday. The improve enhances Ethereum’s scalability by growing blob capability and introducing a extra environment friendly>

The change “boosts Ethereum’s Layer-1 execution capability by way of EIP-7935, which raises the protocol’s default fuel restrict to 60M,” CoinMetrics mentioned. “This immediately will increase the variety of transactions that may slot in a block, permitting for larger throughput, much less congestion and cheaper fuel charges.”

It is no shock that analysts like BRN’s Timothy Misir are calling the improve a tailwind for ether.

“Community development touched 190,000 new addresses in a single day, indicating real natural enlargement post-Fusaka,” Misir mentioned in an electronic mail, noting the renewed aggressive ETH accumulation by wallets holding 1,000-10,000 ETH.

In different bullish information, spot ether ETFs listed within the U.S. pulled in $140 million in traders’ funds on Wednesday. XRP funds pulled in $50 million whereas BTC and SOL ETFs registered outflows.

PayPal’s stablecoin, PYUSD, has grow to be the sixth-largest stablecoin, rising by over 36% up to now month.

In conventional markets, debate raged over the potential influence of rising Japanese authorities bond yields on threat property. Dutch funding financial institution ING flagged potential for a rally within the U.S. 10-year Treasury yield. Keep alert!

Learn extra: For evaluation of as we speak’s exercise in altcoins and derivatives, see Crypto Markets At the moment

What to Watch

For a extra complete record of occasions this week, see CoinDesk’s “Crypto Week Forward”.

- Crypto

- Macro

- Dec. 4, 7 a.m.: Brazil Q3 GDP Progress Price. QoQ Est. 0.2%, YoY Est. 1.7%.

- Dec. 4, 8:30 a.m.: U.S. Preliminary Jobless Claims for week ended Nov. 29 Est. 220K, Persevering with Jobless Claims for week ended Nov. 22 Est. 1960K.

- Dec. 4, 12 p.m.: Federal Reserve Vice Chair for Supervision Michelle W. Bowman will ship a speech on “Financial institution Supervision and Regulation.”

- Dec. 4, 2-4 p.m.: U.S. SEC Investor Advisory Committee Assembly panel dialogue on “Tokenization of Equities.”

- Dec. 4-5: twenty third India-Russia Annual Summit. Russian President Vladimir Putin is visiting New Delhi to satisfy with Indian Prime Minister Narendra Modi.

- Earnings (Estimates primarily based on FactSet information)

Token Occasions

For a extra complete record of occasions this week, see CoinDesk’s “Crypto Week Forward”.

- Governance votes & calls

- Arbitrum DAO is voting to elect the ultimate three members of the 2026 AGV Council from a pool of six candidates. Voting ends Dec. 4.

- The Rootstock Collective is voting to ascertain and develop the Rootstock (RSK) group in Ghana. This initiative focuses on driving adoption of the Bitcoin sidechain by onboarding new customers and coaching native builders. Voting ends Dec. 4.

- Unlocks

- Token Launches

- Dec. 4: Alpha Companions’ crosschain bridge and decentralized trade go stay.

Conferences

For a extra complete record of occasions this week, see CoinDesk’s “Crypto Week Forward”.

- Day 3 of three: FT’s International Banking Summit (London)

- Day 2 of two: Binance Blockchain Week 2025 (Dubai)

- Day 1 of two: Milken Institute Center East and Africa Summit 2025 (Abu Dhabi)

Market Actions

- BTC is down -0.44% from 4 p.m. ET Wednesday at $93,325.36 (24hrs: +0.24%)

- ETH is up 0.93% at $3,194.78 (24hrs: +3.84%)

- CoinDesk 20 is down 0.55% at 3,017.58 (24hrs: +0.95%)

