The U.S. Greenback Index (DXY) is sliding onerous, dropping to round 98.50 after a disastrous jobs report and a political shake-up in Washington have merchants satisfied that Federal Reserve price cuts are coming quickly. The weak greenback has offered a direct enhance to Bitcoin, which is now making an attempt to reclaim the important thing $115,000 degree.

The greenback’s sell-off was kicked into excessive gear by the July nonfarm payrolls report, which confirmed simply 73,000 jobs have been added; effectively under forecasts. Making issues worse, the earlier two months’ figures have been revised down by a large 258,000 jobs.

The sell-off deepened following President Trump’s dismissal of Bureau of Labor Statistics Commissioner Erika McEntarfer and the sudden resignation of Fed Governor Adriana Kugler.

Associated: Trump to Identify New Fed Governor After Kugler Resigns; BLS Head is Fired

These developments unsettled markets and drove the greenback to its sharpest single-day loss since April. By Monday, the index confirmed indicators of stabilizing however remained subdued, buying and selling below strain amid persistent uncertainty.

From a technical standpoint, the DXY stays caught under the important thing resistance degree of 98.50. Analysts are watching to see if it breaks decrease, which may open the door to an extra slide towards the 97.50 space.

BTC vs DXY. Supply: Bitcoin Journal Professional

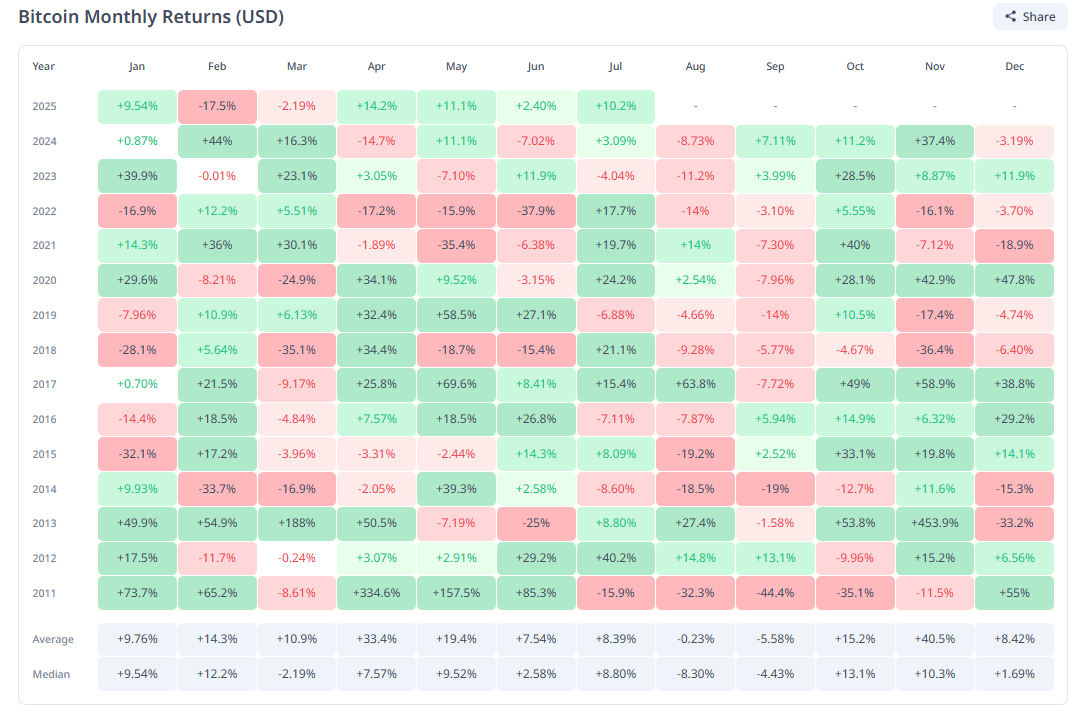

Bitcoin Rebounds to $115,000 as RSI Recovers and Value Nears Key EMA Resistance

Because the greenback weakened, Bitcoin discovered its footing, climbing to round $114,916 after a robust in a single day session.

The 4-hour chart reveals BTC bouncing from a current low close to $112,000, with shopping for quantity selecting up. The value is now approaching its speedy resistance, the 50-period exponential shifting common (EMA) at $115,672.

BTCUSD 4-Hour Chart. Supply: TradingView

The RSI, a key momentum indicator, has bounced onerous from the “oversold” degree of 30 and is now again to a impartial 50.84. This reveals that the extreme promoting strain from earlier within the week has eased for now. If Bitcoin can break and maintain above the EMA, its subsequent goal can be the resistance degree close to $118,000, seen throughout late July highs.

Associated: Bitcoin Value Chart Dropped 4%, However On-Chain, Holder Demand Is Up 160,000 BTC

Quantity information additionally indicators elevated exercise throughout the restoration, reinforcing short-term bullish sentiment. Nonetheless, failure to reclaim the EMA could hold BTC range-bound between $112,000 and $115,000, as merchants await additional affirmation from macroeconomic elements and greenback actions.

Bitcoin vs. DXY Inverse Correlation in Full Impact

The broader crypto market additionally benefited from the rising expectation of simpler cash from the Fed, with Ethereum, XRP, and different main altcoins posting good points. Bitcoin’s value motion stays intently tied to the greenback’s, as a weaker DXY traditionally coincide with stronger crypto efficiency.

Merchants are actually keen to search out out if the U.S. greenback have been to interrupt down additional or stabilize.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.