Onchain analyst and early Bitcoin adopter Willy Woo is warning that growing consideration to quantum computing danger is beginning to weigh on Bitcoin’s long-term valuation case in opposition to gold.

Woo argued in a Monday X submit that markets had begun to cost within the danger of a future “Q‑Day” breakthrough — shorthand for the second when a strong sufficient quantum pc exists to interrupt at the moment’s public key cryptography.

Roughly 4 million “misplaced” Bitcoin ($BTC) — cash whose non-public keys are presumed gone — could possibly be dragged again into play, Woo argued, if a strong quantum pc might derive non-public keys from uncovered public keys, undermining a part of Bitcoin’s core shortage narrative.

He estimated there was a few 25% probability that the community would comply with freeze these cash through a tough fork, some of the contentious points in Bitcoin governance at the moment.

Q‑day danger and “misplaced” cash

In response to blockchain researchers, the 4 million uncovered cash characterize round 25%-30% of the Bitcoin provide and are held in addresses whose public keys are already seen onchain, making them among the many first in danger in a quantum assault situation.

Associated: Establishments could get ‘fed up’ and hearth Bitcoin devs over quantum: VC

Nonetheless, any transfer to freeze these cash would upend lengthy‑standing norms regarding fungibility, immutability and property rights.

Freezing the cash might provoke deep splits between these prioritizing backward‑suitable fixes (upgrades that protect current guidelines and cash with out invalidating previous transactions or requiring a contentious laborious fork), and people prepared to rewrite guidelines to guard early balances.

With a 75% probability of the cash remaining untouched, buyers ought to assume, Woo mentioned, a non‑trivial likelihood that an quantity of $BTC equal to about “8 years of enterprise accumulation” would turn out to be spendable once more.

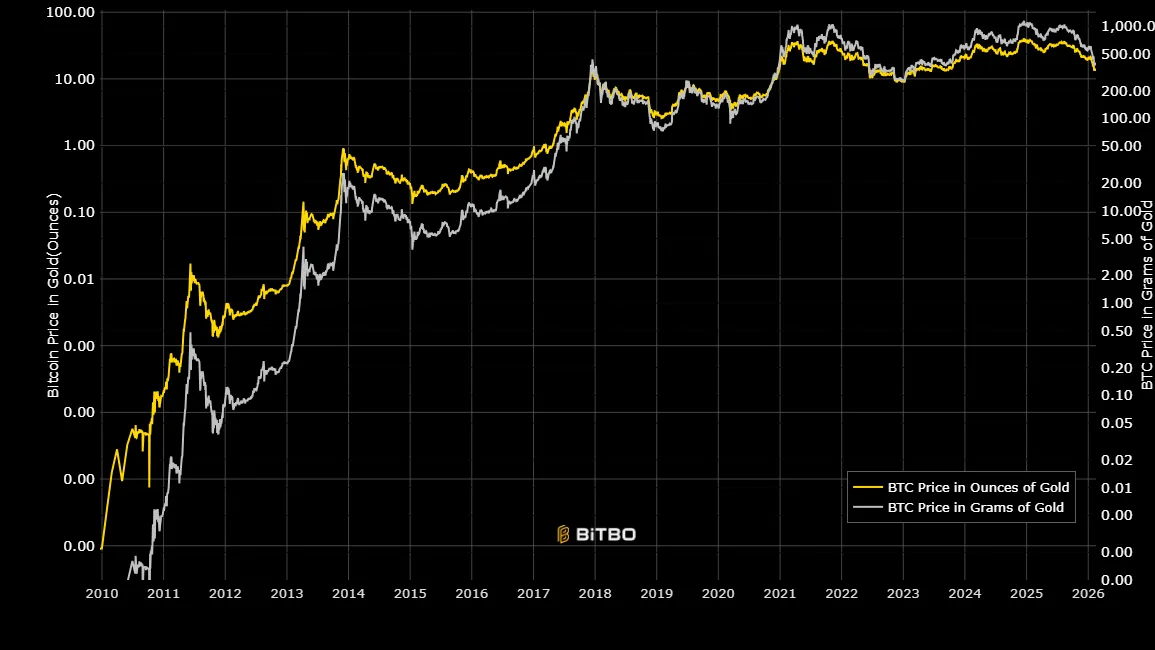

It’s a prospect that’s already being priced in as a structural low cost on $BTC’s valuation versus gold for the following 5 to fifteen years, Woo mentioned, which means that Bitcoin’s lengthy‑time period tendency to realize buying energy when measured in ounces of gold is not in play.

$BTC vs. gold chart value and ratio. Supply: Bitbo

Bitcoin’s submit‑quantum migration path

Many core builders and cryptographers stress that Bitcoin doesn’t face an imminent “doomsday” scenario and has time to adapt.

The rising roadmap for a submit‑quantum migration will not be a single emergency laborious fork, they argue, however a phased course of, finally steering the community towards new tackle codecs and key administration practices over a multi‑12 months transition.

Even when quantum did arrive prior to anticipated and the cash have been recirculated, different Bitcoiners, similar to Human Rights Basis chief technique officer Alex Gladstein, argue that it’s unlikely they’d be dumped onto the market.

Gladstein sees a extra possible situation the place the cash are amassed by a nation-state slightly than instantly bought.

Associated: Why Luke Gromen is fading Bitcoin whereas staying bullish on debasement

Quantum danger goes mainstream in macro

Nonetheless, Woo’s warning lands in a market the place Bitcoin is buying and selling nearly 50% off its all-time excessive, and quantum has already moved from a distinct segment concern to a mainstream danger think about institutional portfolios.

In January, Jefferies’ longtime Greed & Concern strategist Christopher Wooden minimize Bitcoin from his flagship mannequin portfolio and rotated the place into gold, explicitly citing the likelihood that “cryptographically related” quantum machines might weaken Bitcoin’s store-of-value case for pension‑type buyers.

Journal: Kevin O’Leary says quantum attacking Bitcoin could be a waste of time