Simply as Bitcoin (BTC) goes by a tense buying and selling day, Michael Saylor has stepped into the highlight — with out saying a lot, but sufficient. In a brand new publish at this time, the Technique CEO shared an AI-generated photograph of himself at a chessboard, captioned merely: “Bitcoin is Chess.”

What issues is that the timing of the publish coincides with rising unease on the monetary markets as all await recent commentary from Federal Reserve Chair Jerome Powell.

Chess, in spite of everything, is about construction and technique, not panic and prediction. Let’s be truthful, Saylor has mastered enjoying this lengthy recreation, as Technique, the corporate he chairs, holds one of many largest Bitcoin treasuries on the planet: 528,185 BTC valued at roughly $44.31 billion.

With a mean buy value of $67,458, the present market locations the place in a wholesome revenue zone of roughly 24.35%.

Bitcoin is Chess. pic.twitter.com/pnoOKuOfzJ

— Michael Saylor (@saylor) April 16, 2025

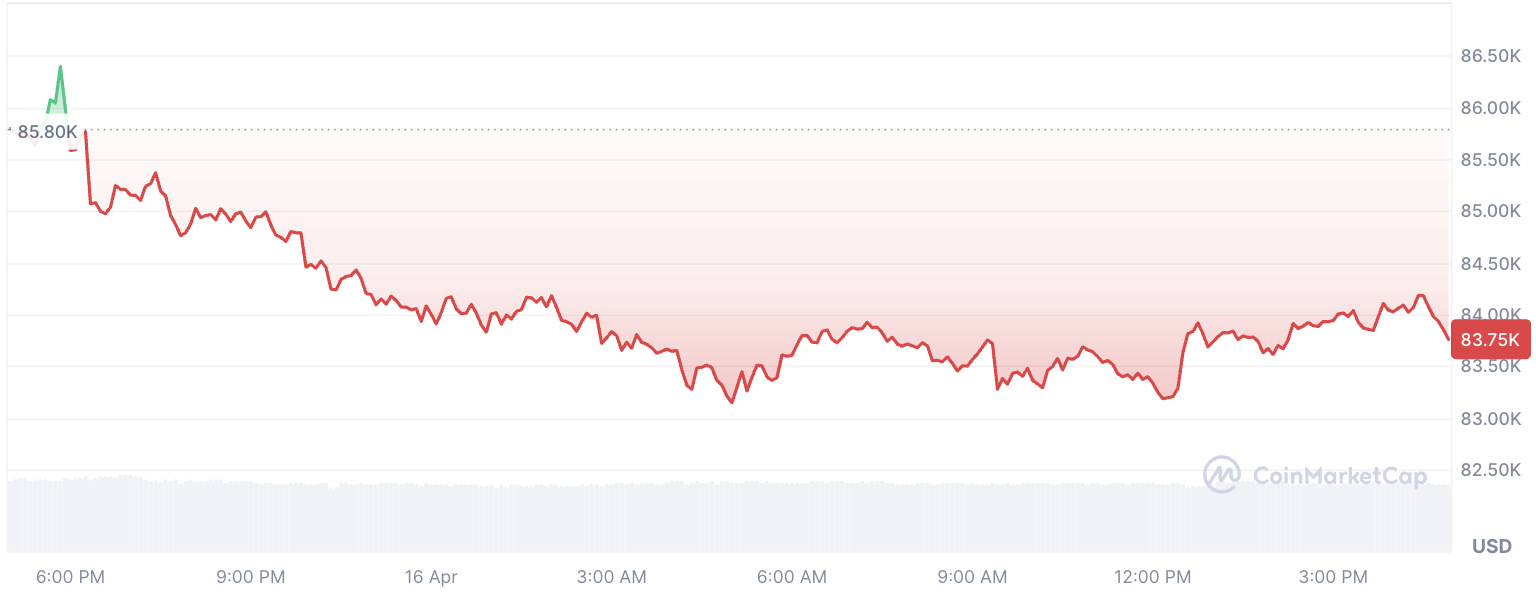

Right this moment, nonetheless, it’s not earnings that dominate the dialog — it’s anxiousness. Bitcoin’s value chart for April 16 reveals all of the basic indicators of nervous buying and selling conduct. From the reset of the buying and selling session, Bitcoin bounced erratically between $83,100 and $84,300, finally touchdown round $83,909.

The sample reveals nervous sentiment: sharp reversals, short-lived rallies and no clear directional conviction. It isn’t a crash, not a breakout — simply pressure.

It’s no coincidence that this environment aligns with Powell’s anticipated commentary, anticipated to the touch on rates of interest, liquidity situations and macro alerts that would ripple by danger property. In that body, Bitcoin — as seen by Saylor’s lens — is much less about timing the Fed and extra about outlasting the noise.