Disclosure: The views and opinions expressed right here belong solely to the writer and don’t signify the views and opinions of crypto.information’ editorial.

United States President Donald Trump signed an govt order to create a sovereign wealth fund. Whereas the media speculates whether or not the US authorities will put money into crypto, let’s take a broader have a look at the previous and the potential way forward for Bitcoin (BTC).

You may also like: The main target is on strengthening US management in crypto tech | Opinion

What fashioned Bitcoin’s traits?

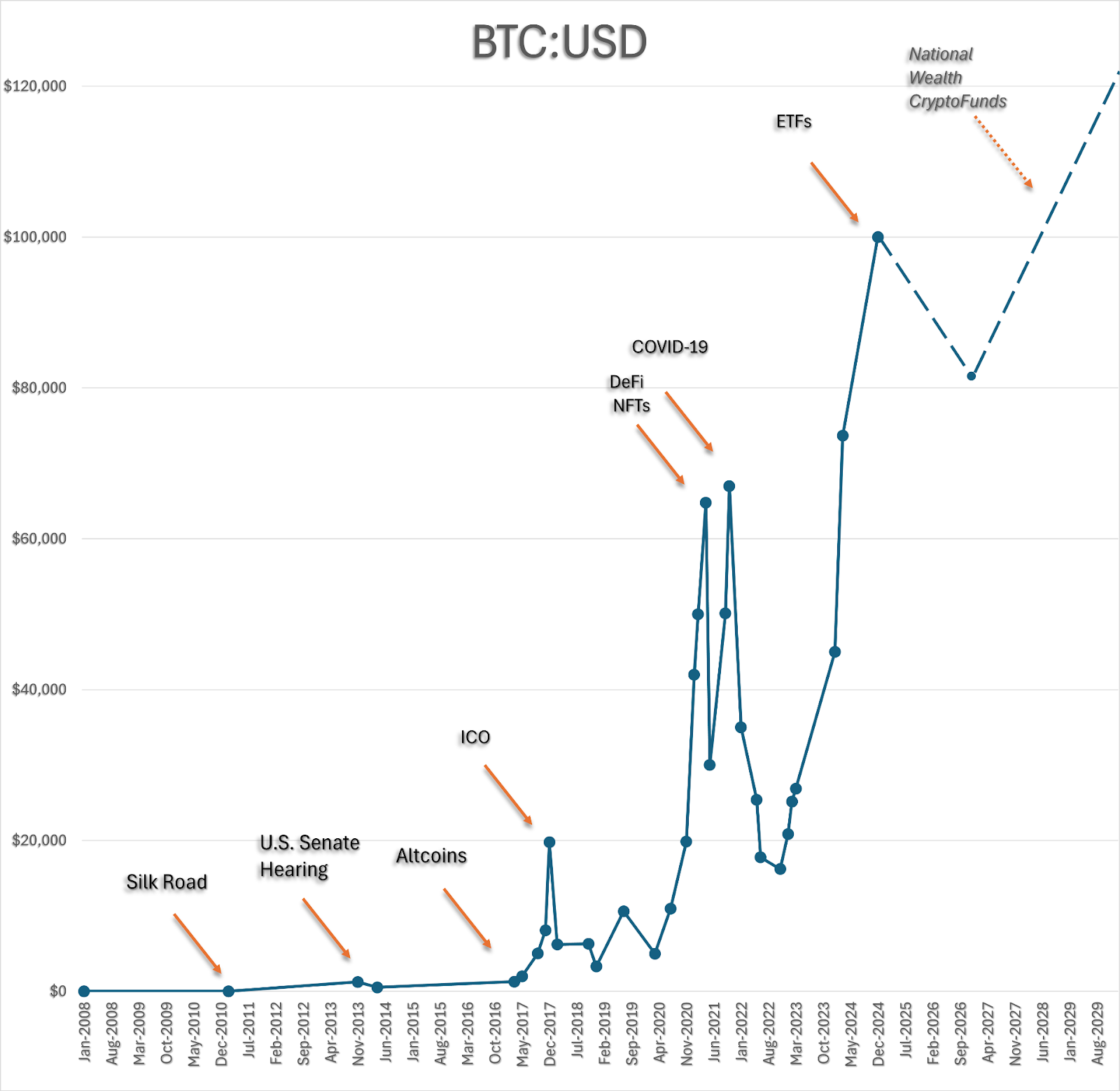

During the last 17 years, Bitcoin’s worth climbed from $0 to a historic excessive of $110,000, but its trajectory has been something however linear. In 2010, for example, you wanted 5 thousand BTC simply to purchase a pizza. The daybreak of the notorious Silk Highway market in 2011 contributed to an early worth spike. When the US authorities took down {the marketplace}, the next US Senate public listening to unexpectedly propelled Bitcoin’s worth from a number of hundred {dollars} to over $1,200 per coin.

