After years of silence, a SpaceX-linked pockets has instantly moved $152 million in Bitcoin, prompting recent issues over what it might imply for BTC’s subsequent value transfer.

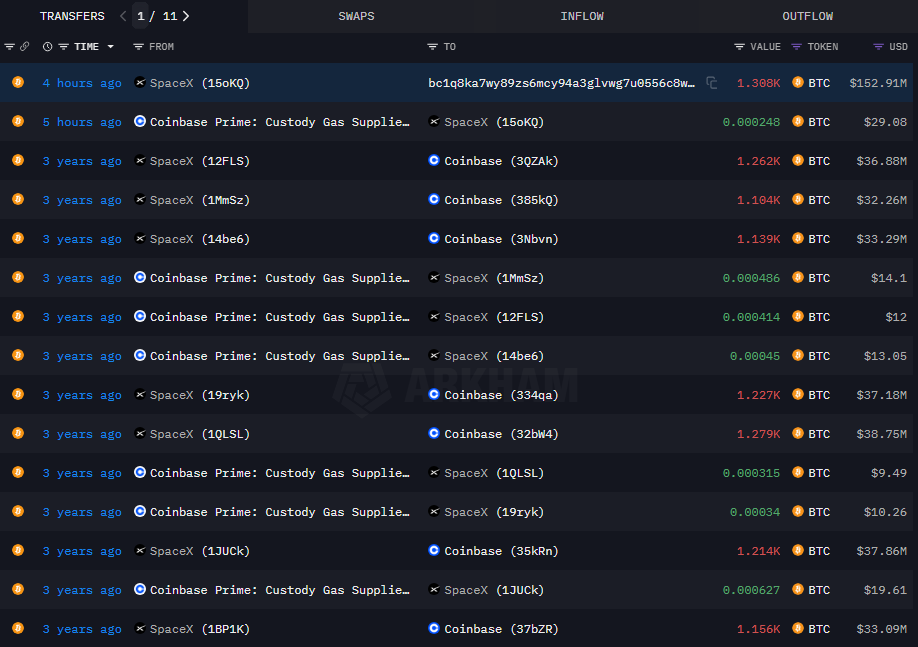

In accordance with knowledge from blockchain analytics platform Arkham Intelligence, on July 22, a pockets linked to Elon Musk’s multibillion-dollar area enterprise, SpaceX, had transferred 1,308.45 BTC, valued at roughly $152.91 million, to a brand new handle.

Notably, the switch adopted after the SpaceX pockets despatched a small transaction payment of 0.000248 BTC value $29 to Coinbase Prime.

Supply: Arkham

Extra knowledge from Arkham reveal that the final time the pockets noticed any motion was almost 3 to 4 years in the past when it obtained a number of Bitcoin inflows from Coinbase wallets, with single deposits starting from 1,100 to 1,279 BTC.

For the uninitiated, SpaceX first made headlines in 2021 when Elon Musk publicly revealed throughout The ₿ Phrase digital convention that the aerospace agency had been stacking Bitcoin.

Whereas the precise quantity was by no means disclosed, later reporting from The Wall Road Journal indicated SpaceX had written down the worth of its Bitcoin holdings by roughly $373 million and offered an undisclosed portion. These occasions occurred following Bitcoin’s sharp decline in 2022.

On-chain exercise later urged the agency’s BTC holdings could have dropped to close zero by the tip of that yr, although this stays unconfirmed.

The agency then step by step rebuilt its steadiness, and was holding roughly 8,285 BTC by September 2024.

You may also like: Bitcoin dominance slides as Ethereum market share jumps to 11.6%

Following in the present day’s large-scale switch, SpaceX now holds roughly 6,977 BTC, valued at round $822.65 million. This locations the corporate among the many world’s largest company Bitcoin holders, trailing corporations like MicroStrategy (MSTR) and Tesla (TSLA), one other Musk-led entity. All of SpaceX’s holdings are presently custodied with Coinbase Prime.

In 2021, each SpaceX and Tesla appeared to distance themselves from Bitcoin, citing environmental issues associated to its power utilization, main Tesla to droop BTC funds.

Nevertheless, the tech billionaire has since shifted tone. Earlier this month, Musk revealed plans to launch a brand new political get together within the U.S., one that may explicitly assist Bitcoin, signaling a renewed embrace of the asset.

As such, many are speculating that SpaceX might now be positioning itself in keeping with different main firms, akin to Technique and Trump Media, which have adopted Bitcoin as a part of their treasury technique.

Will Bitcoin value crash?

As of press time, it stays unclear whether or not the switch indicators a sale or inner reallocation, however merchants stay cautious as a possible offload might set off recent promoting stress.

Some market members have downplayed the dangers, suggesting the transfer might merely be routine housekeeping or a shift to a recent pockets, given the absence of any official clarification.

* @SpaceX JUST MOVED BITCOIN FOR THE FIRST TIME IN 3 YEARS

I imagine this transfer is simply good home holding. There’s the small likelihood that is transferring to promote however there’s ZERO acknowledgement of this, so the belief is transferring the BTC to a recent pockets. pic.twitter.com/6JrPxlOLOf

— Cam (@CryptoNews_eth) July 22, 2025

The broader market has beforehand absorbed large-scale liquidations. As an illustration, in mid‑2024, the German authorities offloaded almost 50,000 BTC, roughly $2.9 billion value, all inside a number of weeks.

That transfer triggered an preliminary dip into the low‑$50,000s, however costs swiftly rebounded above $60,000 as soon as the promoting stress subsided.

Given the present bullish backdrop, the market appears higher positioned to soak up any promoting stress which will come up from the current transfers and not using a extended affect on Bitcoin’s value development.

When writing, Bitcoin (BTC) was buying and selling at $118,134, down 3.7% from its all-time excessive. In accordance with analysts at CryptoQuant, the flagship crypto could face some downward stress within the short-term as retail merchants are reportedly decreasing publicity throughout markets within the U.S., South Korea, and on Binance.

Nevertheless, continued whale accumulation seems to be counterbalancing a number of the sell-side stress, and technicals counsel the cryptocurrency stays in an uptrend.

Learn extra: Solana’s DeFi TVL hits $10B, highest degree in six-month excessive

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.