Bitcoin (BTC) has confronted issue regaining momentum in current days, with costs struggling to interrupt above the $115,000 resistance zone.

Regardless of this short-term weak point, sturdy bullish indicators are rising, suggesting that November may favor upward motion.

Bitcoin Has A Historical past

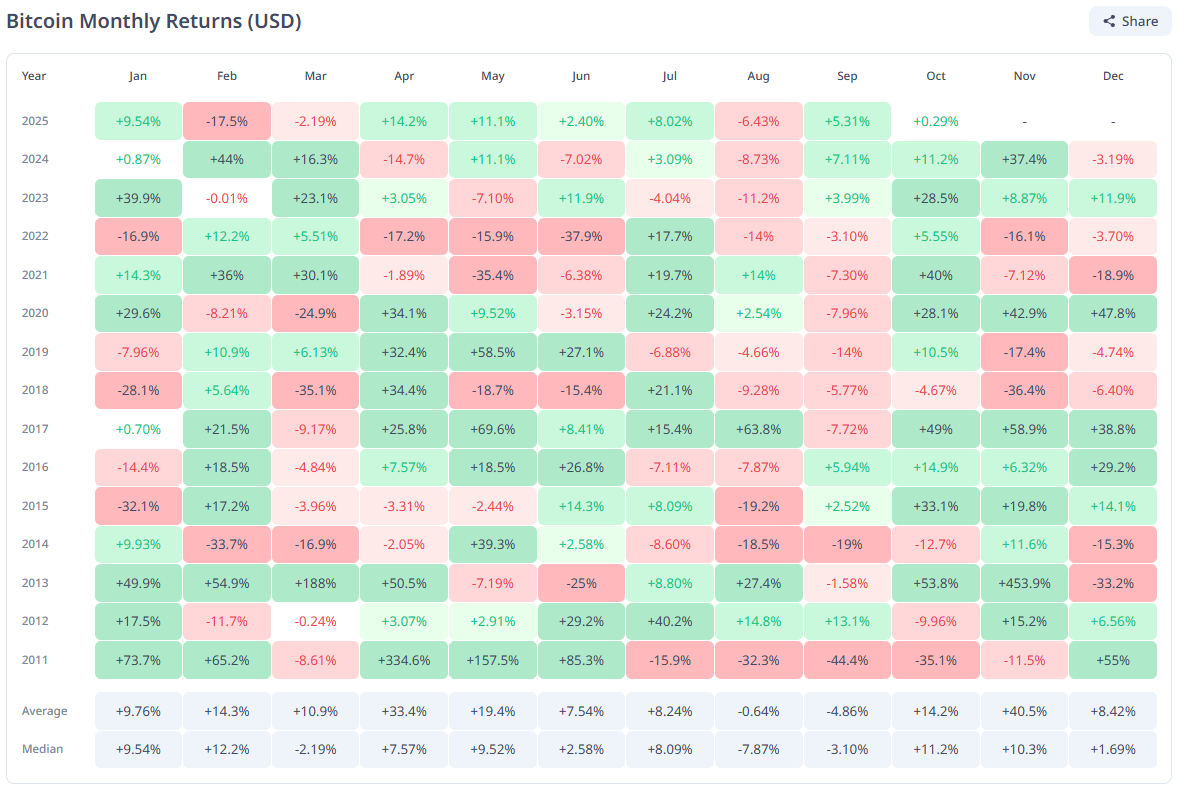

November has historically been one in every of Bitcoin’s strongest months. Historic knowledge reveal that Bitcoin’s median return in November stands at 11.2%, making it the second-best performing month after October. This constant sample of positive factors tends to spice up investor optimism and strengthen market participation at the start of the month.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Bitcoin Historic Month-to-month Returns. Supply: CryptoRank

Nevertheless, talking completely to BeInCrypto, Rachel Lin, Co-Founder and CEO of SynFutures, highlighted that November 2025 may very well be completely different.

