Ethereum builders have formally set December 3, 2025, because the date for the long-awaited Fusaka improve. Merchants are already watching carefully to see if Fusaka can gasoline the subsequent main rally.

The buying and selling technique that follows was generated by AI utilizing real-time market context, the historic influence of Pectra, and structured prompts designed to filter out human bias.

The result’s a sensible, step-by-step plan aimed toward serving to new buyers enter Ethereum forward of Fusaka with out chasing the market or taking over pointless danger.

What Is The Ethereum Fusaka Improve?

The Fusaka improve is Ethereum’s subsequent main community replace. Its important purpose is to enhance scalability and decrease prices for customers and builders.

Necessary selections had been made on immediately’s Ethereum developer name, ACDC #165. Builders confirmed the general public testnet schedule and BPO exhausting fork schedule for Fusaka.

Let’s get into it. pic.twitter.com/mNrYMYyDj2

— Christine D. Kim (@christine_dkim) September 18, 2025

Particularly, a key function is PeerDAS (Peer Information Availability Sampling). This permits validators to examine solely components of huge information blobs as an alternative of downloading them in full.

So, the improve will scale back the burden on {hardware} and make the Ethereum community extra environment friendly.

Additionally, Fusaka will increase blob capability. It’ll allow rollups and Layer-2 options to submit extra information at decrease prices.

Collectively, these adjustments deliver Ethereum nearer to its long-term scaling roadmap often known as “the Surge.”

Ethereum Roadmap. Supply: Ethereum.org

Ethereum Funding Technique Earlier than Fusaka

1. Perceive the Context

- Ethereum trades within the $4,400–$4,600 vary in September 2025.

