The cryptocurrency market is presently navigating a storm of macroeconomic and geopolitical uncertainty. As of January 22, 2026, $Bitcoin is struggling to keep up its footing above the psychological $90,000 mark. Whereas the early weeks of the 12 months confirmed promise with a rally towards $98,000, a sudden escalation in international commerce tensions has shifted the narrative from “moon mission” to “risk-off.”

The “Greenland Standoff” and Its Affect on Crypto

The first driver of the latest market volatility is the escalating diplomatic and commerce dispute involving the US’ aggressive push to accumulate Greenland. This “Greenland Standoff” has not solely rattled conventional markets however has additionally compelled a repricing of danger property throughout the board.

With President Trump threatening 10% tariffs on a number of European nations, the European Union has signaled vital retaliatory measures. This instability has led buyers to flee towards conventional secure havens like gold and silver, which have lately hit all-time highs. Paradoxically, Bitcoin—typically touted as “digital gold”—has seen large outflows, with spot BTC ETFs recording internet exits of over $400 million in a single day this week.

Technical Evaluation: Breaking Down the Chart

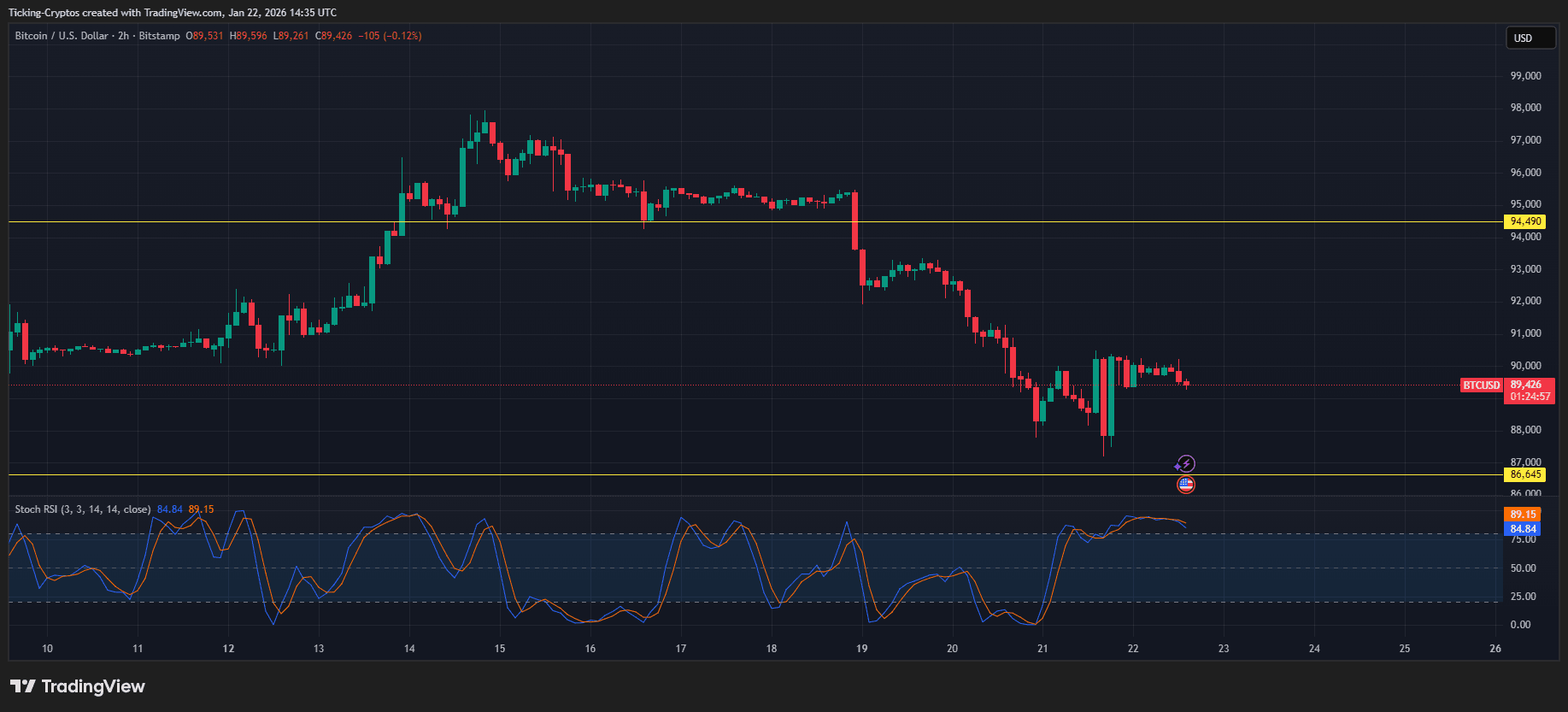

Wanting on the 2-hour chart supplied, we will see a transparent bearish breakdown from the $94,490 resistance degree.

BTC/USD 2H – TradingView

- Resistance: The yellow line at $94,490 now acts as a formidable ceiling. Bitcoin did not maintain its place above this degree, resulting in a pointy correction.

- Present Help: We’re presently hovering round $89,426. The subsequent main “security internet” sits at $86,645, represented by the decrease yellow horizontal line.

- Stochastic RSI: The indicator on the backside exhibits that Bitcoin is reaching deeply oversold territory. Traditionally, this means a possible aid bounce within the brief time period, however in a “Promote America” setting, technical indicators can stay suppressed for longer than anticipated.

If the $86,645 assist degree fails to carry, analysts warn {that a} deeper correction towards the $75,000 – $80,000 zone is feasible as liquidity continues to dry up.

Is the Bull Cycle Over?

Whereas the short-term outlook stays bearish as a consequence of geopolitical “noise,” many institutional gamers stay engaged. The present dip is seen by some as a crucial deleveraging occasion. Nevertheless, for these trying to defend their property throughout such excessive volatility, evaluating completely different {hardware} wallets or reviewing alternate security stays a high precedence.

The correlation between Bitcoin and gold is being examined. Whereas gold thrives on chaos, Bitcoin continues to be behaving extra like a high-beta tech asset. Till the commerce battle rhetoric cools down, count on the BTC worth to stay extremely delicate to each headline popping out of Washington and Brussels.

Disclaimer: This text is for informational functions solely and doesn’t represent monetary recommendation. Cryptocurrency investments carry a excessive degree of danger. At all times conduct your personal analysis or seek the advice of an expert monetary advisor earlier than making any funding choices.