ETH worth motion within the 2-week chart confirmed an inverse head and shoulders sample, suggesting a possible bullish reversal.

Ranging from the low of round $1,985, Ethereum’s worth shaped the “head” of the sample in October, rallying to the neckline close to $4,000 earlier than pulling again to type the “proper shoulder” at a better low, indicating growing market confidence.

ETH Value Motion Intensifies

The value oscillated round $3,960, approaching the crucial neckline.

This sample was vital as a result of a breakout above the neckline at $4K may verify the sample, probably propelling Ethereum in the direction of $7,250.

This situation stays conditional on continued shopping for strain and favorable market situations.

ETHUSD weekly chart | Supply: Dealer Tardigrade/X

The anticipated bullish consequence, nevertheless, should think about the $7,250 goal as a pivotal resistance degree, the place a convergence of historic sell-offs may problem additional features.

– Commercial –

If ETH sustains above this neckline, it may sign a powerful buyer-dominated market section, supporting the climb to the projected excessive.

This evaluation positions Ethereum advantageously if the market maintains its present dynamics, aligning with broader bullish sentiment within the crypto market.

ETH/BTC was additionally breaking out on the intraday timeframe marking a possible onset of an explosive Altseason.

This might propel ETH towards and probably past $7K. Ethereum’s worth breaking out of a consolidation sample may very well be a bullish sign for its subsequent worth targets.

With RSI on the rise, at the moment positioned above the midline, it instructed growing shopping for momentum.

ETHBTC 8-hour chart | Supply: Buying and selling View

The resistance ranges to look at had been round 0.03800 BTC, with a powerful help established close to 0.03285 BTC.

These actions point out a shift from bearish to bullish sentiment, presumably main Ethereum to succeed in new heights in opposition to Bitcoin.

This situation was supported by the value motion the place ETH has proven resilience and energy in opposition to BTC, hinting at a bigger market shift favoring altcoins.

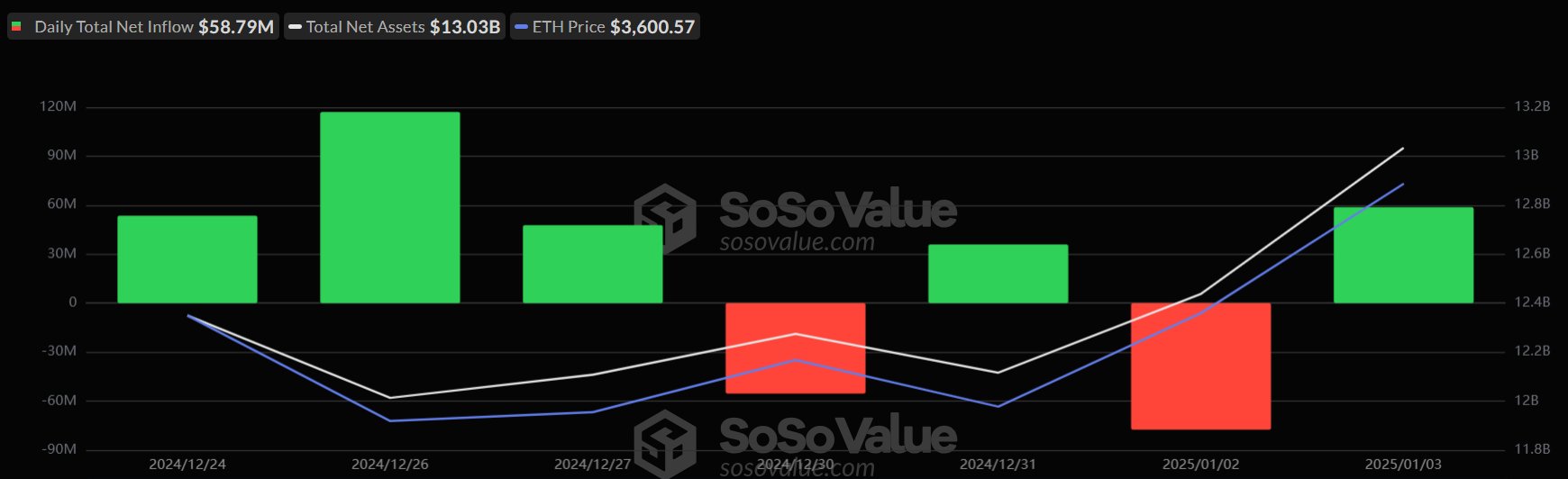

Whole Internet Influx of Ethereum Spot ETF

A glance into Ethereum ETF confirmed vital internet inflows on January 3, totaling $58.79 million.

