Ethereum exercise throughout the broader ecosystem has climbed sharply, whereas separate charts present a possible long run reversal construction and a brief time period pause close to key averages. Collectively, the visuals level to heavier community use as value trades at a call space.

Ethereum ecosystem exercise jumps on growthepie chart

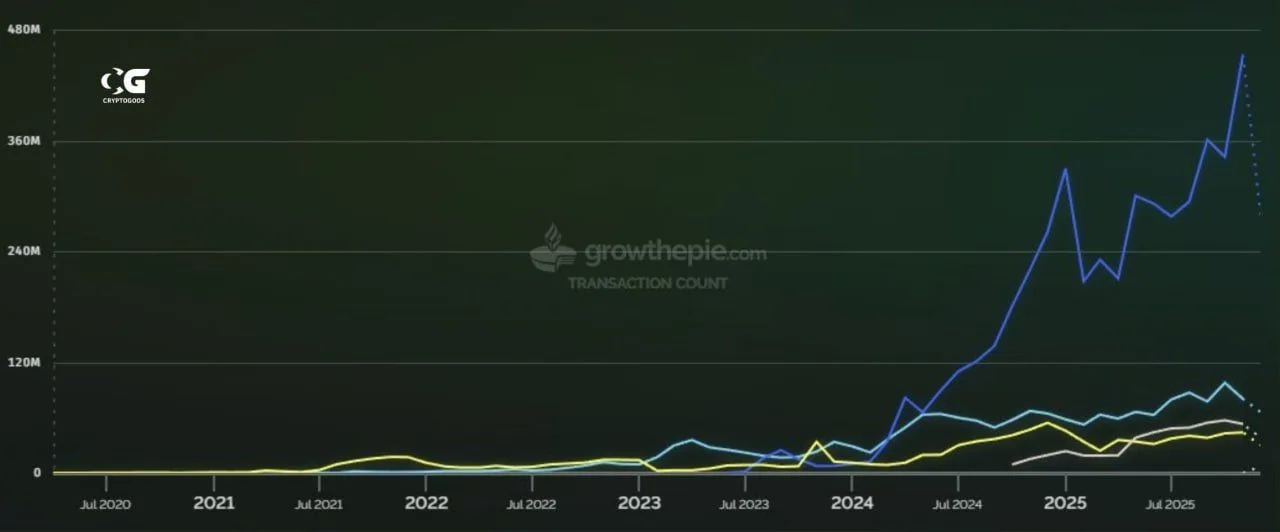

A publish from CryptoGoos on X stated “Ethereum ecosystem exercise is exploding now,” alongside a growthepie.com chart that tracks transaction depend from mid 2020 by way of mid 2025. The graphic reveals exercise staying low for years, then turning greater by way of 2023 and accelerating in 2024 and 2025.

Ethereum Ecosystem Transaction Rely. Supply: growthepie. com / X

One line on the chart climbs sharply after early 2024, pushing previous the 240 million mark and approaching the highest of the dimensions close to 480 million by 2025. In the meantime, a number of different strains additionally pattern upward, however they rise extra regularly and stay far under the highest line.

The chart doesn’t clarify what drives the soar, however the form suits a broader shift towards heavier onchain utilization, particularly throughout a number of Ethereum associated networks that may course of transactions outdoors mainnet after which settle again to Ethereum. Even so, transaction depend alone doesn’t present what number of distinctive customers participated or how a lot worth moved, so the surge wants extra context earlier than it alerts wider adoption.

