Bitcoin has proven a big restoration, reclaiming the $100,000 milestone yesterday. It trades at $101,805, marking a 1.4% improve over the previous 24 hours.

Amid this worth efficiency, analysts have carefully examined varied metrics to gauge potential market actions, together with figuring out optimum cash-out moments. In the meantime, current information reveals intriguing patterns that might information investor methods.

When Ought to You Money Out Your Bitcoin?

One key perception shared by a CryptoQuant analyst, Onchain Edge, highlights a vital sign for when traders ought to think about decreasing their Bitcoin holdings. Different metrics counsel a resurgence in purchaser exercise, reinforcing optimism in Bitcoin’s ongoing rally.

Onchain Edge emphasizes the significance of the BTC provide loss proportion as a marker for peak market phases. He notes that when this metric drops beneath 4%, it might signify the end result of a bull market and the start of an overheated market section.

Presently, the present provide loss proportion stands at 8.14%, offering room for additional worth progress earlier than a possible peak. The analyst warns, nonetheless, that failing to behave on the proper time throughout such peak phases might result in substantial losses in a subsequent bear market.

Elaborating on his evaluation, Onchain Edge encourages traders to contemplate dollar-cost averaging (DCA) out of their positions as soon as the provision loss proportion breaches the 4% threshold.

It’s value noting that this technique by Edge might assist mitigate the danger of holding by the transition right into a bear market. Traditionally, peak bull run phases are characterised by important income amongst market individuals, usually adopted by sharp corrections. Buyers can defend their positive aspects by exiting strategically whereas making ready for decrease entry factors throughout future market downturns.

BTC Purchaser Exercise Resurges

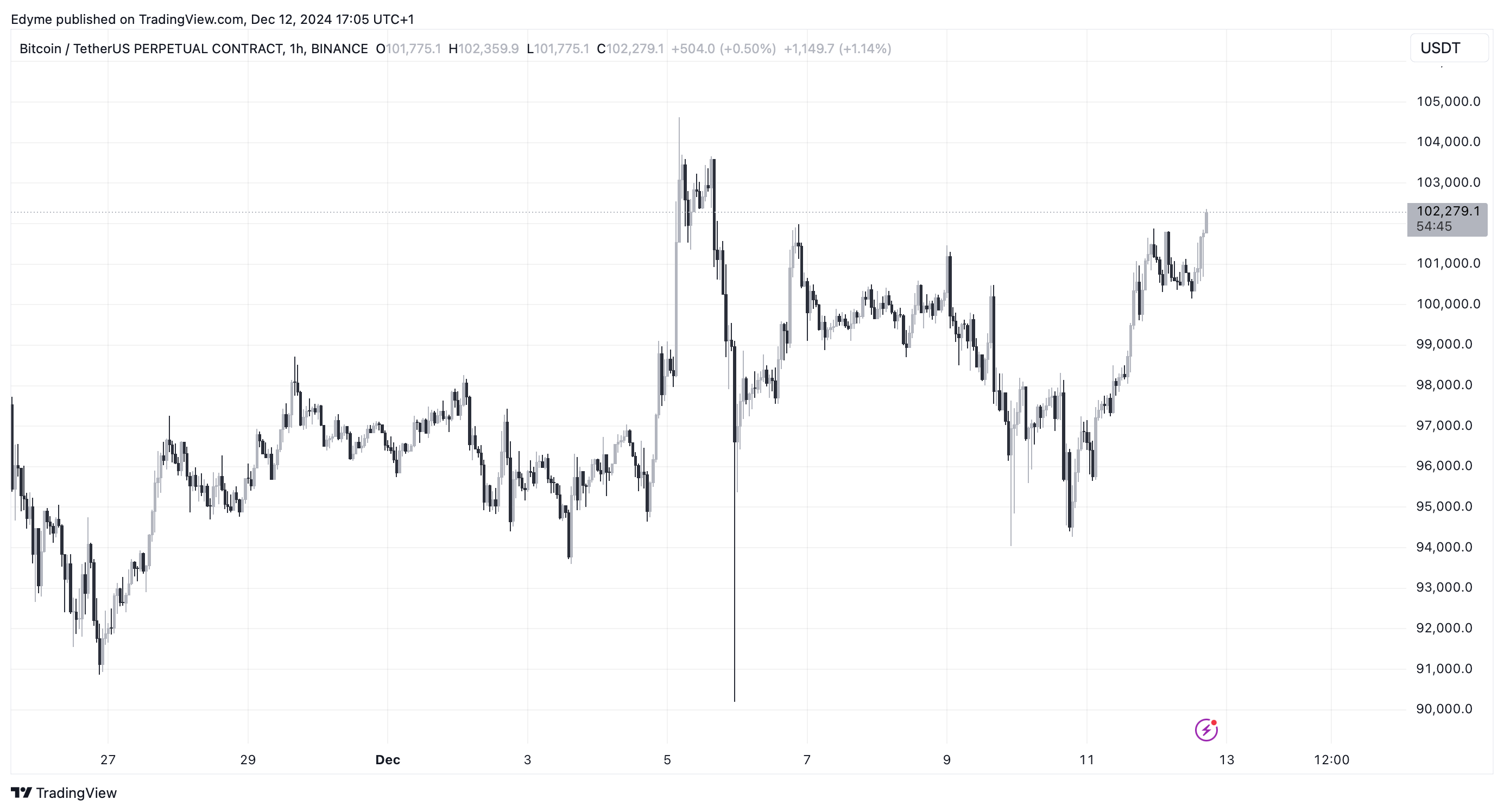

In the meantime, in a separate evaluation, one other CryptoQuant analyst often known as Crazzyblockk sheds gentle on the conduct of takers on Binance, one of many largest cryptocurrency exchanges. Information from the Taker Purchase/Promote Ratio reveals a shift towards aggressive shopping for exercise.

This metric, which compares the amount of purchase orders crammed by takers to promote orders, had skilled a interval of detrimental month-to-month values, indicating a choice for promoting amongst market individuals.

Nevertheless, the ratio has just lately turned optimistic, signifying renewed curiosity from consumers. This development suggests diminished promoting strain and rising optimism amongst merchants about Bitcoin’s potential worth improve.

Based on Crazzyblockk, sustaining this momentum is vital for sustaining the bullish trajectory, notably as Bitcoin consolidates across the psychologically important $100,000 degree.

Featured picture created with DALL-E, Chart from TradingView