Over the previous 24 hours, bitcoin has drifted between $103,133 and $104,841, whereas South Korea’s infamous premium quietly inverted, dipping into low cost territory for a number of days this month.

Bitcoin’s Comeback Inverts South Korea Premium to 0.76% Under World Common

Bitcoin has skilled an eventful week, buoyed by renewed urge for food and reclaiming the $100,000 milestone for the primary time since February. Nonetheless, following these recent worth peaks, the premium on South Korean exchanges reversed into a reduction. As of Sunday, Might 11, 2025, charges on Bithumb and Upbit align virtually identically with worldwide exchanges.

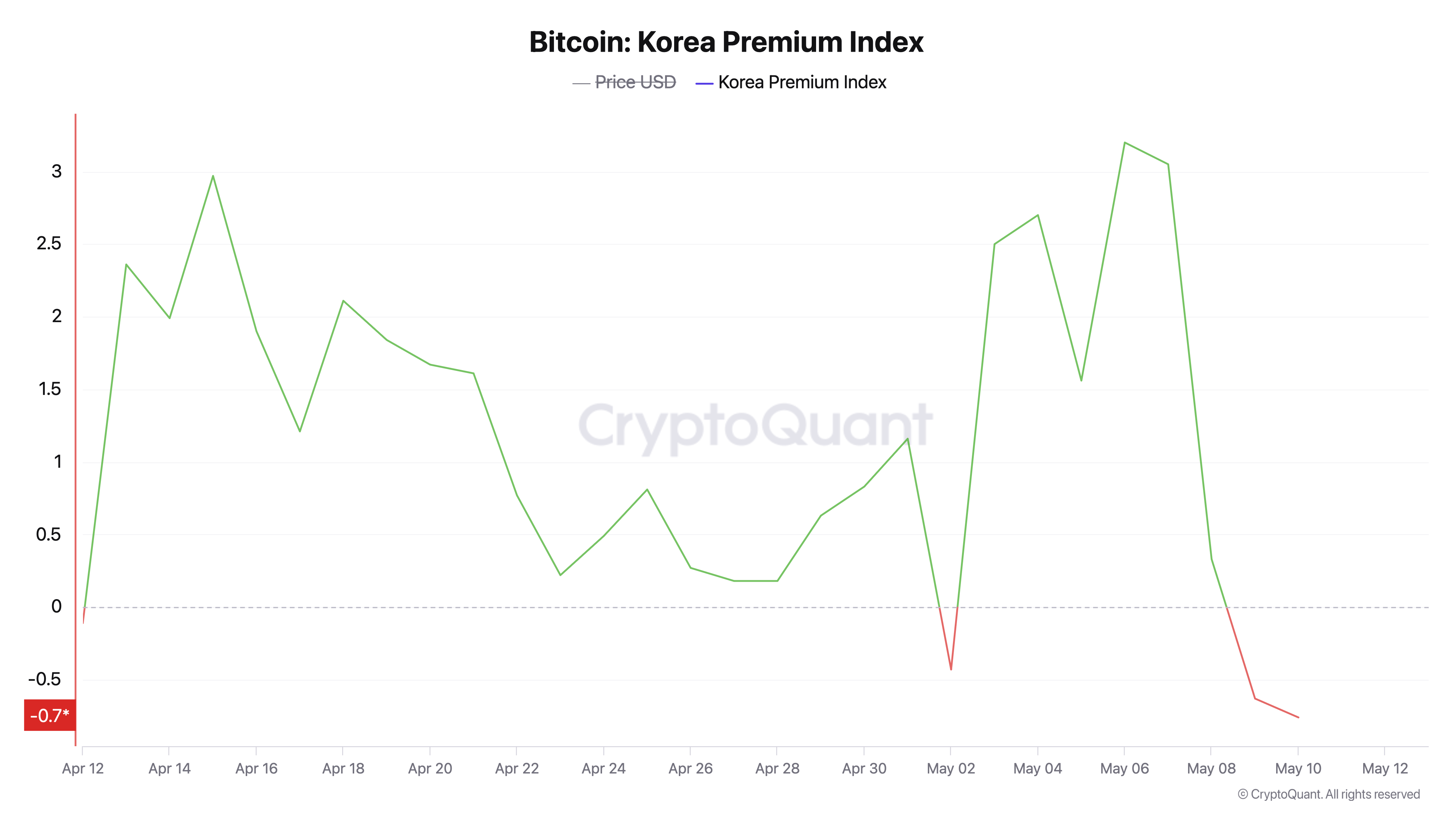

Information from cryptoquant.com present the inversion started on Might 2, falling 0.43% beneath the worldwide common, then deepening on Might 9 and 10 to achieve a 0.76% shortfall on the latter date. Between Might 2 and 9, premiums climbed to as excessive as 3% on Might 6. Such reductions in South Korea are an unusual prevalence.

