Regardless of a deep correction as we speak, Bitcoin nonetheless stays rangebound within the consolidation pocket between $80.5K and $95k for the eleventh week operating. From tariff escalations to geopolitical friction, these macro headwinds have weighed closely towards a threat off sentiment and discouraged any early momentum we noticed through the begin of the 12 months.

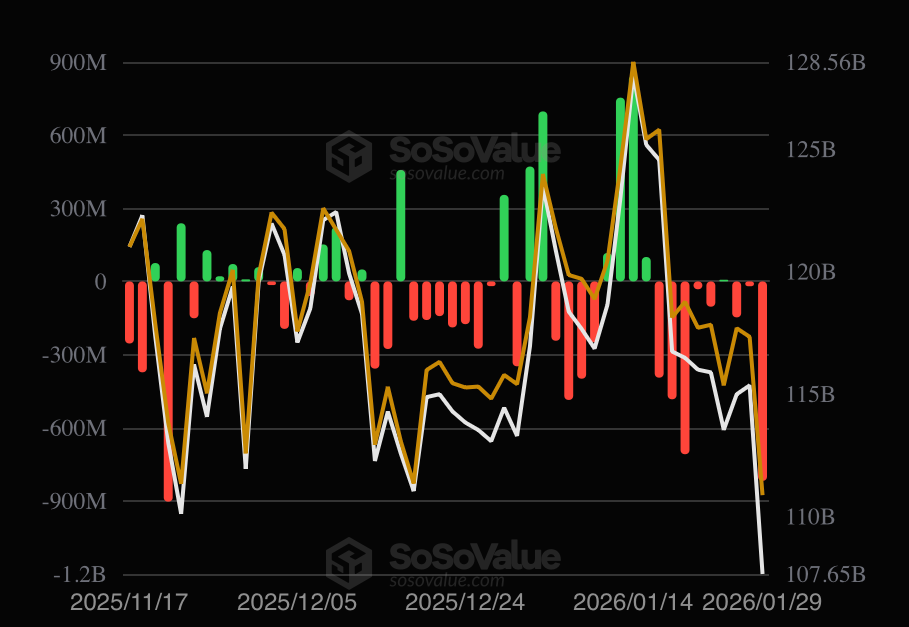

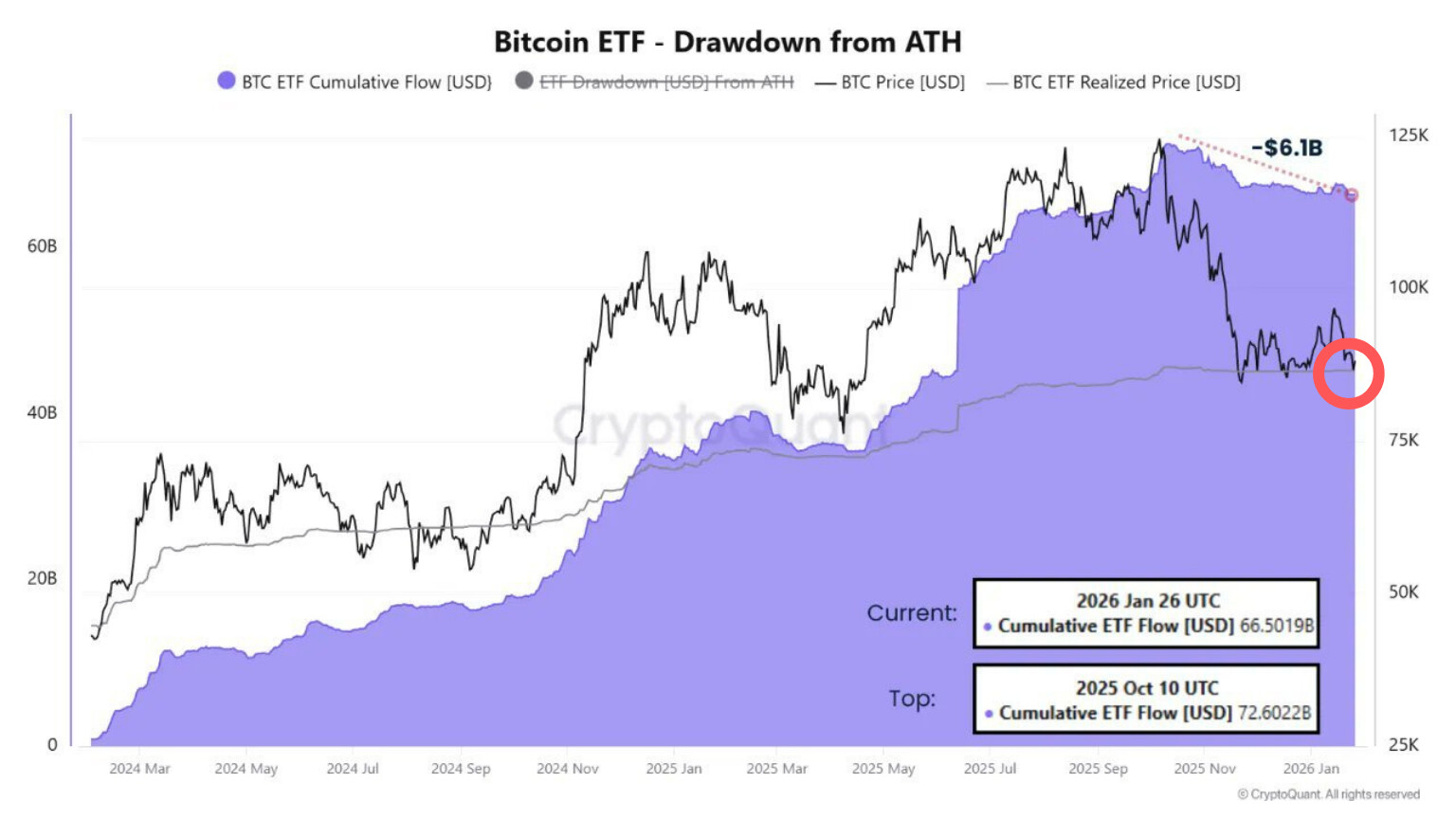

This sentiment has seemingly spilled over into the institutional aspect. Spot Bitcoin ETFs within the U.S. have seen a pickup in promote aspect strain since January sixteenth, with sustained outflows culminating in final week marking the second largest weekly internet outflows thus far. Regardless of the heavy outflows, ever for the reason that deleveraging occasion on October tenth final 12 months, Bitcoin has weathered this promote aspect strain adamantly to this point and continues to carry its broader consolidation vary.

The query that bears answering now turns to what’s propping up the worth for $BTC in the intervening time. For merchants and buyers, this is a crucial query to ask as a result of extended consolidation within the face of fixed macro headwinds and ETF outflows recommend that underlying demand is coming from someplace extra structural than quick time period hypothesis. Figuring out present demand additionally provides perspective on any future worth strikes because it lets you assess the standard and sturdiness of any swings.

It’s clear that Bitcoin in the intervening time is on the lookout for clear and decisive directionality. The dearth of a breakout, nonetheless, doesn’t suggest a scarcity of demand. The promote aspect strain from the ETFs are at present being absorbed by three pronged dynamic: demand from company treasuries, particularly Technique, a cohort of whales persevering with to build up and a quieter derivatives market.

Company Treasuries Offering a Bid

Bitcoin is at present round 13% down from the highest of its consolidation zone it’s been in since November sixteenth. Inside this timeframe, $BTC Spot ETFs have seen a unfavorable internet circulation of -$3.34 Billion. At present costs (~$83K), this equates to roughly 40.241 $BTC of sell-side strain, with the necessary caveat that ETF outflows occurred throughout a number of worth ranges, making this a $BTC-equivalent approximation.

U.S. $BTC Spot ETFs internet day by day flows from November sixteenth to twenty ninth January. Supply: SoSoValue