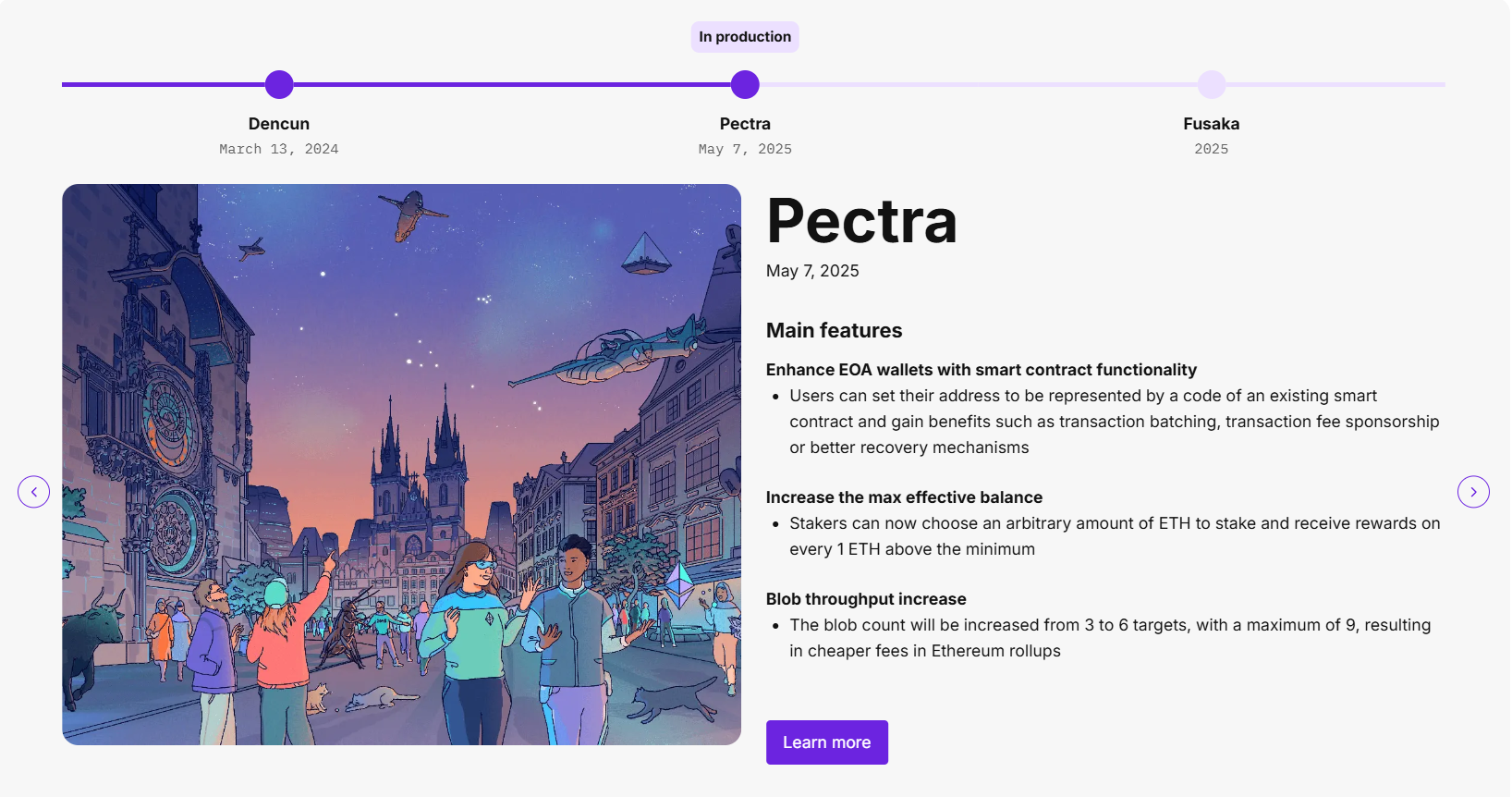

- Traditionally, Ethereum upgrades (Shanghai, Pectra) created short-term rallies, adopted by profit-taking.

- Fusaka focuses on scalability (PeerDAS, extra blobs), which immediately advantages Layer-2 rollups and reduces transaction prices. That’s a bullish long-term catalyst, however upgrades can even set off “promote the information” occasions.

Takeaway: New patrons ought to enter with structured, phased publicity relatively than going all in.

2. Entry Technique: Phased Shopping for (Greenback-Price Averaging)

Since ETH is “costly” now, new patrons ought to stagger entries.

Instance: $1,000 fund dimension (adjustable to any quantity):

- 40% ($400): Purchase regularly throughout September–October (earlier than testnet outcomes). Unfold into weekly buys to common entry ~ $4,400–4,600.

- 30% ($300): Maintain for November. That is when Fusaka hype usually builds. Allocate buys on dips (if ETH retests $4,200–4,300).

- 20% ($200): Preserve as dry powder in case ETH dips exhausting post-Fed conferences or into December.

- 10% ($100): Non-compulsory — allocate to a high-conviction Layer-2 token (Arbitrum, Optimism, or Base ecosystem tasks), which can rally tougher from Fusaka advantages.

Consequence: You unfold danger, catch dips, and scale back remorse from chasing tops.

3. Buying and selling Technique: Core + Swing Strategy

- Core place: Preserve no less than 50–60% of whole ETH purchased untouched till Q1 2026. This ensures publicity to longer-term upside ($5,500+ if Fusaka adoption narrative performs out).

- Swing place: With the remaining 40–50%, commerce round resistance ranges.

Instance (persevering with with $1,000 plan):

- Core holding: $600 ETH, simply stake or preserve in chilly storage.

- Swing buying and selling: $400 ETH.

- If ETH breaks $4,700 and pushes $5,000, promote 25% ($100) to lock revenue.

- If ETH retraces to $4,300, re-deploy that $100 again in.

- Repeat the cycle.

This fashion, you accumulate ETH over time whereas nonetheless benefiting from rallies.

4. Staking Technique (Non-compulsory for Lengthy-Termers)

- If planning to maintain ETH past Fusaka, contemplate staking ETH (by way of Lido, Rocket Pool, or immediately).

- Present annualized staking yield: ~3–4%.

- For a $1,000 instance, staking $600 core ETH generates ~$18–24/12 months. Small, nevertheless it compounds over time and offers publicity to staking incentives.

5. Danger Administration

- By no means go 100% in a single entry. Even when ETH rallies, shopping for staggered reduces draw back danger.

- Set exit ranges:

- Take partial revenue close to $5,000–$5,200.

- Reload if ETH dips to $4,200–$4,300.

- Macro watch: Fed coverage shifts, ETF flows, or Bitcoin value corrections might drag ETH. All the time preserve 10–20% money buffer.

6. Psychological Edge

- Don’t chase inexperienced candles — higher to overlook the highest 5% of good points than get trapped in a 20% correction.

- Deal with Fusaka as a multi-month catalyst (Oct → Jan). Endurance issues greater than attempting to time one single rally.

Abstract Plan for First-Time Consumers

- Allocate in phases: 40% now, 30% subsequent month, 20% pre-Fusaka, 10% for non-compulsory L2 bets.

- Maintain a core bag (50–60%) till post-Fusaka, commerce swings with the remaining.

- Use dips round $4,200–4,300 to scale in, take earnings close to $5,000+.

- Stake long-term ETH if holding past the improve.

The submit AI Reveals Finest Ethereum Buying and selling Plan Forward of Fusaka Improve appeared first on BeInCrypto.