Ethereum weekly chart reveals inverse head and shoulders setup close to neckline

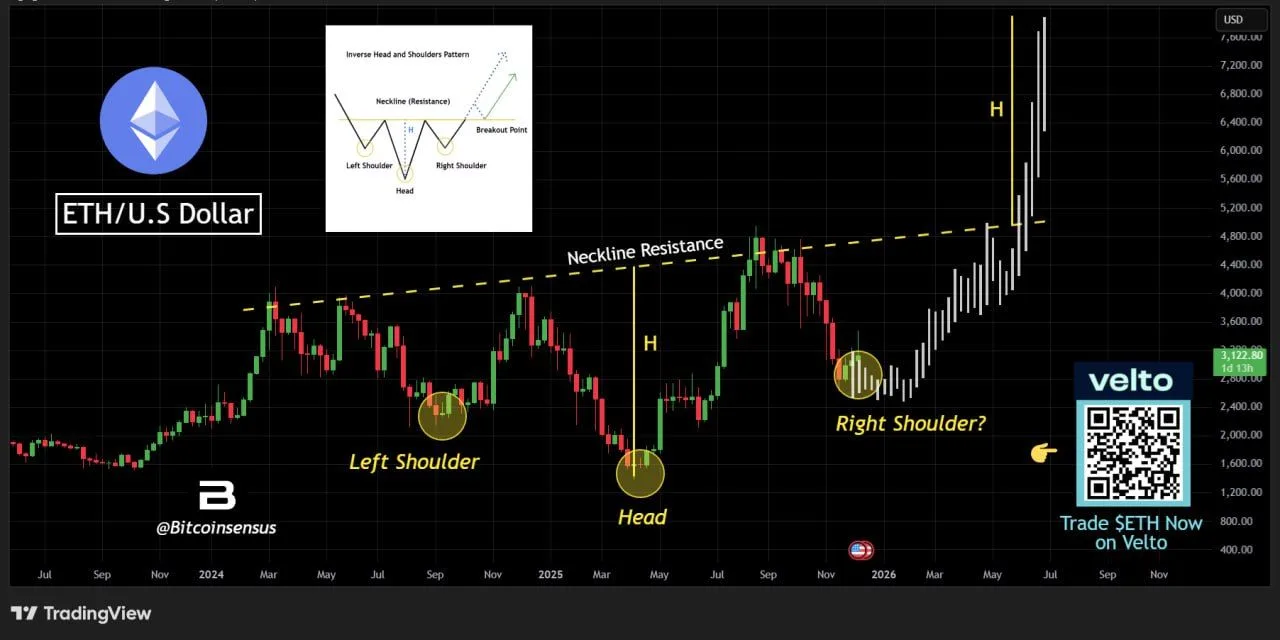

In the meantime, Bitcoinsensus stated Ethereum is near finishing a macro inverse head and shoulders sample on the weekly chart. The picture marks a left shoulder in late 2024, a deeper “head” low in early 2025, and a attainable proper shoulder that fashioned after the mid 2025 peak and pullback.

Ethereum Inverse Head and Shoulders Sample. Supply: TradingView / X

The chart additionally attracts a rising neckline labeled as resistance, with value motion repeatedly stalling close to that zone earlier than the bigger transfer greater. If ETH holds the upper low construction on the fitting facet after which pushes by way of the neckline, the sample’s textbook sign could be a breakout that confirms the reversal from the sooner downtrend.

Nonetheless, the fitting shoulder label features a query mark, so the setup is dependent upon comply with by way of. If ETH fails to remain above the shoulder space and drops again towards the pinnacle area, the sample loses construction and merchants often deal with the neckline as unbroken resistance fairly than a set off.

Ethereum trades close to key transferring averages as RSI steadies

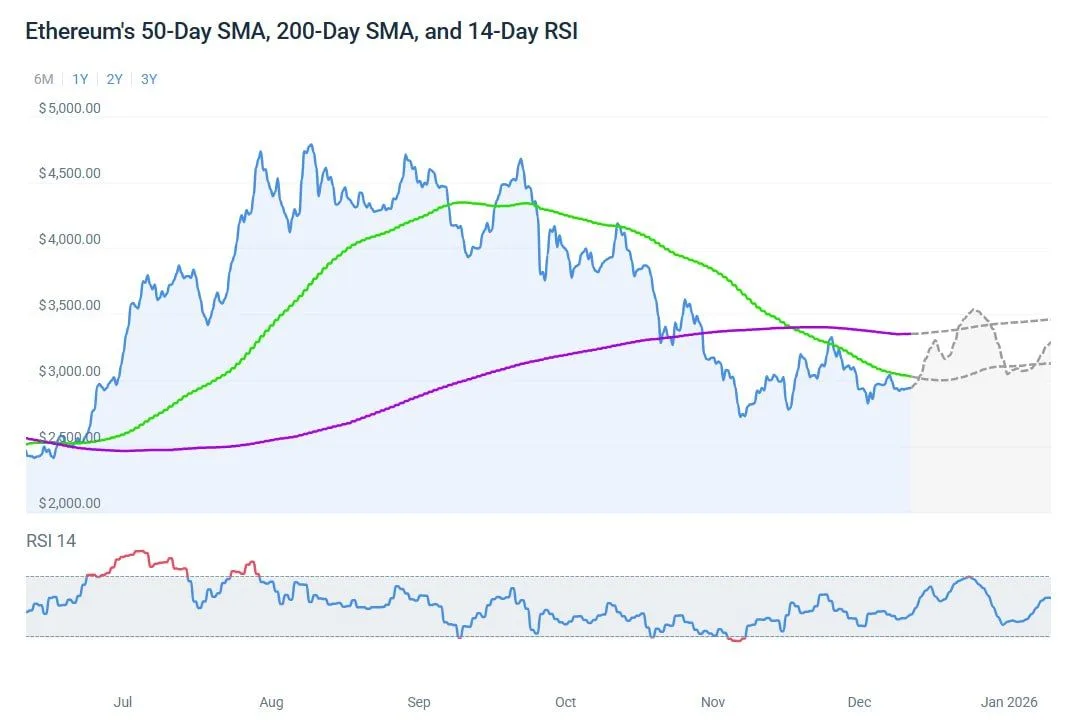

Ethereum value motion reveals a combined technical setup, with the asset transferring near its 50 day and 200 day easy transferring averages. The chart locations ETH under the shorter time period common whereas it hovers close to the long term pattern line, signaling a pause after the latest decline from earlier highs.

Ethereum 50 Day SMA, 200 Day SMA, and 14 Day RSI. Supply: CoinCodex

The 50 day SMA has turned decrease and now slopes towards the 200 day SMA, reflecting weaker momentum over latest weeks. On the similar time, value has stabilized close to the mid vary, suggesting promoting strain has slowed fairly than accelerated.

In the meantime, the 14 day RSI stays close to impartial ranges. The indicator has recovered from earlier lows however has not reached overbought territory, which factors to balanced circumstances. Collectively, the alerts present Ethereum consolidating as merchants look forward to a clearer directional transfer.