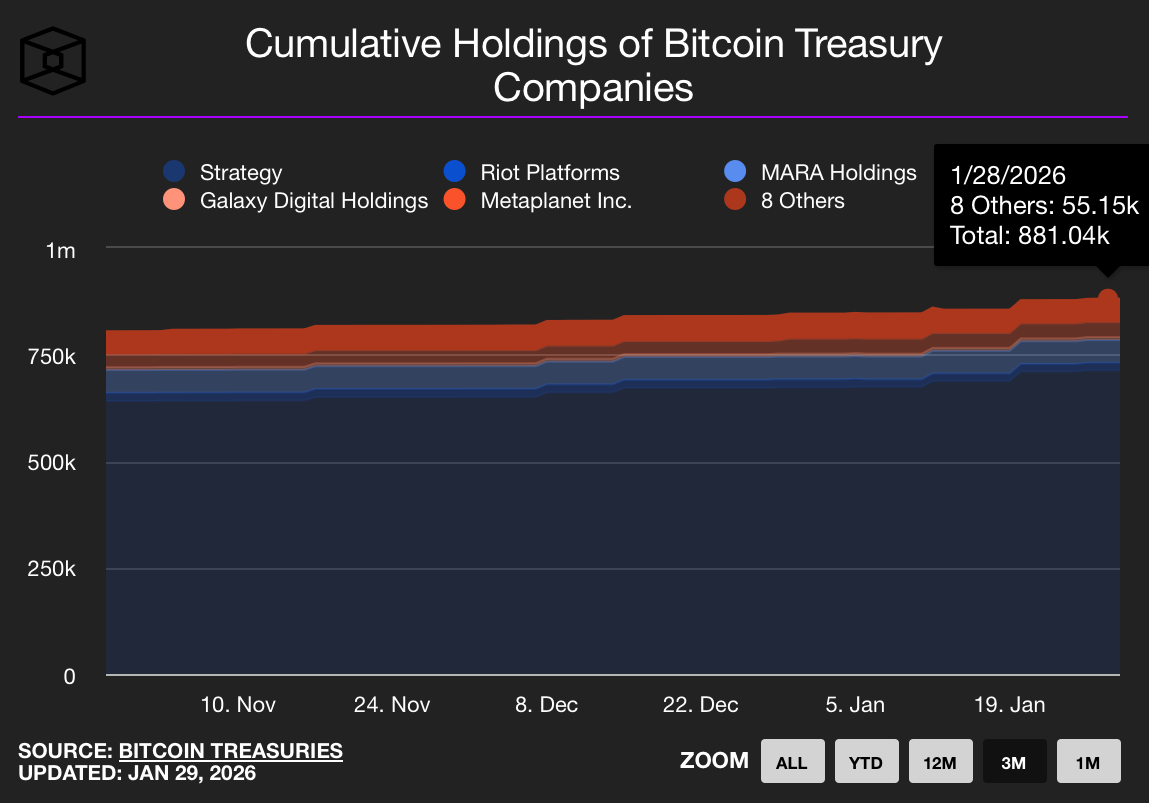

Supply: The Block

Then again, since November 16, information from the block exhibits that cumulative Bitcoin holdings of treasury firms rose from 809.02k $BTC to 881.04k $BTC, a rise of 72,020 $BTC, representing a roughly 8.9% progress over the interval. In internet phrases, treasury shopping for alone exceeds ETF-driven promoting by round 1.8x, serving to clarify why $BTC stays constricted in a zone moderately than breaking down within the face of constant macro and outflow pushed information.

