As December attracts to an in depth, Ethereum (ETH) holders are dealing with more and more difficult market situations. On-chain information reveals that greater than 40% of Ethereum’s provide is at present held at a loss.

Notably, ETH holders are responding to mounting losses in sharply alternative ways, with some capitulating and others persevering with to build up regardless of deep unrealized drawdowns.

Ethereum Holders’ Positions Sink Underwater as ETH Slides

Ethereum has closed the previous three consecutive months within the pink, with November alone posting a steep 22.2% decline. In December, the asset has continued to face volatility.

Regardless of briefly reclaiming the $3,000 degree, ETH failed to carry above it and has since slipped again under the important thing threshold.

On the time of writing, Ethereum was buying and selling at $2,973.78, up 1.10% over the previous 24 hours, in step with the broader cryptocurrency market.

Ethereum (ETH) Worth Efficiency. Supply: BeInCrypto Markets

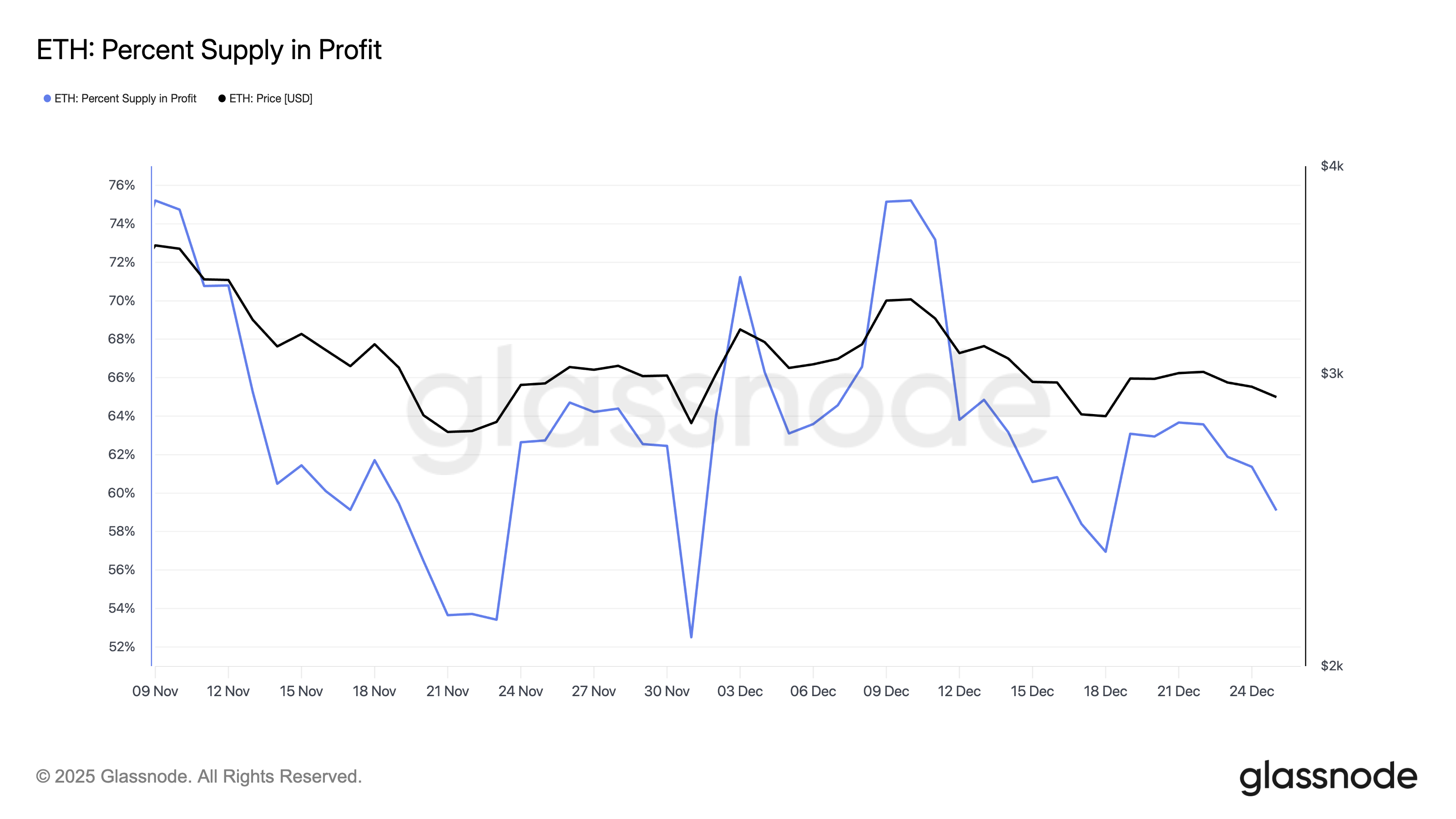

Nevertheless, the latest value weak point has considerably impacted holder profitability. Glassnode information reveals that earlier this month, greater than 75% of Ethereum’s circulating provide was held at a revenue. That share has now fallen to 59%, reflecting the rising variety of underwater positions.

Ethereum Provide in Revenue. Supply: Glassnode

Ethereum Whales React In another way as Losses Deepen

Towards this backdrop, a number of outstanding holders have begun repositioning. Lookonchain reported that Erik Voorhees, founding father of Venice AI, deposited 1,635 ETH, value roughly $4.81 million, into THORChain to swap for Bitcoin Money (BCH).

The transfer follows an identical transaction earlier this month, when Voorhees swapped ETH for BCH from a pockets that had remained inactive for practically 9 years, signaling a notable portfolio shift.

In the meantime, Arthur Hayes has additionally been transferring ETH to exchanges. Commenting on the technique, Hayes mentioned he’s “rotating out of ETH and into high-quality DeFi names,” citing expectations that choose tokens might outperform Ethereum as fiat liquidity situations enhance.