“World commerce tensions, inflation, and recession fears have weighed closely on all danger belongings, and Bitcoin hasn’t been spared. We’ve seen it commerce in that $104,000 to $108,000 vary not too long ago. Trying forward, I feel November will possible carry consolidation or a modest restoration — not a full-on rally except a robust catalyst seems. If commerce tensions worsen, Bitcoin may retest the $90,000 space. But when assist holds above $110,000, we may simply see a ten to twenty% rebound towards $120,000 to $140,000 by the top of the month, particularly with ETF inflows holding up and whales quietly accumulating,” acknowledged Lin.

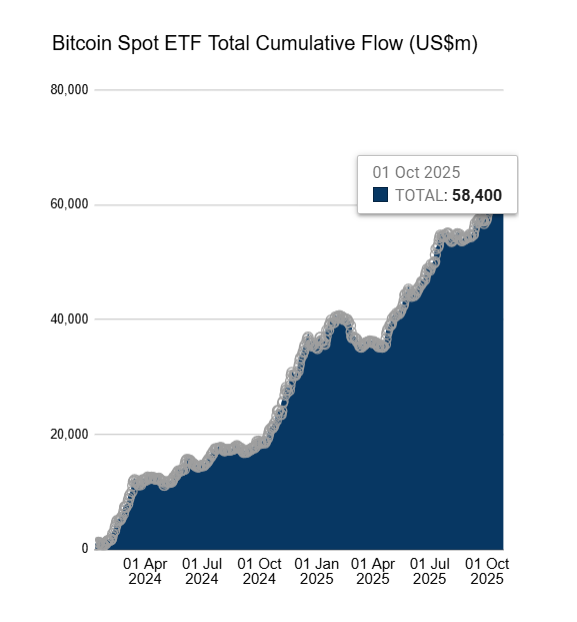

Nonetheless, an indication of power lies within the efficiency of Bitcoin spot exchange-traded funds (ETFs). In October alone, Bitcoin ETFs recorded web inflows totaling $3.69 billion. The month started with cumulative flows at $58.4 billion and closed at $62.1 billion, reflecting a considerable improve in investor publicity to BTC by regulated funding merchandise.

Bitcoin Spot ETF Internet Flows. Supply: Farside

These inflows display that institutional buyers proceed to see Bitcoin as a helpful asset in diversified portfolios. Lin additionally famous that even after some mid-month outflows, the general development is clearly constructive.

“On October 21 alone, we noticed almost half a billion {dollars} in new inflows led by BlackRock and Constancy. That reveals simply how sturdy conviction nonetheless is. Establishments more and more see Bitcoin as “digital gold,” a hedge in opposition to inflation, debasement, and international uncertainty… What’s additionally attention-grabbing is how this habits mirrors onchain exercise. Each time we get a correction, inflows resume rapidly, whales accumulate, and ETFs find yourself holding an excellent bigger share of the overall Bitcoin provide, now over 6%. With regulation enhancing and charges dropping, it’s turn into simpler and cheaper than ever for conventional buyers to get publicity,” Lin advised BeInCrypto.