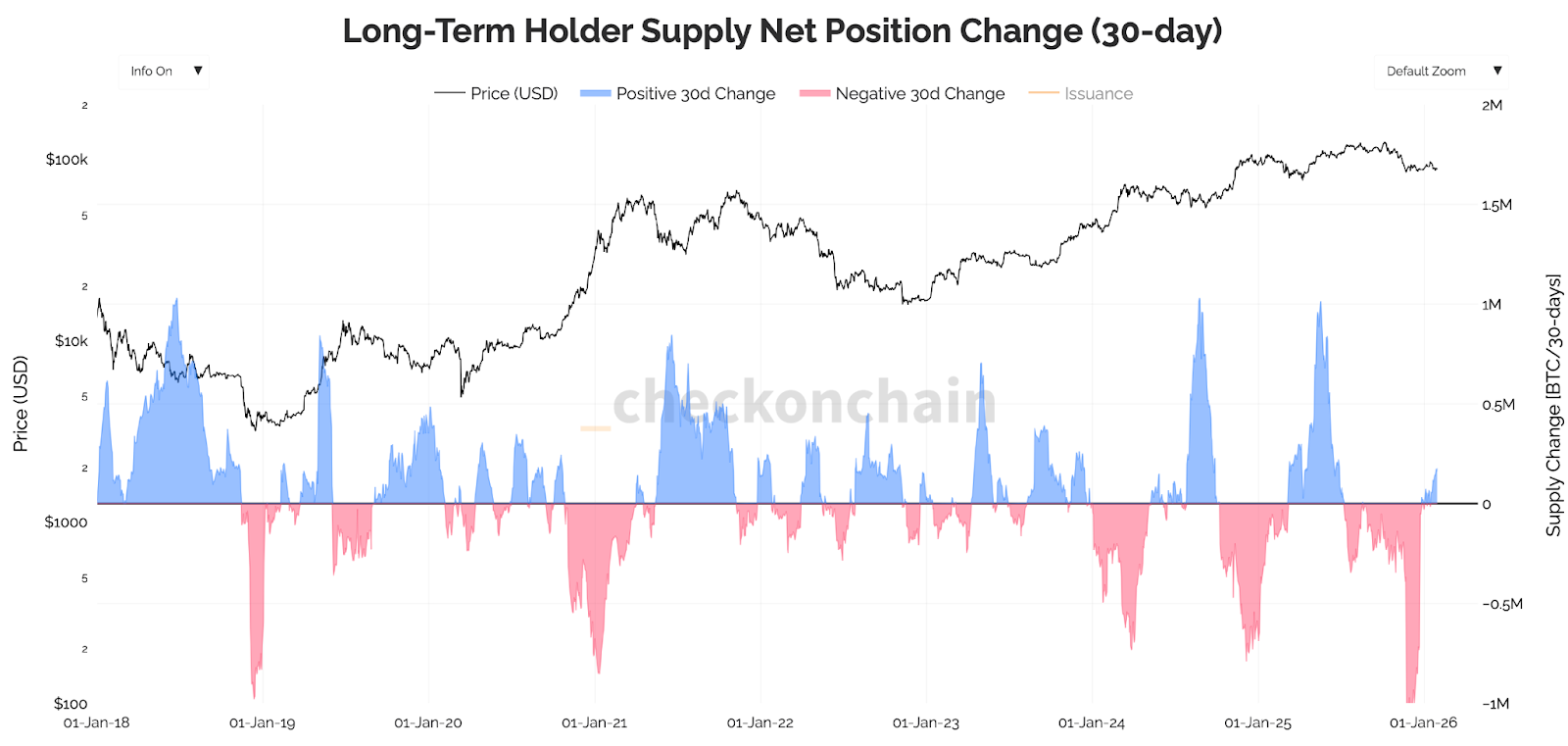

Lengthy Time period Holder Web Place Change

Supply: Checkonchain

One other key information level that explains why Bitcoin stays vary sure for now’s that promoting strain amongst long run holders has now dried up and actually flipped optimistic for the reason that begin of the month. In on-chain evaluation, Lengthy Time period Holders (LTH) are sometimes known as wallets holding Bitcoin for 155 days or longer. The chart seen above tracks the 30-day internet change in LTH provide over $BTC’s worth. In easy phrases, it exhibits us whether or not affected person, larger conviction holders are including or eradicating publicity to their positions.

After an extended interval of LTH promoting that accelerated after November final 12 months, this dynamic has began to shift. The 30-day internet place change has now flipped into the optimistic territory, standing at +177.08K $BTC, which means these holders, over the previous month, have added that a lot to their collective holdings.

This not solely marks a transparent change from distribution to accumulation but in addition alerts that cash offered into weak spot at the moment are being reabsorbed by holders with long term outlook. What’s extra is that, traditionally, optimistic shifts in LTH provide change have acted as a number one indicator of broader development reversals.

That stated, it’s necessary to be cautious of the very fact this isn’t a backside sign or name for an instantaneous breakout. LTH accumulation can persist however macro circumstances nonetheless play a vital function in shaping quick time period worth motion and subsequent reactions from this group.

