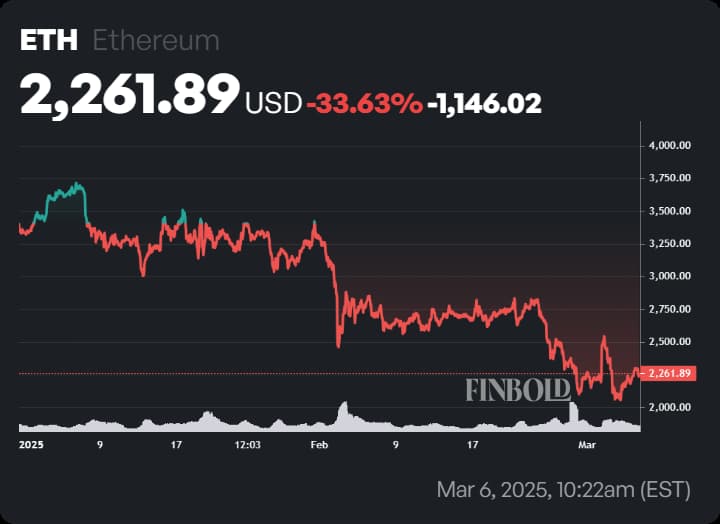

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has had a rocky begin to the 12 months, plunging over 30% year-to-date to commerce at $2,261 at press time.

Nonetheless, the cryptocurrency has rebounded almost 9% from its March 4 sell-off, regaining some misplaced floor.

The downturn erased positive factors from a short-lived rally triggered by Trump’s March 2 announcement of a strategic crypto reserve, which initially included XRP, Solana (SOL), and Cardano (ADA), with Trump later increasing the record to Bitcoin (BTC) and Ethereum, calling them the ‘coronary heart of the reserve.’

But, Ethereum’s near-term trajectory stays unsure, with traders divided on whether or not the rebound marks the beginning of a sustained restoration or simply one other short-term bounce inside a broader downtrend.

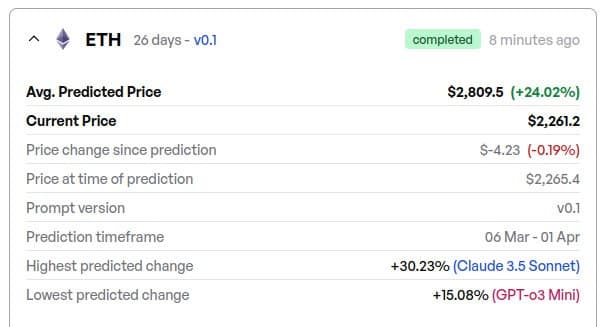

Finbold AI predicts Ethereum value goal for March 31

Finbold’s AI-powered prediction software has supplied an up to date outlook for Ethereum’s trajectory main as much as March 31, 2025. Factoring in technical indicators and market traits, the mannequin forecasts a mean ETH value of $2,809.5, marking a 24.02% improve from its present degree of $2,261.

Regardless of the bullish projection, AI fashions stay divided on Ethereum’s trajectory. Essentially the most optimistic outlook, generated by Claude 3.5 Sonnet, predicts a 30.23% surge, which may see ETH testing ranges above $2,945 within the coming weeks.

Conversely, GPT-03 Mini provides a extra cautious outlook, forecasting a 15.08% improve, which might place ETH round $2,606 by the tip of the prediction interval.

Ethereum’s broader panorama

Ethereum’s regulatory panorama and upcoming community upgrades may play an important position in shaping its subsequent market shift.

The extremely anticipated Pectra improve, scheduled for April 2025, not too long ago went reside on the Sepolia take a look at web. Designed to reinforce scalability, transaction speeds, and price effectivity, this improve may additional drive demand for ETH.

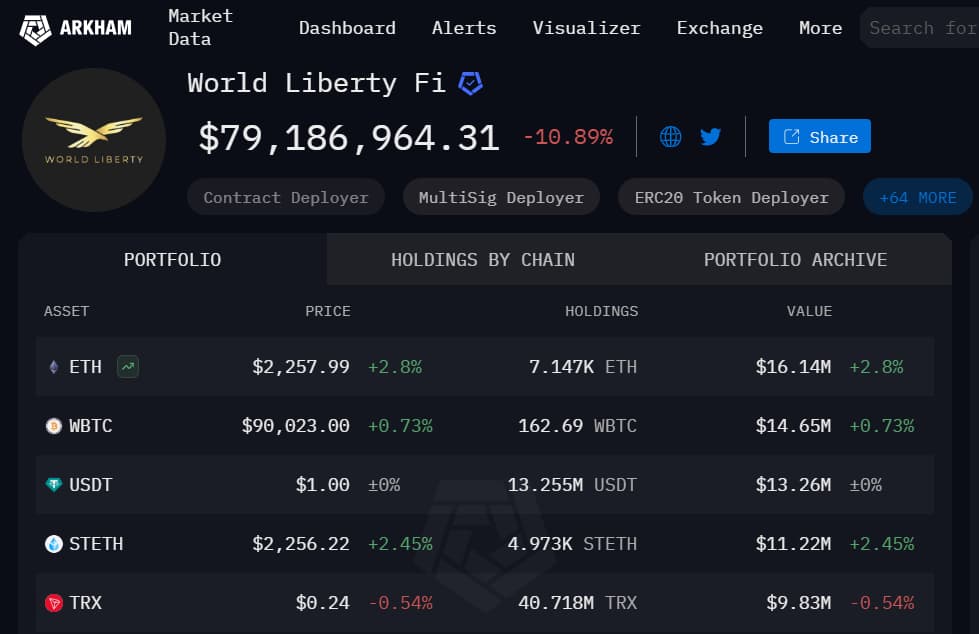

In the meantime, institutional curiosity in Ethereum is on the rise. World Liberty Monetary (WLFI), a decentralized finance platform backed by Donald Trump, has considerably elevated its ETH holdings, now holding $16.14 million in Ethereum, alongside $14.65 million in Wrapped Bitcoin, in accordance with Arkham Intelligence.

On-chain metrics additional help the bullish case. The MVRV ratio (Market Worth to Realized Worth) has dropped beneath 1, traditionally signaling an undervalued value zone and a possible shopping for alternative close to the common acquisition price of holders, together with whales.

Furthermore, there was a pointy improve in ETH accumulation addresses, indicating large-scale institutional accumulation at present ranges.

From a technical perspective, Ethereum’s value motion mirrors its 2016 fractal, the place a consolidation part preceded a serious breakout. If this historic sample repeats, Ethereum could possibly be gearing up for a major rally, making its present value ranges a sexy entry level for long-term traders.

Featured picture through Shutterstock