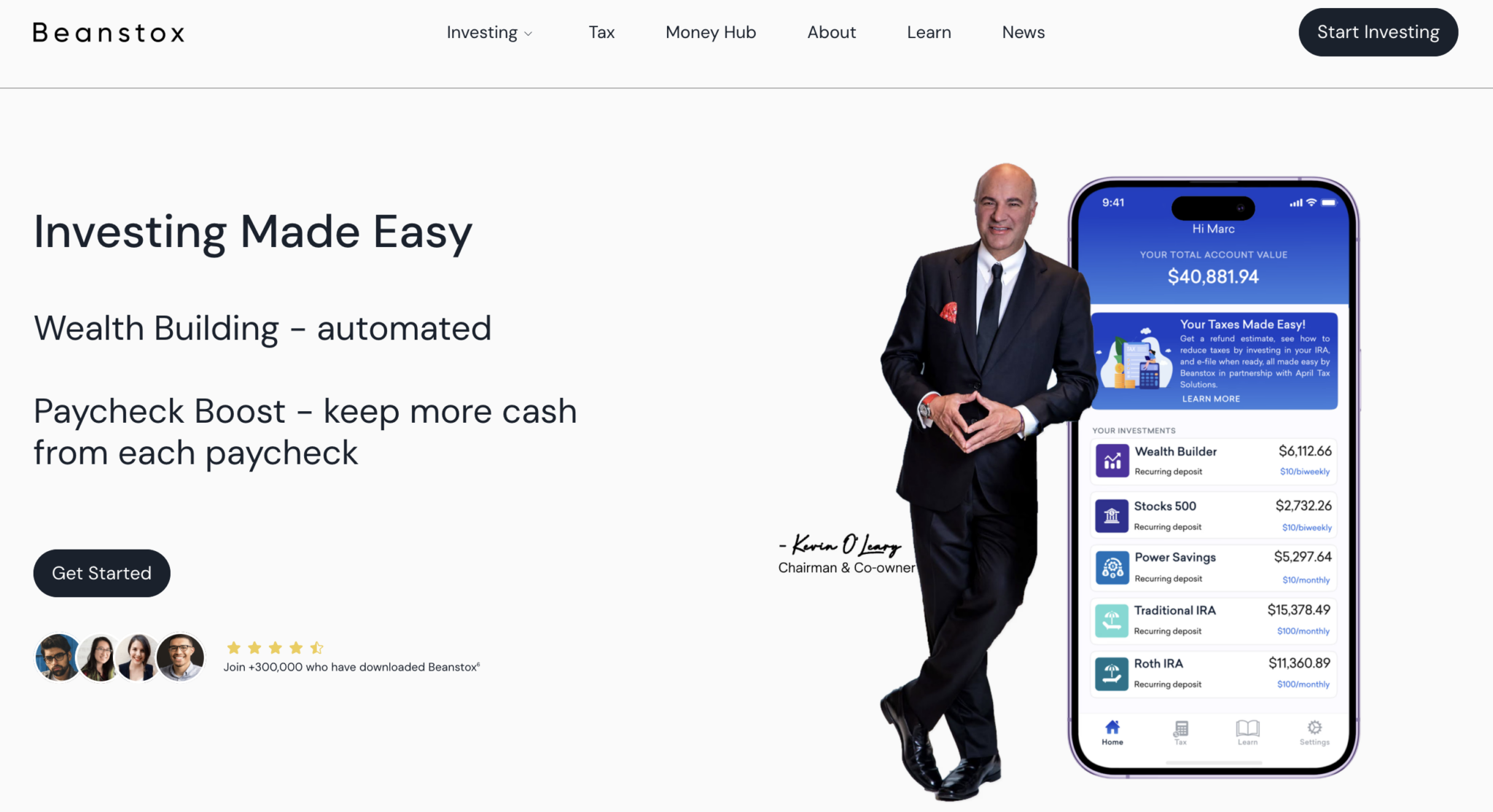

Kevin O’Leary, investor and TV present Shark Tank star, is increasing Beanstox, the corporate he co-founded, with new options that permit clients to put money into Bitcoin and gold by exchange-traded funds.

All trades and holdings stay inside Beanstox accounts. This construction provides readability and ease of use, particularly for shoppers unfamiliar with crypto custody.

CEO Says Property Provide Inflation Hedge

Beanstox CEO Connor O’Brien introduced the launch of the brand new ETF system. In accordance with the press launch, it offers traders a easy technique to maintain various assets. Clients can start investing with as little as $20.

“Bitcoin and Gold can reply in a different way than conventional investments to market situations corresponding to inflation. That distinction can assist with portfolio diversification. We’re making it doable for shoppers to do that simply, and with no need to be consultants.”

Kevin O’Leary, co-founder and chairman of Beanstox, additionally commented on the enlargement. He’s broadly referred to as “Mr. Fantastic” on Shark Tank, a TV present the place entrepreneurs give enterprise displays to angel traders. O’Leary mentioned, “By investing in Bitcoin and Gold utilizing ETFs in a Beanstox account, traders may benefit from further diversification.”

Kevin O’Leary’s Beanstox now brings on a regular basis traders a simple manner so as to add Bitcoin and Gold to their portfolios; no wallets, vaults, or guesswork required. With automated investing, shoppers can begin small and develop over time. https://t.co/F6oWDkSSH7

— Beanstox (@beanstox) August 28, 2025

The corporate additionally famous that Premium subscribers can now select the iShares Bitcoin Belief (IBIT) and iShares Gold Belief (IAU). Importantly, they face no buying and selling commissions or additional prices.

O’Leary Tasks Bitcoin at $250,000 in 2025

O’Leary has considerably shifted his views on Bitcoin lately. Though he as soon as referred to as it “rubbish,” he now says crypto-related property, together with cash, tokens, and platform stakes, signify practically 20% of his portfolio.

In June 2025, talking on the Consensus convention in Toronto, O’Leary urged sooner regulation and warned that the trade had “hit a wall on property below administration.”

Furthermore, he argued that solely decisive motion by Congress—corresponding to passing the GENIUS Act—can unlock what he described as a trillion-dollar alternative.

He additionally predicted that Bitcoin may attain $250,000 by 2025, underscoring his bullish outlook regardless of earlier skepticism.

Company Shifts Below Regulatory Change

The transfer comes as institutional curiosity in digital property grows below clearer regulatory situations. The US and European frameworks have signaled help for regulated entry to crypto markets, paving the way in which for mainstream adoption.

Beanstox, registered with the Securities and Trade Fee, supplies advisory providers alongside brokerage providers from DriveWealth LLC, a registered broker-dealer and member of FINRA/SIPC.

Beanstox is a Boston-based fintech platform that simplifies investing for retail clients by ETFs and automatic portfolios. The agency positions itself as an accessible entry level into diversified investing with clear prices and user-friendly instruments.