Bitcoin faces renewed macro strain after the most recent US jobs report signaled a stronger-than-expected labor market, pushing Treasury yields greater and decreasing the probability of near-term Federal Reserve charge cuts.

The US financial system added 130,000 jobs in January, practically double consensus expectations. On the similar time, the unemployment charge fell to 4.3%, displaying continued labor market resilience.

Whereas robust employment is constructive for the broader financial system, it complicates the outlook for danger belongings like Bitcoin.

US job development unexpectedly accelerated in January and the unemployment charge fell to 4.3%, indicators of labor-market stability that would give the Fed room to maintain rates of interest unchanged for a while whereas policymakers monitor inflation https://t.co/kFkiSxgylK pic.twitter.com/dHZX5mWOvr

— Reuters (@Reuters) February 11, 2026

Robust Jobs Knowledge Delays Price Minimize Expectations

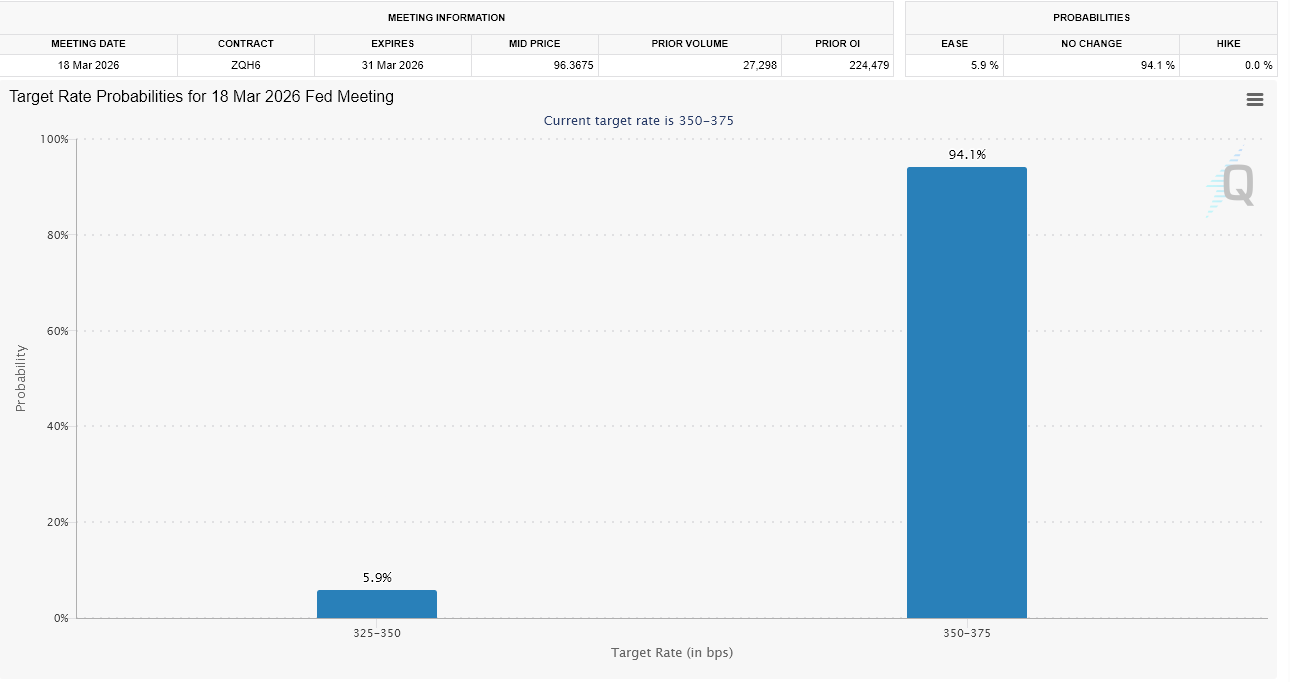

Markets had been anticipating potential charge cuts within the coming months amid slowing development issues. Nevertheless, a resilient labor market reduces the urgency for financial easing.

Consequently, buyers repriced expectations for Federal Reserve coverage.

Bond markets reacted instantly. The US 10-year Treasury yield jumped towards the 4.2% stage, rising a number of foundation factors after the report. The 2-year yield additionally climbed, reflecting diminished likelihood of near-term cuts.

Ten yr treasury yields jumped 8 bps to 4.20% (which has been a magnet for the market) on the roles report. Given the combo of big downward revisions and better than anticipated Jan hiring – the path is probably going sideways till CPI report on Friday. pic.twitter.com/GOM1uNl19B

— Kathy Jones (@KathyJones) February 11, 2026

Greater yields tighten monetary situations. They improve borrowing prices throughout the financial system and lift the low cost charge used to worth danger belongings.

Why Greater Yields Strain Bitcoin

Bitcoin is extremely delicate to liquidity situations. When Treasury yields rise, capital tends to rotate towards safer, yield-generating belongings similar to authorities bonds.

On the similar time, a stronger greenback typically accompanies rising yields. A firmer greenback reduces international liquidity and makes speculative belongings much less enticing.

