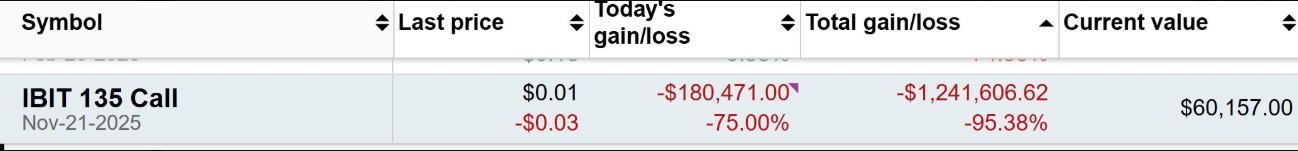

Former Ohio State Treasurer Josh Mandel, as soon as hailed as an early political champion of Bitcoin, has revealed a private lack of greater than $1.2 million on name choices tied to BlackRock’s iShares Bitcoin Belief (IBIT).

The previous state official’s gamble adopted his daring prediction that Bitcoin would attain $444,000 by November 8, a forecast that has clearly not materialized.

Ohio’s Crypto Tax Pioneer Loses $1.2 Million Betting on Bitcoin Choices

Mandel shared particulars of his failed commerce in a publish on X (Twitter), saying he had gone “all in” on IBIT name choices, solely to look at them expire nugatory.

“Earlier within the cycle, I printed a MSTR and MSTR-option-only portfolio. Initially, it was solely lengthy, then shifted to quick with in-the-money coated name gross sales as I predicted Bitcoin would hit $84,000…These strikes labored out effectively sufficient, however I grew impatient with my closing name for $444,000, and as they are saying, you’re solely nearly as good as your final name,” he wrote.

Mandel added that his publish was meant “to be clear,” rejecting accusations that he misled buyers or sought to revenue by means of coin issuance.

Josh Mandel Loses $1.2 Million in Bitcoin Choices Commerce. Supply: Mandel on X

Lengthy earlier than retail Bitcoin hypothesis reached mainstream America, Josh Mandel helped Ohio “plant a flag” for crypto adoption.

In November 2018, as State Treasurer, he launched OhioCrypto.com, the primary US authorities platform permitting companies to pay state taxes in Bitcoin. The funds, processed by means of BitPay, have been mechanically transformed into US {dollars} for the state treasury.

On the time, Mandel described Bitcoin as “a reliable type of foreign money” and positioned Ohio as a pacesetter in blockchain innovation.

“We’re trying to plant a flag for Ohio,” he instructed reporters, arguing that the transfer would modernize state funds and appeal to tech-forward companies.

This system, nonetheless, confronted regulatory hurdles below his successor, Treasurer Robert Sprague, who suspended it in 2019 after figuring out that BitPay’s cost construction might have violated state procurement legal guidelines. Fewer than ten corporations had used the service earlier than it was shut down.

Dangers and Classes From the Bitcoin ETF Choices Market

Mandel’s high-stakes loss comes as curiosity in Bitcoin ETF choices has surged since their launch in late 2024. As Kaiko analysis famous, buying and selling volumes in Bitcoin ETF choices soared, with many merchants favoring bullish positions.

Just lately, nonetheless, Bitcoin ETFs haven’t been performing as effectively, with outflows reaching ranges final seen in Could. The truth is, they solely lately recorded the primary influx after a $2.9 billion outflow streak.

Nonetheless, speculative long-term bets like Mandel’s stay outliers, highlighting the numerous dangers related to choices and the volatility of Bitcoin costs.

By making his funding loss public, Mandel gives a reminder that skilled public figures and crypto pioneers may misjudge timing or threat in digital property.

As regulated crypto derivatives broaden and appeal to extra buyers, Mandel’s expertise demonstrates that market predictions, even when extensively shared, include no assure of success.

The publish Man Who As soon as Let Ohio Pay Taxes in Crypto Simply Misplaced $1.2 Million on Bitcoin Choices appeared first on BeInCrypto.