This spike, largely on account of BlackRock’s ETF ETHA, which alone contributed $33.88 million, elevated the ETHA’s cumulative influx to $3.559 billion.

This inflow doubtless enhanced Ethereum’s market energy, pushing its worth to $3,600.57 on that day.

ETH each day whole internet influx | Supply: Soso Worth

This might sign rising institutional curiosity in Ethereum, probably stabilizing and driving the value additional.

Future implications hinge on sustained influx ranges; if they continue to be sturdy, Ethereum may see continued upward momentum.

Nevertheless, any reversal in these inflows may undermine this bullish outlook, indicating a necessity for cautious optimism in buying and selling methods.

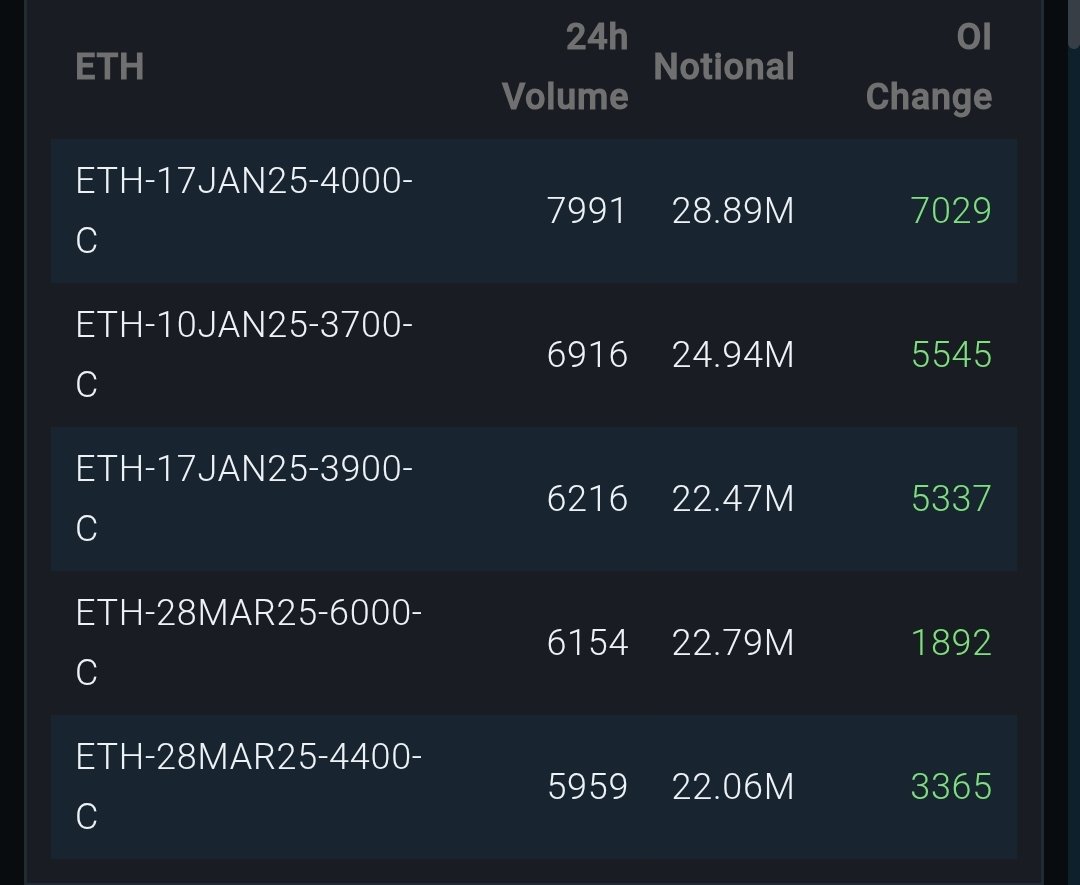

Ethereum Choices Market Replace

The ETH choices market exhibited sturdy bullish sentiment, particularly within the name positions on the $3,700 and $4,000 strike costs, reflecting short-term confidence.

The buying and selling quantity and open curiosity instructed a major anticipation of worth motion past these ranges.

Notably, name positions for $6K strike worth for late March indicated that some buyers had been positioning for a considerable upward shift in ETH’s worth in the long term.

ETH 24-hour name choices | Supply: X

The potential for ETH to succeed in and even surpass $7,000 was supported by the underlying market dynamics.

Buyers’ strategic placement in greater strike costs aligned with a broader expectation of bullish momentum pushed by constructive market influences.

This evaluation instructed a powerful basis for progress, contemplating each present buying and selling behaviors and historic responses to comparable setups within the choices market.

If this bullish development continues, bolstered by constant market inflows and buying and selling patterns, ETH may see vital features, aiming in the direction of $7K.