Bitcoin lately skilled a pointy sell-off that almost dragged the value right down to the $60,000 degree earlier than a swift bounce adopted. Dip shopping for helped $BTC stabilize close to present ranges, however this rebound alone doesn’t verify a development reversal.

As an alternative, the transfer seems extra like a short lived pause inside a broader corrective part, leaving traders questioning whether or not additional draw back lies forward.

This Is What Bitcoin Indicators Counsel

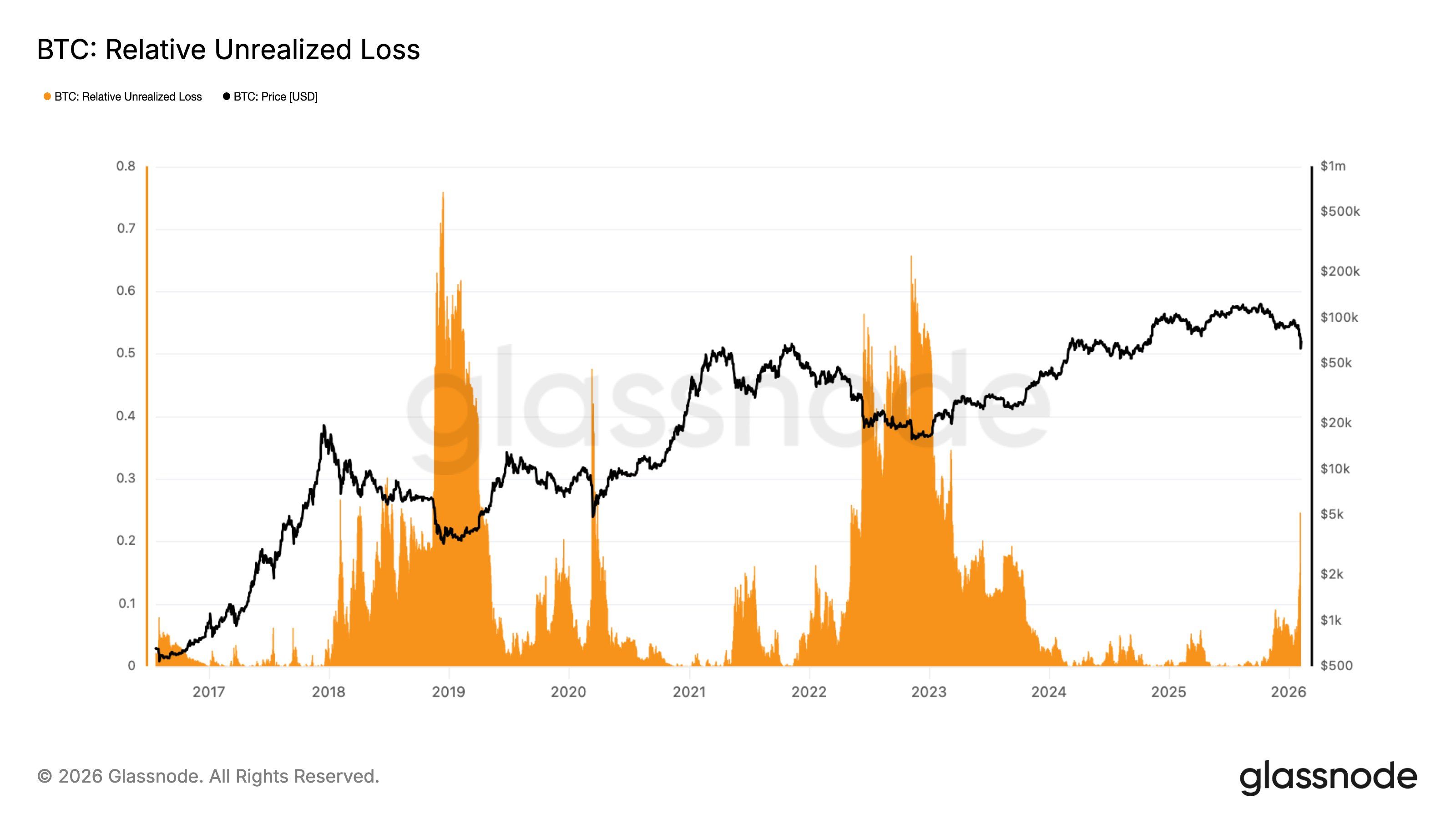

One defining attribute of bear markets is elevated Relative Unrealized Loss, which measures the greenback worth of underwater cash relative to whole market capitalization. Throughout Bitcoin’s drop towards $60,000, this ratio surged to roughly 24%.

That degree sits effectively above the everyday bull-bear transition zone, putting the market firmly in bearish territory.

Whereas the metric alerts an intense bear regime, it stays under excessive capitulation ranges traditionally seen above 50%. This means Bitcoin is present process an lively capitulation course of relatively than reaching its ultimate backside. Promoting strain is widespread, however not but exhausted, implying additional volatility because the market seeks equilibrium.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Bitcoin Relative Unrealized Loss. Supply: Glassnode

One other lens into investor habits is the distribution of Bitcoin provide amongst pockets sizes. Knowledge exhibits wallets holding lower than 0.01 $BTC have been steadily growing their share of provide. This group represents small retail individuals who usually react emotionally to cost swings however are at present accumulating.

On the similar time, wallets holding between 10 and 10,000 $BTC have proven gentle internet distribution in the course of the dip. This divergence is notable as a result of public sentiment on social platforms stays overwhelmingly bearish.

Regardless of unfavourable commentary, small merchants are quietly including publicity, signaling perception that present costs provide worth.

Bitcoin Good vs Small Retail Cash. Supply: Santiment

This imbalance suggests optimism has not absolutely reset. Ideally, deeper bear phases see retail capitulation align with bearish social metrics.

Till small retail provide begins declining, rebounds could wrestle to realize lasting traction, limiting the upside of near-term restoration makes an attempt.