- Ether CESR Composite Staking Price is up 1 bps at 2.85%

- BTC funding price is at 0.0078% (8.5728% annualized) on Binance

- DXY is unchanged at 98.86

- Gold futures are unchanged at $4,231.00

- Silver futures are down 1.16% at $57.94

- Nikkei 225 closed up 2.33% at 51,028.42

- Grasp Seng closed up 0.68% at 25,935.90

- FTSE is unchanged at 9,692.43

- Euro Stoxx 50 is up 0.39% at 5,717.01

- DJIA closed on Wednesday up 0.86% at 47,882.90

- S&P 500 closed up 0.30% at 6,849.72

- Nasdaq Composite closed up 0.17% at 23,454.09

- S&P/TSX Composite closed up 0.36% at 31,160.54

- S&P 40 Latin America closed up 0.2% at 3,216.12

- U.S. 10-Yr Treasury price is up 2.1 bps at 4.079%

- E-mini S&P 500 futures are unchanged at 6,864.75

- E-mini Nasdaq-100 futures are unchanged2% at 25,662.25

- E-mini Dow Jones Industrial Common Index futures are unchanged at 47,994.00

Bitcoin Stats

- BTC Dominance: 59.33% (+0.09%)

- Ether-bitcoin ratio: 0.03419 (0.18%)

- Hashrate (seven-day transferring common): 1,047 EH/s

- Hashprice (spot): $39.66

- Complete charges: 3.56 BTC / $331,173

- CME Futures Open Curiosity: 122,040 BTC

- BTC priced in gold: 22.2 oz.

- BTC vs gold market cap: 6.24%

Technical Evaluation

ETH/BTC’s day by day chart in candlestick format. (TradingView)

- The chart exhibits day by day swings within the ether-bitcoin (ETH/BTC) ratio in candlestick format.

- The ratio has damaged out of a descending channel, indicating ether outperformance forward.

Crypto Equities

- Coinbase International (COIN): closed on Wednesday at $276.92 (+5.19%), +0.23% at $277.56 in pre-market

- Circle (CRCL): closed at $86.29 (+11.43%), +0.15% at $130.04

- Galaxy Digital (GLXY): closed at $27.05 (+6.66%), +0.37% at $27.15

- Bullish (BLSH): closed at $46.37 (+7.69%), -0.15% at $46.30

- MARA Holdings (MARA): closed at $12.47 (+4.7%), +0.24% at $12.50

- Riot Platforms (RIOT): closed at $15.64 (+2.76%), +0.32% at $15.69

- Core Scientific (CORZ): closed at $16.55 (+4.61%), -0.36% at $16.49

- CleanSpark (CLSK): closed at $14.49 (+5.69%), -0.14% at $14.47

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $45.47 (+4.10%), -0.99% at $45.02

- Exodus Motion (EXOD): closed at $14.33 (-1.04%), unchanged in pre-market

Crypto Treasury Firms

- Technique (MSTR): closed at $188.39 (+3.89%), +0.21% at $188.78

- Semler Scientific (SMLR): closed at $20.44 (+2.3%)

- SharpLink Gaming (SBET): closed at $10.59 (+6.22%), +0.94% at $10.69

- Upexi (UPXI): closed at $2.91 (+0.52%), -5.32% at $7.66

- Lite Technique (LITS: closed at $1.76 (-2.22%), -2.27% at $1.72

ETF Flows

Spot BTC ETFs

- Each day web flows: -$14.9 million

- Cumulative web flows: $57.74 billion

- Complete BTC holdings ~1.31 million

Spot ETH ETFs

- Each day web flows: $140.2 million

- Cumulative web flows: $13.02 billion

- Complete ETH holdings ~6.24 million

Supply: Farside Traders

Whereas You Had been Sleeping

- Citadel Challenges DeFi Framework in Letter to SEC, Sparking Trade Outrage (CoinDesk): Citadel Securities mentioned some DeFi platforms resemble broker-dealers and urged formal rulemaking, warning that unequal regulation of tokenized and conventional markets might weaken investor protections.

- Putin and Modi Deepen Relationship That Has Drawn Trump’s Anger (The Wall Road Journal): Russian President Vladimir Putin’s go to to New Delhi for talks on oil and arms is prone to escalate tensions with the U.S., as President Donald Trump pushes again towards India’s rising ties with Moscow.

- BTC at $100K Again on Desk as Volatility Shatters Uptrend, Ether Bulls Develop Bolder (CoinDesk): A pointy drop in bitcoin volatility and reclaiming of $93K has bulls aiming for $100K, whereas ether’s restoration from a failed breakdown is fueling requires $3,500.

- CZ Teases New BNB Chain Native Prediction Market Predict.Enjoyable (CoinDesk): The platform pays yield on lively bets, however restricted stablecoin provide on BNB Chain might hinder development as it really works to rival smaller opponents like Limitless.