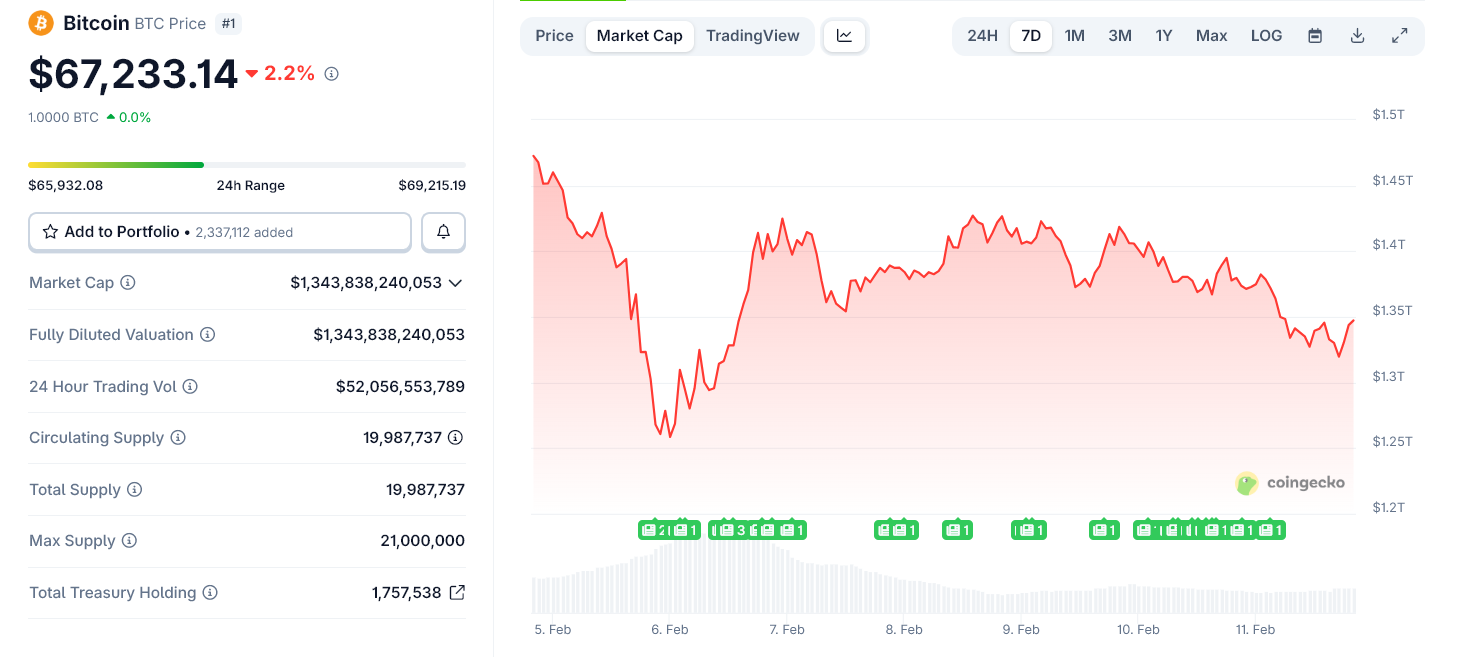

Bitcoin Worth Over the Previous Week. Supply: CoinGecko

This mix creates headwinds for crypto markets.

Though Bitcoin briefly stabilized close to the $70,000 stage earlier within the week, the roles information will increase the danger of renewed volatility. And not using a clear sign that the Fed will ease coverage, liquidity stays constrained.

“For Bitcoin, this report is a short-term headwind. A beat of this magnitude dampens the likelihood of a March charge reduce and reinforces the Fed’s pause at 3.50%-3.75%. The cheaper cash catalyst that danger belongings have to mount a sustained restoration simply bought pushed additional out. Anticipate the greenback to agency and yields to reprice greater, each of which strain BTC into a spread within the close to time period,” David Hernandez, Crypto Funding Specialist at 21shares instructed BeInCrypto.

Market Construction Amplifies Macro Stress

The latest crash demonstrated how delicate Bitcoin has turn into to macro shifts. Massive ETF flows, institutional hedging, and leveraged positioning can speed up strikes when monetary situations tighten.

A stronger labor market doesn’t assure Bitcoin will fall. Nevertheless, it reduces one of many key bullish catalysts: expectations of simpler financial coverage.

“Within the quick time period, Bitcoin appears to be like defensive. The important thing stage to look at is $65,000. Nevertheless, if this robust report seems to be short-term quite than an indication the financial system is heating up once more, the Fed may nonetheless reduce charges later this yr. When that occurs, Bitcoin’s restricted provide turns into essential once more. Robust information as we speak could delay a rally, nevertheless it doesn’t break the long-term bullish case,” Hernandez stated.

Fed Price Minimize Likelihood for March 2026. Supply: CME FedWatch

The Backside Line

The most recent US jobs report reinforces a “higher-for-longer” charge setting.

For Bitcoin, that isn’t instantly catastrophic. Nevertheless it does make sustained upside tougher.

Except liquidity improves or yields retreat, the macro backdrop now leans cautious quite than supportive for crypto markets.

The submit Why the US Jobs Knowledge Makes a Worrying Case for Bitcoin appeared first on BeInCrypto.