The latest rise in gold and bitcoin costs reveals greater than market dynamics—it displays a quiet awakening to the centuries-old fraud of fiat cash.

The Fraud of Fiat: How Inflation Turned Accepted Theft

Isn’t it curious how folks reminisce concerning the previous, casually recalling {that a} sweet bar as soon as price 50 cents—as if costs rising over time have been some cosmic inevitability? Not often does anybody interrupt this nostalgia to level out that what they’ve witnessed will not be nature’s doing however a calculated deception that has endured for generations.

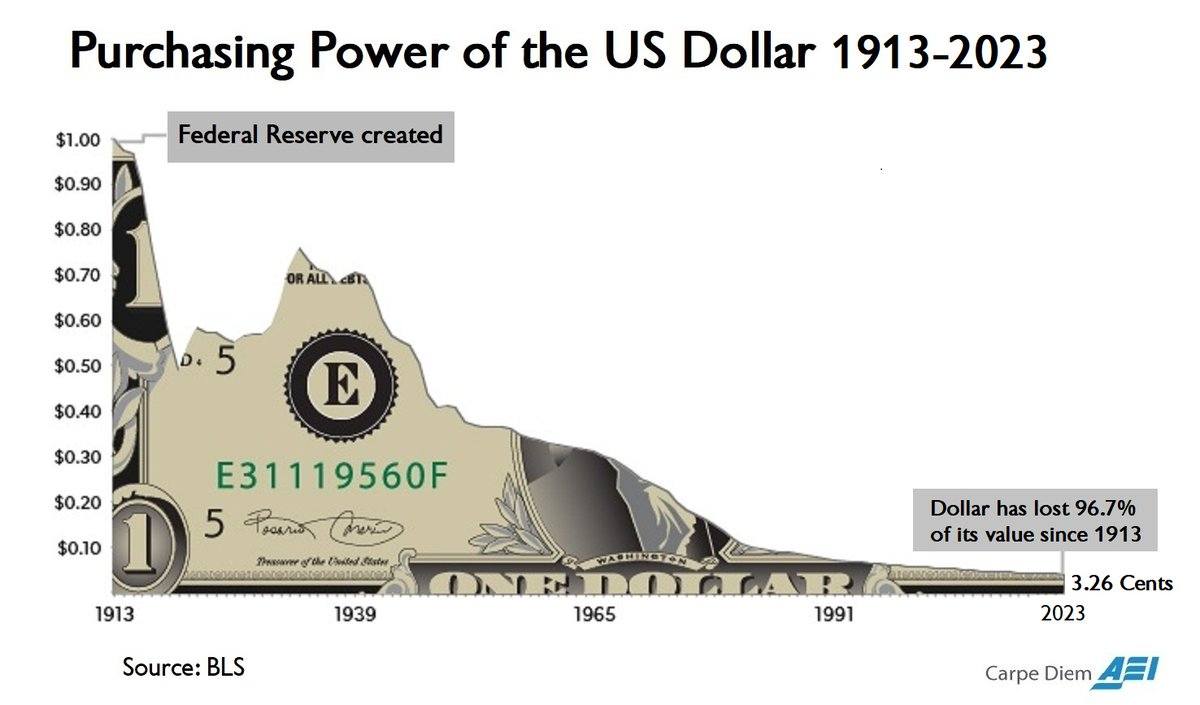

Between 1913 to 2023, or 110 years, the U.S. greenback misplaced 96.7% of its buying energy. $1 in 2025 solely buys about 3.1% of what it may purchase in 1913, which means its worth has declined to roughly $0.03 in 1913 phrases. What occurs at zero?

Inflation will not be an accident. It’s not the results of mysterious market forces past comprehension. It’s a deliberate consequence of a system designed to dilute the worth of cash by permitting the availability of forex to develop quicker than the manufacturing of precise items and companies. That’s its solely definition and inflation’s solely trigger. In the meantime, know-how—man’s instrument for mastery over nature—has made manufacturing quicker, cheaper, and extra environment friendly than ever earlier than.

So why ought to costs rise, if not as a result of somebody is tampering with the cash?

And but, society accepts this ongoing theft with a shrug. They repeat “again in my day” like a lullaby, blind to the confession hidden of their nostalgia: that they’ve been robbed. Robbed by political and banking establishments, they have been taught to belief. The federal government has drained their wealth slowly, silently, and with chilly precision. The central financial institution has engineered this betrayal in plain sight, not simply as soon as, however over generations since its creation.

That is the ethical context through which we should perceive the gravitation towards gold, now priced at $3,356 per ounce, and bitcoin, buying and selling over $109,000 per coin at 10 a.m. Jap time on Friday. These will not be mere commodities—they’re acts of defiance. They symbolize a rising recognition of what laborious cash really means: cash that can’t be conjured out of political comfort or central planning.

Cash backed by shortage, rooted in goal worth, and resistant to manipulation.

Gold and bitcoin will not be relics of the previous or speculative whims of the long run; they’re the direct consequence of an ethical revolt. They replicate a refusal to be enslaved by a dishonest financial regime. Persons are not simply looking for security—they’re looking for justice.

Each gold and bitcoin possess a uncommon and highly effective attribute in a world dominated by centralized authority: they’re essentially proof against censorship and manipulation. Gold, by its very nature, is a bodily asset past the attain of political decree. It can’t be printed, duplicated, or solid into existence. It requires effort—mining, refining, and safeguarding.

No bureaucrat can merely will extra gold into circulation with a signature.

Bitcoin, although digital, is ruled by the identical precept of incorruptibility. Its code is public, its provide is mounted, and its community is decentralized—run by 1000’s of unbiased nodes and miners throughout the globe. No single authorities, establishment, or cartel can alter its issuance schedule or freeze a transaction with out consensus from a world neighborhood. In Bitcoin, the primary consensus guidelines are clear and immutable; they apply equally to all.

This is the reason these laborious property matter—not merely as alternate options, however as lifelines for financial integrity. They symbolize methods that refuse to bend to coercion, cronyism, or inflationary deceit.

They’re the monetary devices of free women and men, the person who calls for the best to personal, commerce, and save with out begging permission.

When a financial system may be twisted to serve political pursuits, it ceases to serve the folks. In distinction, gold and bitcoin provide a realm the place voluntary alternate, property rights, and goal worth nonetheless prevail. To grasp them is to know freedom itself.

The flight to laborious cash will not be about earnings. It’s about precept. It’s a signal that people are waking as much as a reality that has lengthy been obscured by jargon, forms, and lies: that the one solution to repair the world is to repair the cash.