Derivatives Strain Being Launched

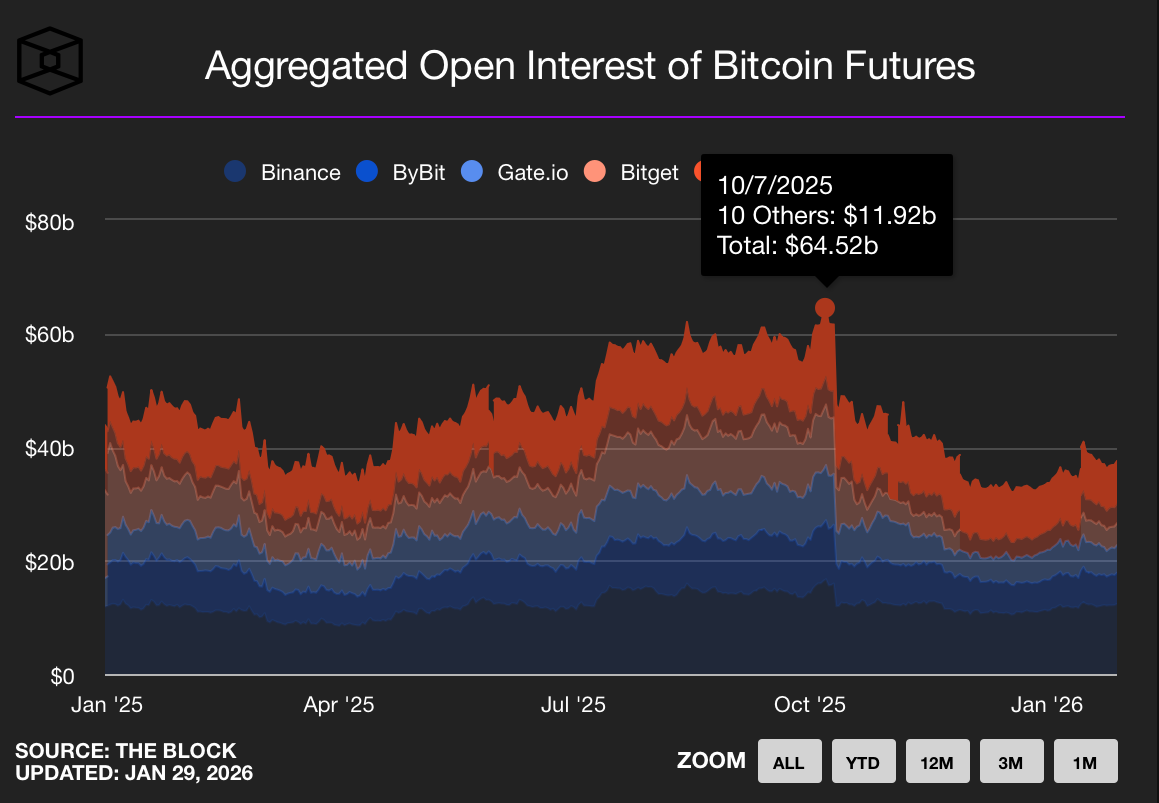

Supply: The Block

One other necessary issue serving to clarify Bitcoin’s consolidation is the regular launch of derivatives strain. Over the past 12 months, mixture open curiosity in Bitcoin futures throughout the highest 15 centralized exchanges peaked at roughly $64.52 billion on October 7, exhibiting a closely leveraged market with elevated speculative positioning.

Nonetheless, following the liquidation occasion that unfolded after October 10, open curiosity fell off a cliff and has continued to go decrease. As of now, mixture open curiosity stands at round $37.53 billion, representing a large discount in leverage throughout the system.

This decline in open curiosity means that extra leverage has been systematically flushed out, lowering each pressured liquidations and reflexive momentum-driven strikes. In such an atmosphere, worth motion tends to compress: with out aggressive lengthy positioning to gasoline upside or crowded shorts to set off squeezes, Bitcoin is extra more likely to commerce sideways as spot flows take in residual provide.

In that sense, the present rangebound habits isn’t essentially an indication of indecision alone, however moderately a mirrored image of a market that’s resetting positioning and rebuilding from a cleaner base, the place directional strikes usually tend to emerge as soon as leverage and conviction start to re-accumulate.

What the Vary is Really Signalling

Bitcoin is at present correcting sharply to the draw back. The actual fact, nonetheless, is that we nonetheless stay in a long run market construction. The market remains to be in a interval of testing acceptance, albeit below rising draw back momentum, moderately than resolving course.

That stated, there’s the ETF realized worth at present sitting at 86.6k, which is a key degree that Bitcoin must reclaim. This zone has traditionally acted as a stabilization and accumulation space. A chronic interval under this zone will possible add promote aspect strain as ETF holders are internet underwater.