Technique’s powerhouse bitcoin technique has unleashed a jaw-dropping $5.1 billion achieve to this point this yr, electrifying buyers and cementing its dominance as the final word bitcoin treasury titan.

Technique’s Daring Bitcoin Guess Pays off in Large Treasury Positive aspects and Hovering Investor Curiosity

Software program intelligence agency Microstrategy (Nasdaq: MSTR), now working underneath the identify Technique, revealed new monetary information Saturday, emphasizing its aggressive bitcoin-focused technique. Govt Chairman Michael Saylor underscored the corporate’s treasury success on social media platform X, stating:

To this point this yr, MSTR treasury operations have generated a BTC $ achieve of $5.1 billion.

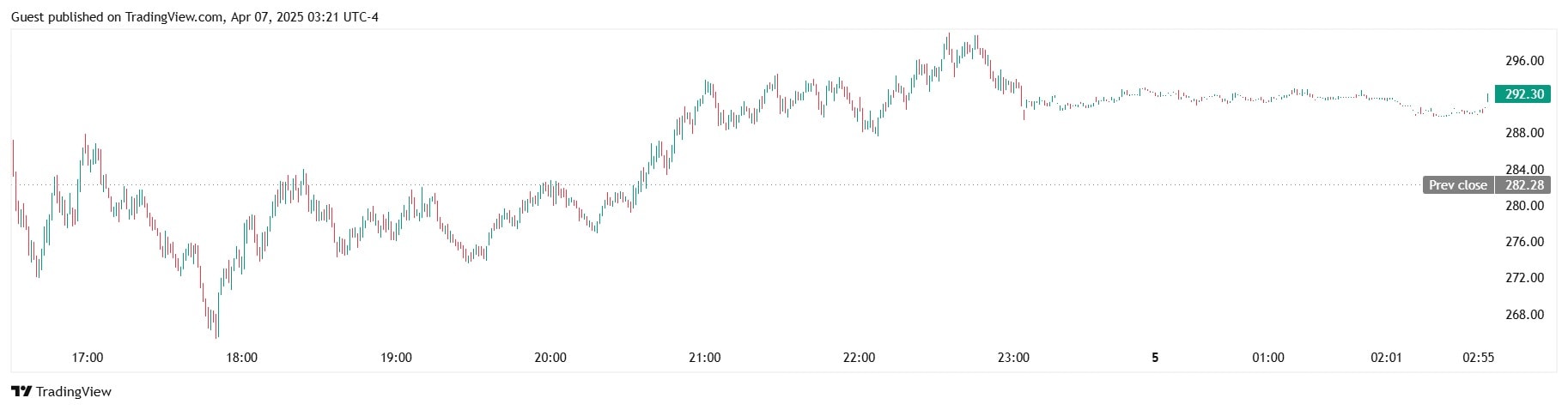

Technique’s bitcoin treasury operations shared by Michael Saylor.

Technique’s bitcoin reserves have grown to 538,200 BTC, with the present worth at $94,367. The corporate’s bitcoin internet asset worth (NAV) now totals $50.8 billion. Metrics reveal a year-to-date (YTD) bitcoin yield of 12.1%, amounting to a achieve of 54,029 BTC. For the quarter-to-date (QTD), the agency achieved a 1.0% yield, representing a 5,209 BTC achieve and an related $492 million improve. The technique achieved a 74.3% bitcoin yield in 2024, leading to a achieve of 140,538 BTC, equal to an estimated $13.1 billion in worth.

Technique has continued bolstering its bitcoin holdings by leveraging debt and most popular inventory gross sales. Its most up-to-date buy, disclosed April 21, concerned buying 6,556 BTC for about $555.8 million at a mean worth of $84,785 per bitcoin. Saylor additionally revealed on April 20 that public information from Q1 2025 exhibits greater than 13,000 establishments and 814,000 retail accounts now immediately maintain MSTR shares. Moreover, about 55 million people have oblique publicity by means of exchange-traded funds (ETFs), mutual funds, pension plans, and insurance coverage portfolios. Reinforcing his pro-bitcoin stance, Saylor not too long ago acknowledged:

Bitcoin has no counterparty danger. No firm. No nation. No creditor. No forex. No competitor. No tradition. Not even chaos.