In one other on-chain transfer, Winslow Sturdy, a associate at Cluster Capital, transferred 1,900 ETH together with 307 cbBTC to Coinbase, bringing the full worth of the switch to roughly $32.62 million. Such transfers don’t routinely verify promoting exercise.

Nevertheless, actions to centralized exchanges are generally seen as potential sell-side indicators, significantly in periods of heightened market uncertainty.

“The ETH was withdrawn one month in the past at a mean value of $3,402.25, whereas the cbBTC was accrued between August 2025 and December 2025 at a mean value of $97,936.68. If bought, the full loss would quantity to roughly $3.907 million,” an on-chain analyst said.

Persistent Shopping for Amongst Main Holders

Not all whales are exiting the market. Whale handle 0x46DB has maintained aggressive shopping for all through December. The investor has accrued 41,767 ETH since December 3 at a mean value of $3,130.

The present place reveals an unrealized lack of over $8.3 million. BitMine, with an unrealized lack of roughly $3.5 billion, has additionally made notable purchases this week.

This divergence highlights a transparent cut up in market outlook. Whereas BitMine believes ETH might be positioned for potential upside over the approaching months, the continuing promoting exercise means that different giant gamers stay much less assured about ETH’s prospects.

BeInCrypto’s evaluation has additionally recognized 4 key warning indicators indicating that Ethereum might face additional draw back strain. These embrace rising alternate reserves, an elevated Estimated Leverage Ratio, and continued ETF outflows. On the identical time, the Coinbase Premium Index has fallen to -0.08, its lowest degree in a month.

This mixture of losses, excessive leverage, and outflows presents a difficult outlook for Ethereum as 2025 attracts to an in depth. Contrarian shopping for amongst huge holders reveals some bullish sentiment, however promoting strain has up to now overwhelmed these remoted efforts. Whether or not the sentiment might finally shift in 2026 stays to be seen.

The publish 40% of Ethereum Provide Slips Into Loss as Whales Take Opposing Positions appeared first on BeInCrypto.