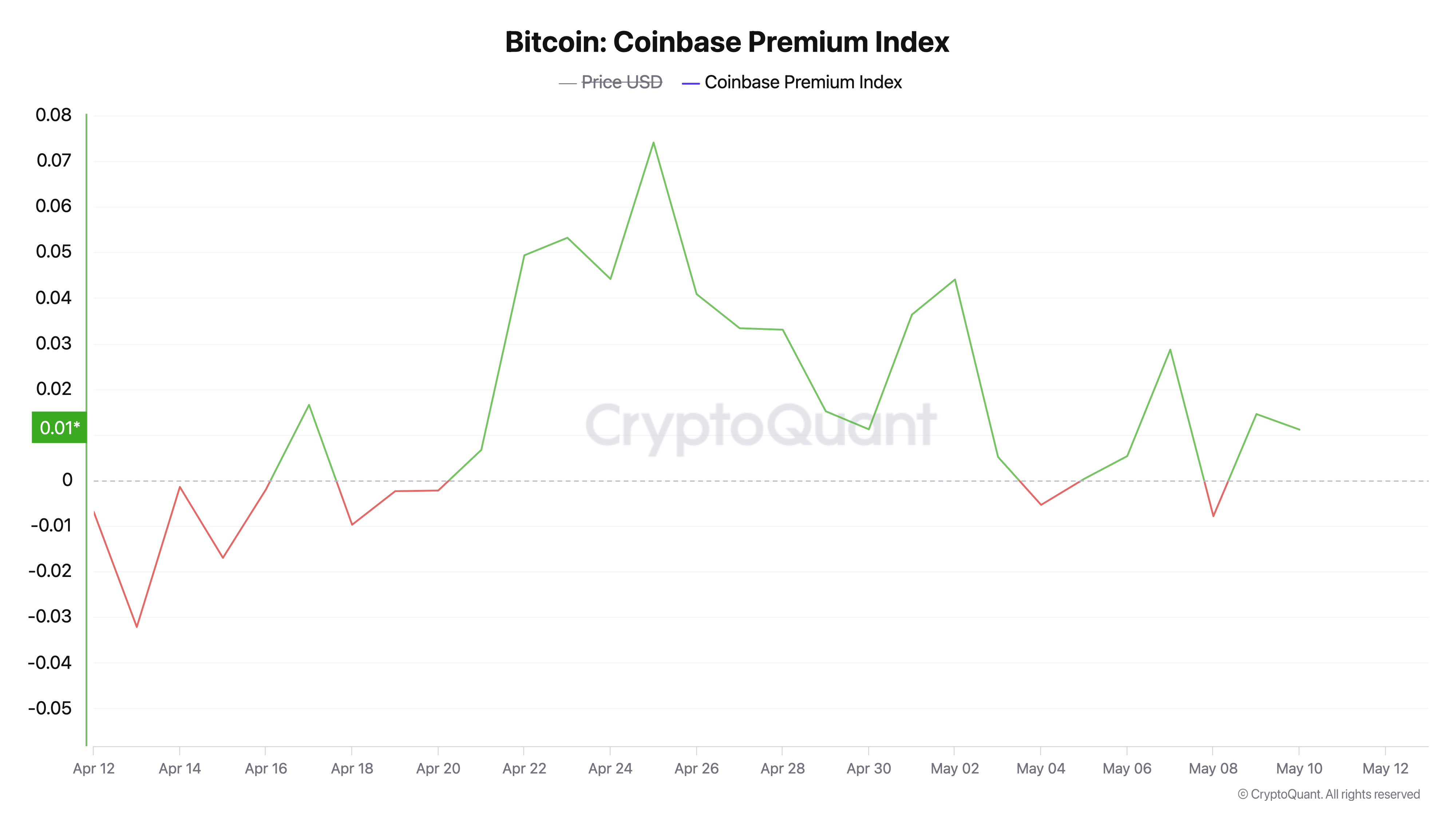

The earlier inversion dates to April, when costs dipped 1.19% underneath the weighted world common, marking a fair deeper low cost. Previous to that episode, the final gained low cost was recorded in December of final yr. In the meantime, since April 20, Cryptoquant’s Coinbase Premium Index has predominantly remained in premium territory.

There have been two transient, modest reversals—on Might 4 and once more on Might 8. In essence, the Coinbase Premium Index from Cryptoquant calculates the proportion hole between Coinbase Professional and Binance, with elevated premiums indicating vigorous shopping for strain from U.S. buyers. Conversely, a gained low cost could sign subdued demand, surplus provide, or heightened native uncertainty within the South Korean market.