Bitcoin worth chronology: Major traits and milestones | Supply: Courtesy of the writer

Then got here the primary altcoin season, fueled by the arrival of Ethereum (ETH) in 2016 and the preliminary coin providing increase ending in 2017. This era pushed Bitcoin to an unbelievable excessive of $20,000. After its first crypto winter of 2017–2018, Bitcoin regularly rebounded. The rise of decentralized finance and the explosion of nonfungible tokens injected renewed vitality as modern tasks and enthusiastic adopters bid up costs once more. Though Bitcoin itself was not the driving drive behind DeFi—Ethereum’s sensible contracts took that position—Bitcoin remained the primary gateway for crypto investments, with its “wrapped” model showing on decentralized exchanges and automatic market makers from 2018 to 2020. NFTs additionally accompanied Bitcoin’s climb. After a modest rollback, COVID-19 struck, and governments all around the world poured out a rain of freshly printed cash to their residents, fueling one other wave of investor curiosity.

Simply because it appeared traits have been slowing, institutional traders entered the scene. Conventional monetary establishments started embracing Bitcoin, launching exchange-traded funds round 2022, which peaked in recognition between 2024 and 2025. This broadened entry for each retail and institutional traders and strengthened Bitcoin’s standing as “digital gold.”

Nationwide wealth funds

Now, with rumors swirling that the US authorities would possibly quickly maintain direct crypto investments by way of newly initiated Sovereign Wealth Funds, it’s value contemplating what would occur if this turns into actuality.

Undoubtedly, america would set a world precedent for different nations. This development may form the subsequent two to 5 years and doubtlessly ship Bitcoin’s worth skyrocketing, maybe fulfilling the wildest goals by reaching $1,000,000 per coin. There’s a catch, although. Even essentially the most highly effective monetary organizations can undergo from short-sightedness.

What drives Bitcoin’s worth?

Bitcoin by no means absolutely grew to become the “digital money” envisioned in Satoshi Nakamoto’s white paper. Its Silk Highway period could have been its golden age for real-world transactions. For readability, it stays the go-to possibility for shady trades worldwide. In legit markets, Bitcoin features primarily as a retailer of worth—a speculative asset traded by traders with little regard for its unique utility.

We’ve seen it evolve by way of a number of eras, and we now stand on the brink of doubtless the largest one but: nationwide investments. Many governments already personal some BTC, typically seized from legal enterprises. Nonetheless, if treasury departments leap in late, they could miss vital earnings, whereas early movers like El Salvador may take pleasure in a bigger windfall. Every development up to now has expanded Bitcoin’s investor base, however what may surpass the participation of institutional organizations, superannuation funds (but to embark), and nationwide treasuries? Ultimately, you run out of patrons on Earth—there’s actually nobody on the Moon to proceed the development as soon as Bitcoin will get there.

That’s the reason I take into account it short-sighted to count on that Bitcoin’s speculative worth will proceed to be fueled by these traits indefinitely. Those that may form Bitcoin’s future and make its use actually sustainable, past mere hypothesis, sadly, present few indicators of getting a long-term imaginative and prescient. My prediction is that they’ll quietly exit earlier than the development turns downward.

Various (sustainable) future

Many query Bitcoin’s reliability, however such skepticism typically depends on flawed assumptions. Bitcoin is neither centralized nor weak: it has operated as a publicly accessible ledger for over 17 years with out main disruptions—an unparalleled feat.

If nationwide treasuries acknowledge Bitcoin’s resilience, it may pave the best way for long-overlooked functions. Bitcoin has the potential to evolve into a strong software platform just like Ethereum. Whereas some engineers debate this, I imagine their skepticism stems from a scarcity of in-depth experience on this space.

Think about leveraging Bitcoin’s blockchain for a nationwide land registry, a decentralized different to ICANN’s TLD system, or perhaps a voting system for democratic nations. Bitcoin’s larger charges could possibly be justified by its unprecedented safety—significantly for mission-critical private and non-private methods that deal with useful property. Whereas cheaper, much less safe blockchains could enchantment to speculative or experimental tasks, Bitcoin is designed for eventualities the place reliability trumps value.

Conclusion

I’ve lengthy advocated for constructing dApps and sensible contracts on Bitcoin (and I’m deeply concerned within the technical aspect), contending that its excessive charges are a worthwhile trade-off for top-notch safety. It’s for the “large boys”—sectors the place reliability is non-negotiable. If nationwide treasuries lastly embrace Bitcoin as the last word digital retailer of worth, it is going to open the door to its true utility because the digital fortress for essentially the most crucial items of public infrastructure—its worth won’t ever flip again, actually reaching the Moon and even Mars.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.

Learn extra: Will Bitcoin survive the approaching monetary collapse? | Opinion