Bitcoin Is Establishing Essential Ranges

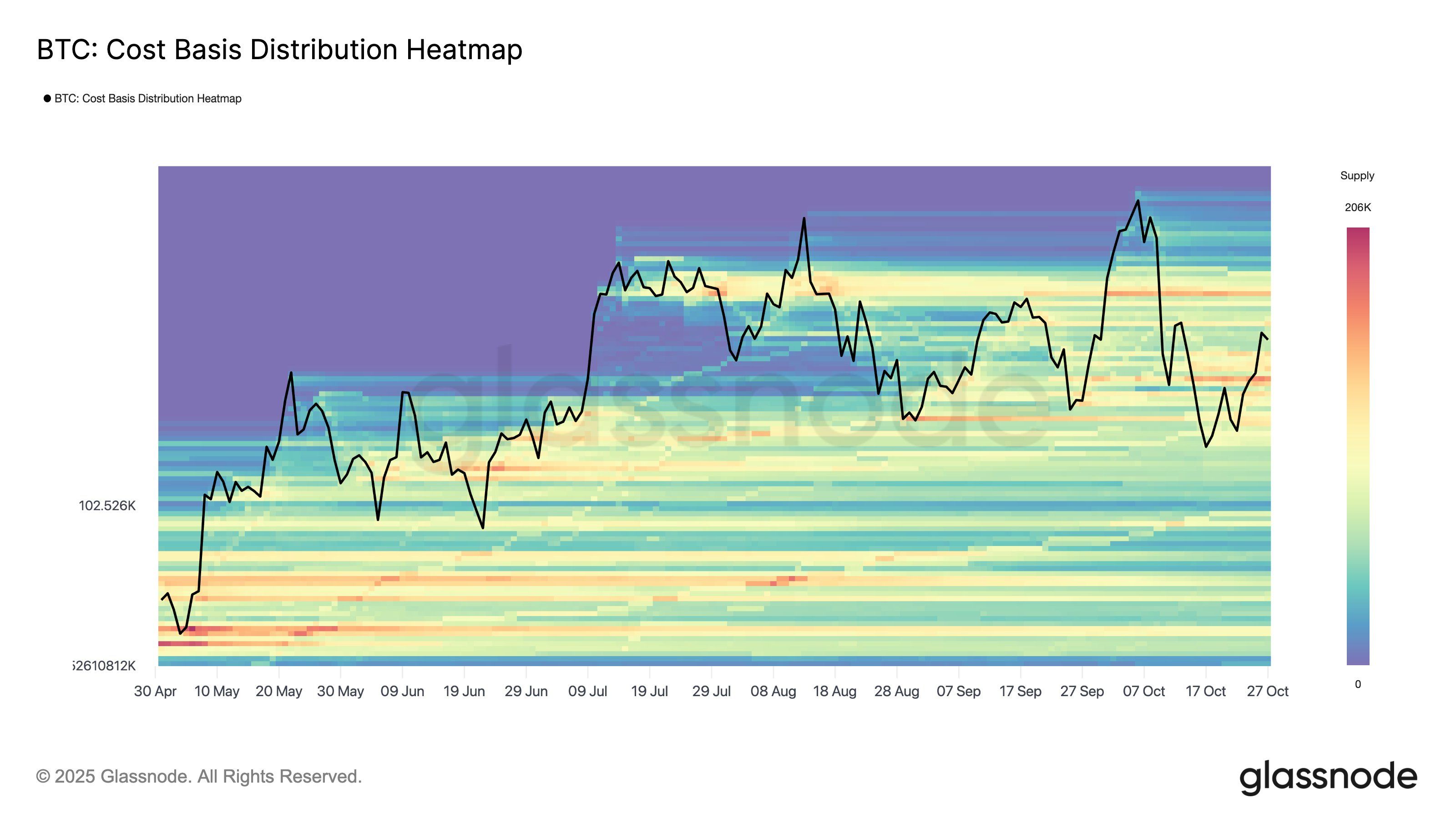

On-chain knowledge provides one other layer of perception into Bitcoin’s present place. The Value Foundation Distribution Heatmap highlights vital assist of round $111,000 and notable provide strain of almost $117,000. This vary defines the battleground between current consumers trying to defend positions and profit-takers searching for exits after the current rally.

A breakout in both path may decide the trajectory for the approaching weeks. If bulls handle to push past the $117,000 provide zone, momentum may speed up sharply. Conversely, a failure to carry $111,000 may shift sentiment bearish, prompting short-term corrections.

