The crypto market braces for vital actions as greater than $3 billion in Bitcoin and Ethereum choices expire right this moment.

With substantial contracts and most ache factors recognized, how will these expiring choices have an effect on the market’s volatility?

Crypto Markets Brace for $3 Billion Choices Expiry

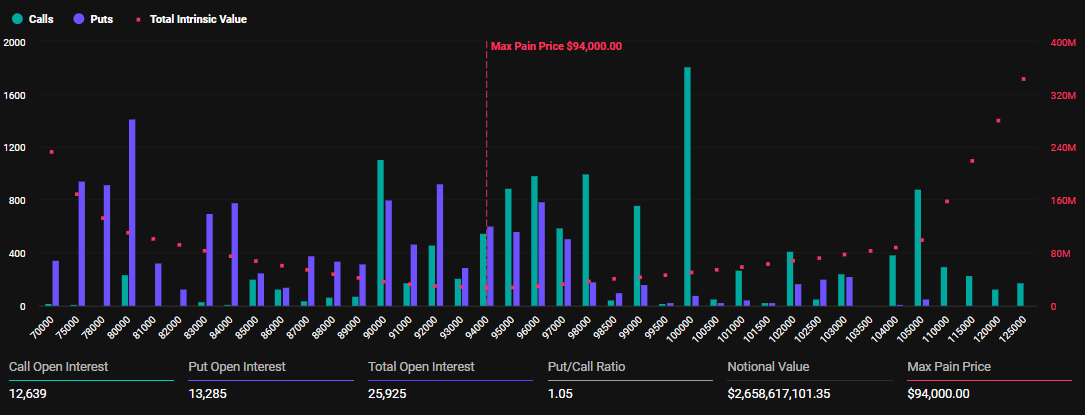

In accordance with Deribit knowledge, roughly $2.65 billion in Bitcoin choices are set to run out right this moment. The utmost ache level for these choices is $94,000, accompanied by a put-to-call ratio of 1.05.

This expiration consists of 25,925 contracts, barely fewer than final week’s 26,949 contracts.

Expiring Bitcoin Choices. Supply: Deribit

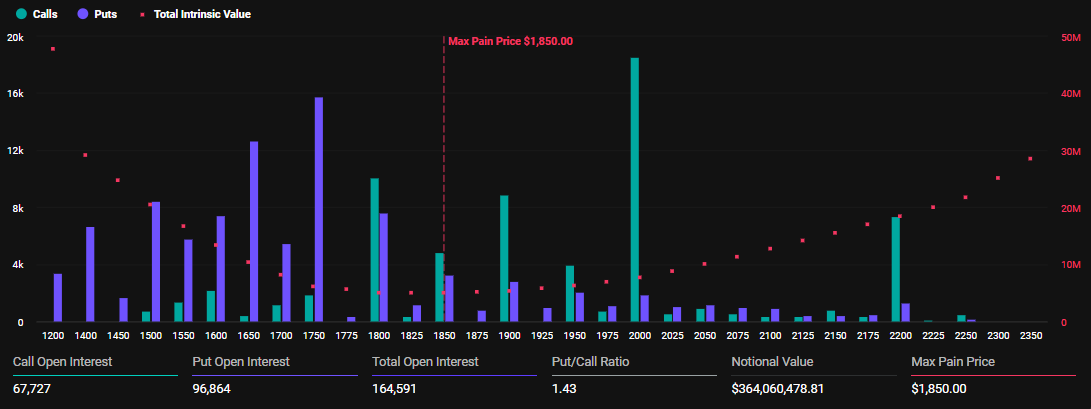

Ethereum additionally sees the expiration of 164,591 contracts, decrease than final week’s 184,296 open curiosity. These expiring contracts have a notional worth of $364.06 million. The utmost ache level for these contracts is $1,850, with a put-to-call ratio of 1.43.

Expiring Ethereum Choices. Supply: Deribit

With Bitcoin and Ethereum gross sales exceeding buy calls, analysts at Greeks.stay cite a predominantly bearish market sentiment.

“The group appears to be leaning bearish with merchants positioning for potential draw back strikes,” wrote Greeks.stay.

For Bitcoin, this sentiment turns into extra obvious with its max Ache degree properly beneath its present value of $102,570. Primarily based on the Max Ache idea, costs have a tendency to attract in the direction of these strike costs because the choices close to expiration.

Primarily based on this, analysts at Greeks.stay be aware that some merchants are watching Bitcoin’s $93,00000 to $99,000 value degree. Additionally they cite an absence of enthusiasm about BTC’s foray previous the $100,000 milestone.

“Market described as boring chop with merchants trying to capitalize on time decay whereas sustaining draw back publicity,” the analysts added.

Positioning Skews Bearish, Max Ache Sits Beneath Value

In the meantime, with put-to-call ratios above one for each Bitcoin and Ethereum, there are extra Put choices (bearish bets) than Name choices (bullish bets). Extra merchants are betting that the value will go down.

The histograms within the photographs above verify this. The BTC open curiosity chart exhibits a major focus of choice contracts at strike costs beneath the present BTC value of $102,570, notably between the $93,000 round $100,000 costs.

This clustering of choice contracts at decrease strikes signifies that merchants are positioning for a possible value drop, therefore the bearish skew.

It comes amid the expectation of a risky weekend, which might threaten Bitcoin’s upside potential. As BeInCrypto reported, envoys from China and the US will meet in Switzerland over the weekend for commerce talks.

Nevertheless, issues linger on the danger of a breakdown within the tariff talks. The assembly would mark the primary official commerce talks since President Trump escalated tariffs on Chinese language imports to 145%.

Nevertheless, Treasury Secretary Scott Bessent articulated that the US doesn’t look to decouple. In the meantime, in a Thursday announcement, the Chinese language Embassy in Washington mentioned it will not permit any try and strain or coerce China.

China has dedicated to safeguarding its official pursuits and upholding worldwide equity and justice. Basic sentiment is that Beijing is deeply skeptical of US intentions.

“In any potential dialogue or talks, if the US doesn’t rectify its faulty unilateral tariff measures, it will display a whole lack of sincerity and additional undermine mutual belief. Saying one factor whereas doing one other, and even trying to make use of talks as a canopy for coercion and blackmail, won’t work with China,” China’s embassy within the US acknowledged.

With neither aspect providing concrete concessions forward of the assembly, crypto merchants concern the summit might finish in one other diplomatic stalemate.

In opposition to this backdrop, any trace of escalation might act as a volatility catalyst, derailing Bitcoin’s upside potential. Then again, a optimistic growth within the assembly might present tailwinds for Bitcoin, because it occurred when Trump introduced a significant take care of the UK.

“Donald Trump simply dropped a large new commerce take care of the UK, his first since rolling out international tariffs. The markets are exploding. Bitcoin simply shot previous $100,000 for the primary time since February,” a consumer noticed on X (Twitter).