Bitcoin Continues To Witness Help

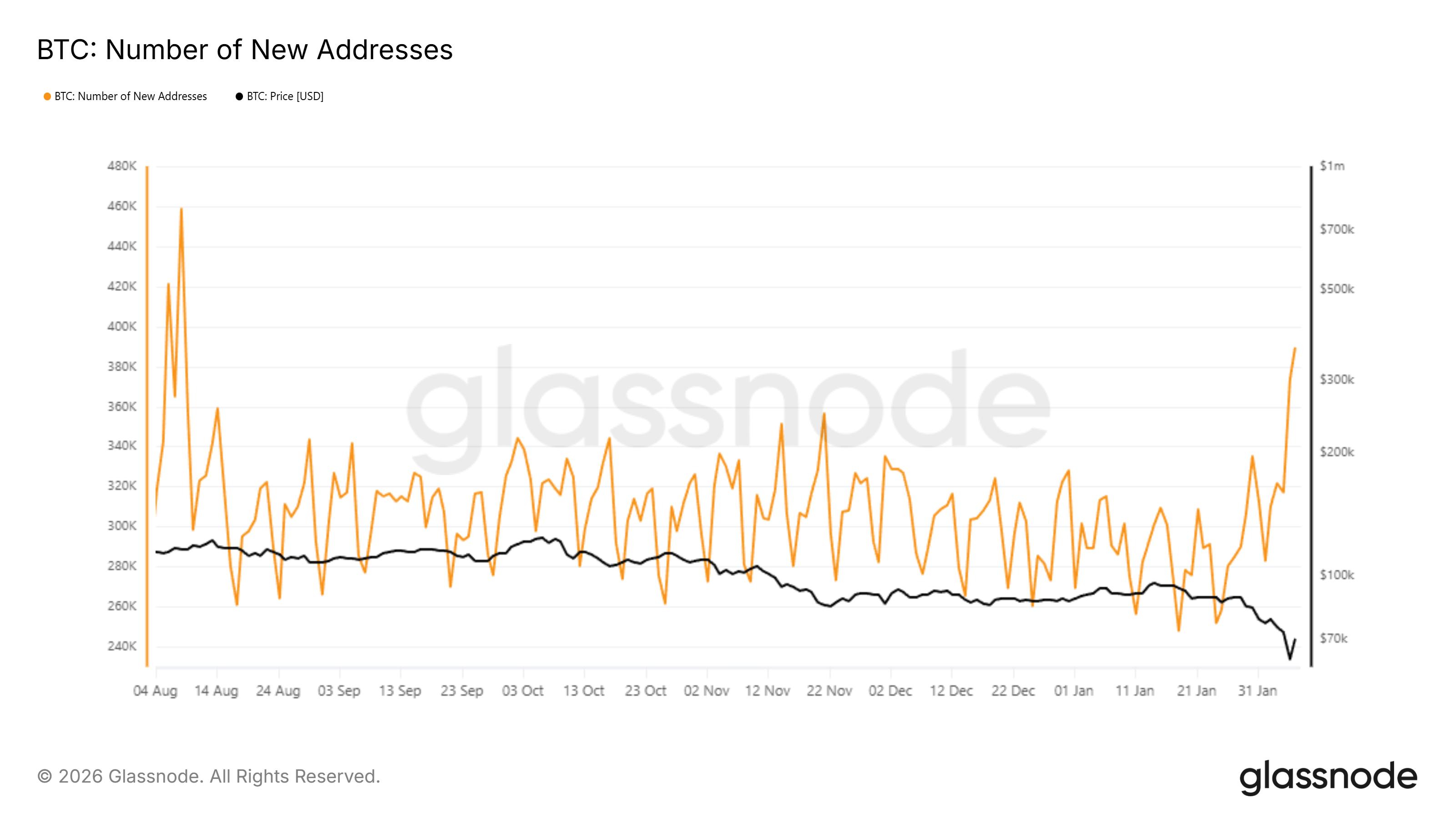

Regardless of worth weak point, community exercise presents a contrasting sign. Bitcoin has seen a pointy rise in new addresses over the previous week. The variety of traders conducting their first on-chain transaction elevated by roughly 37%, indicating recent participation getting into the community.

Such development displays continued curiosity in Bitcoin as costs right. New entrants usually emerge in periods of volatility, making an attempt to place early for potential recoveries.

Whereas not a assure of fast upside, rising deal with exercise suggests confidence in Bitcoin’s longer-term worth proposition stays intact.

Bitcoin New Addresses. Supply: Glassnode

This inflow of latest customers can present help throughout consolidation phases. Nonetheless, if macro strain persists, even robust community development could wrestle to offset broader risk-off situations throughout monetary markets.