Bitcoin Value Foundation Distribution Heatmap. Supply: Glassnode

BTC Value Awaits Breakout

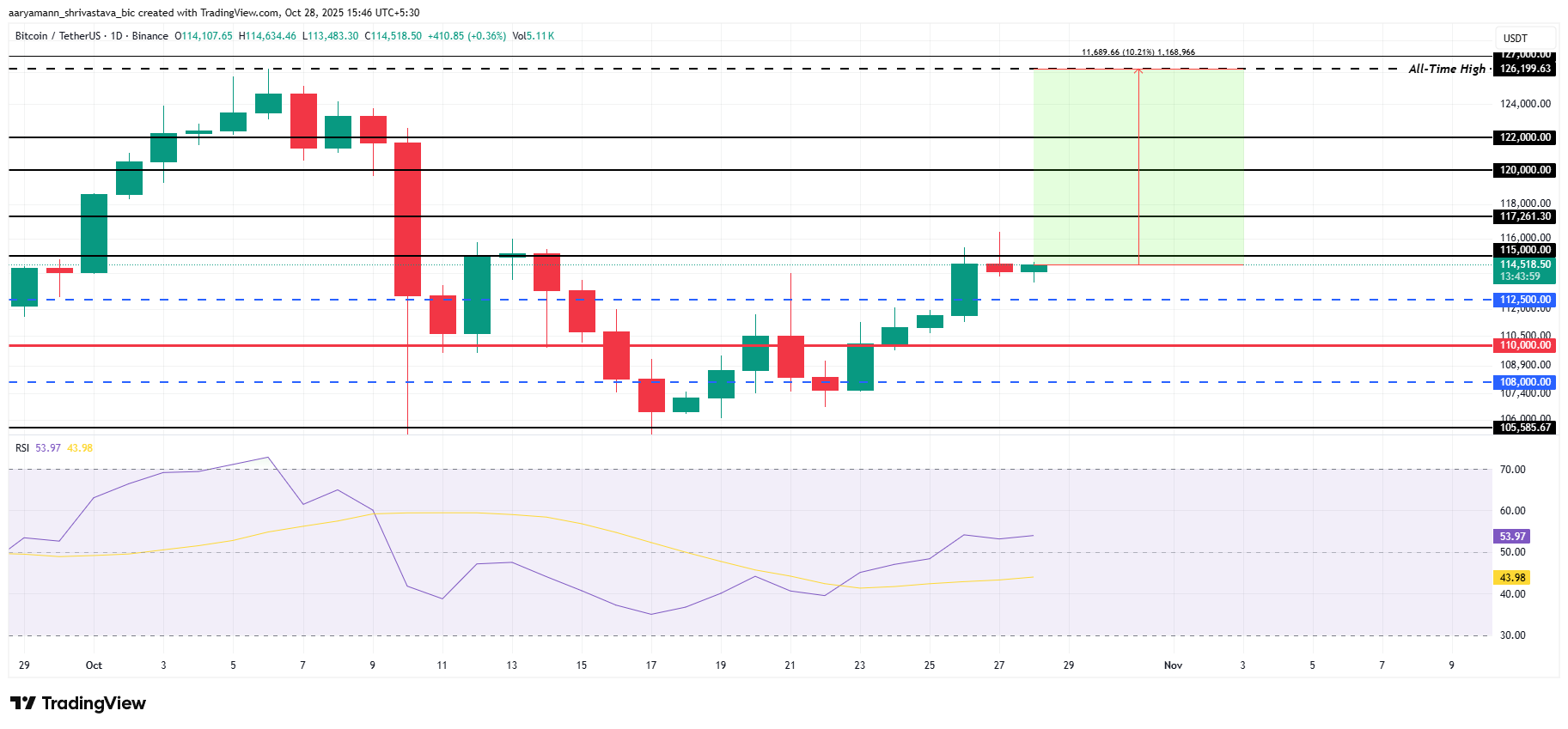

On the time of writing, Bitcoin trades at $114,518, sitting slightly below the important thing $115,000 resistance stage. With investor sentiment turning more and more constructive, BTC may quickly push by this barrier. A confirmed breakout would possible set off renewed momentum, driving Bitcoin value towards greater resistance ranges in November.

Bitcoin’s near-term goal stays its all-time excessive (ATH) of $126,199, which requires a ten.2% rise from present ranges. To realize this, BTC should first clear sturdy resistance zones at $117,261 and $120,000, the place heavy provide from profit-takers may briefly gradual progress.

Bitcoin Value Evaluation. Supply: TradingView

Nevertheless, if Bitcoin fails to maintain momentum above $115,000, short-term weak point may reemerge. A dip towards $110,000 stays attainable if consumers lose conviction. Any transfer under this assist would invalidate the bullish outlook.

The publish What To Anticipate From Bitcoin Value In November 2025 appeared first on BeInCrypto.