$BTC Worth Ranges To Watch

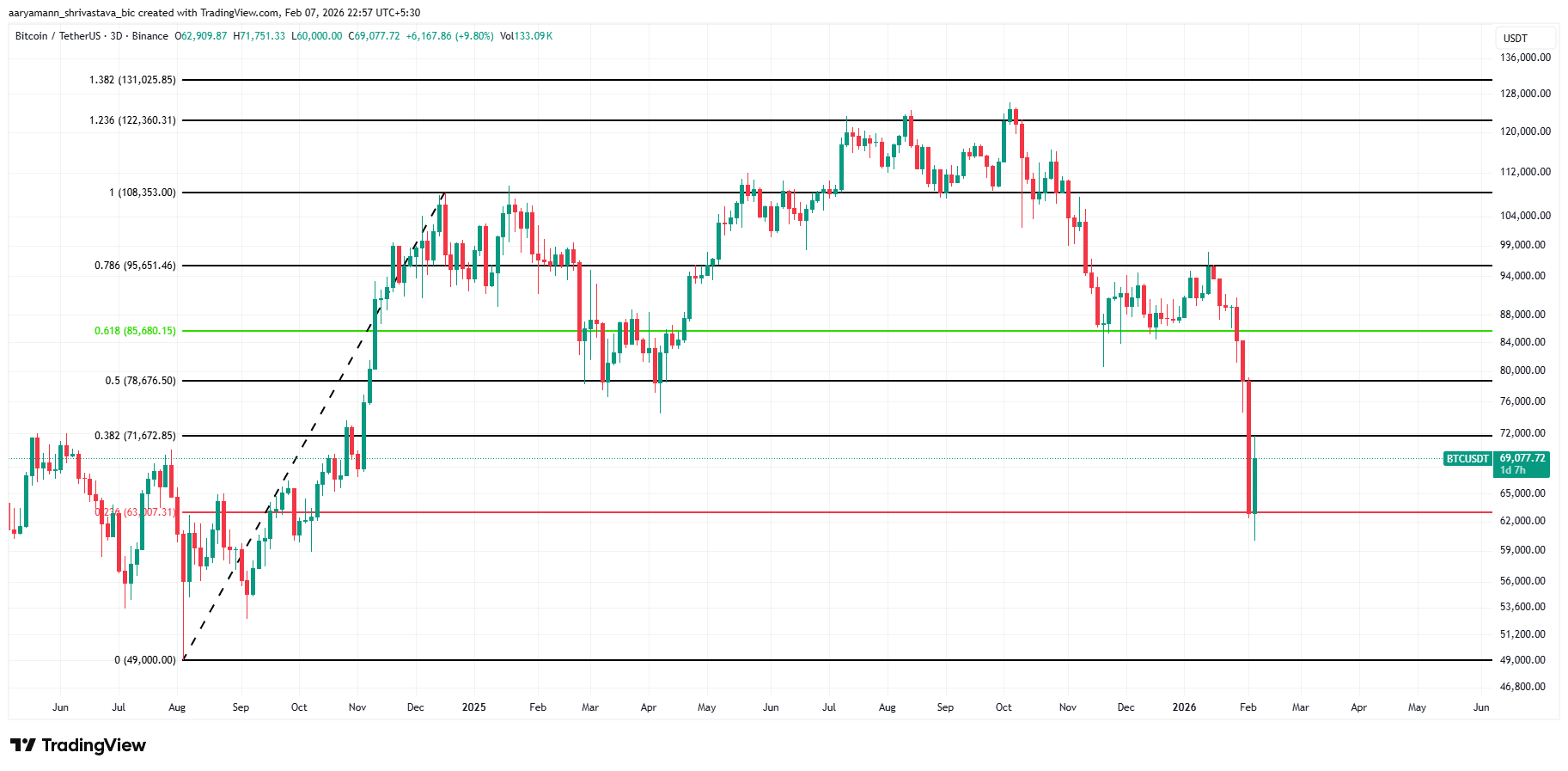

Bitcoin worth is buying and selling close to $69,077 on the time of writing after rebounding from the $63,007 help in the course of the current crash. Aggressive dip shopping for prevented a deeper slide towards $60,000. This protection highlights robust demand at decrease ranges, at the very least within the quick time period.

Regardless of this bounce, draw back threat stays elevated. The broader macro outlook suggests Bitcoin should face additional breakdowns within the coming weeks. A lack of the $63,007 help would reinforce a bearish continuation, with the following main draw back goal close to $55,500 based mostly on historic help zones.

Bitcoin Worth Evaluation. Supply: TradingView

A brief-term restoration stays attainable if recent capital inflows persist. Rising new deal with exercise might assist Bitcoin consolidate and reclaim $71,672 as help. Securing that degree would invalidate the fast bearish setup and sign stabilization, although it will not absolutely negate the broader bear market construction.

The submit How Extreme Is This Bitcoin Bear Market and The place Is Worth Headed Subsequent? appeared first on BeInCrypto.