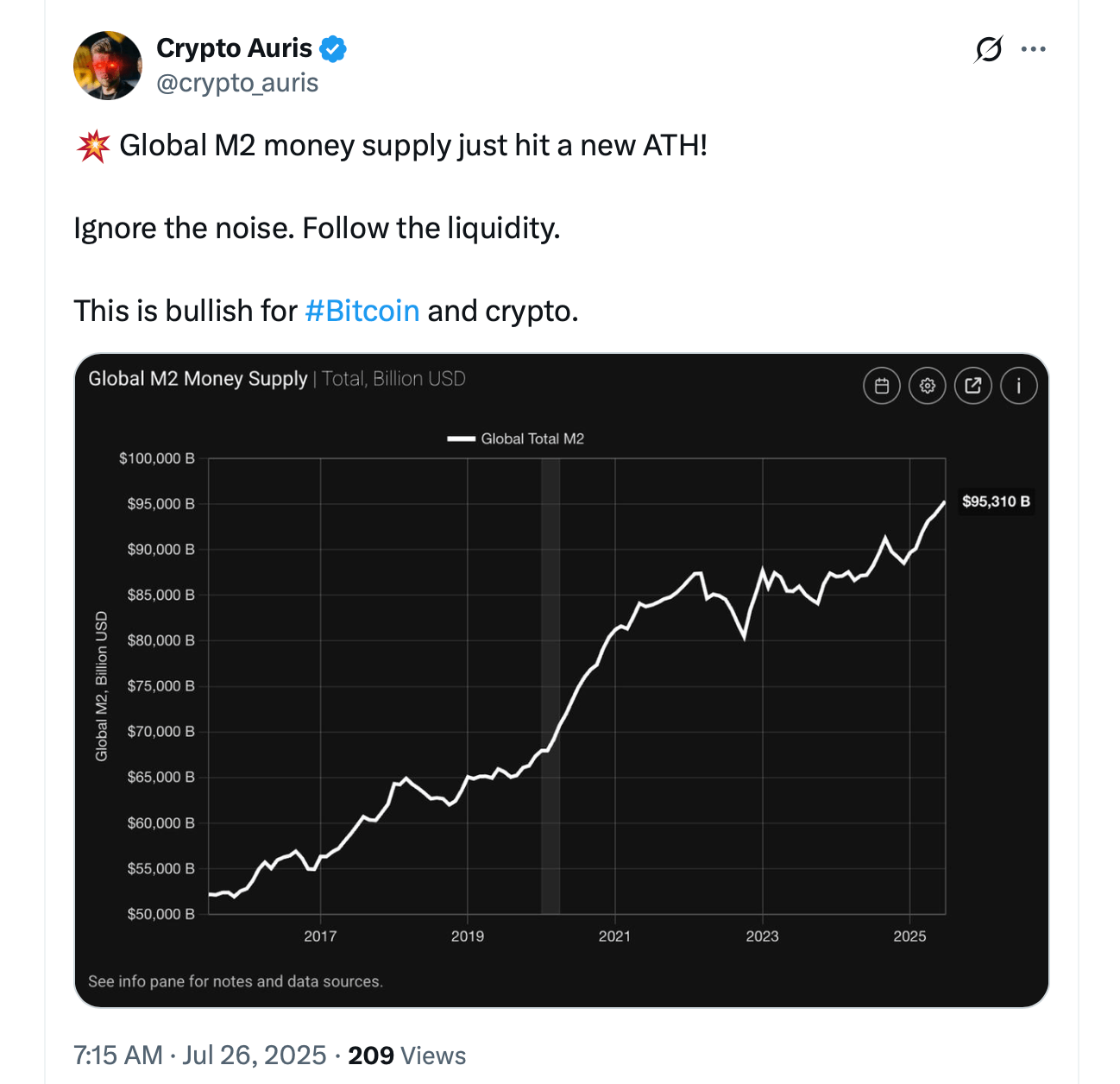

With international M2 cash provide climbing to an all-time excessive of $95 trillion to $96 trillion, bitcoin—buying and selling between $117,800 and $118,102 prior to now 24 hours—appears set to seize severe upside in 2025 as liquidity floods into belongings.

M2 Cash Increase: Why Bitcoin Costs Might Soar Amid Liquidity Flood

Loads of crypto followers are banking on the concept that a ballooning M2 will give the digital forex house a significant raise. This notion has been recurrently making the rounds on platforms like Reddit and X, the place customers are spinning up threads and sharing posts dissecting precisely how this may unfold.

A put up on r/cryptocurrency linking bitcoin to international M2 is making the rounds—certainly one of many flooding Reddit and X currently.

Primarily, M2 represents a broad measure of cash provide in an financial system, encompassing bodily forex in circulation, demand deposits in checking accounts, financial savings deposits, cash market funds and different extremely liquid near-money belongings.

In contrast to narrower measures like M1, which focuses on money and checking deposits, M2 captures funds available for spending or funding, offering perception into financial liquidity and potential inflationary pressures. In different phrases, M2 gives a transparent window into international liquidity.

Globally, M2 aggregates these figures from main economies, transformed to U.S. {dollars}, with current knowledge displaying the world’s 4 largest central banks—the U.S. Federal Reserve, European Central Financial institution, Financial institution of Japan, and Folks’s Financial institution of China—driving the whole to new highs.

This measure capabilities as a barometer for financial coverage effectiveness; central banks affect M2 by instruments like rate of interest changes, open market operations and reserve necessities, which increase or contract the cash out there within the banking system.

Over on r/bitcoin, many are betting that M2 development will pave the best way for sky-high bitcoin costs.

When M2 grows, it indicators elevated liquidity, enabling extra lending, spending and funding, although extreme growth can result in inflation as extra money chases the identical items and companies.

The present rise in international M2 stems from a resurgence in authorities stimulus and liquidity operations, together with quantitative easing packages the place central banks buy belongings to inject funds into economies and direct fiscal helps like infrastructure spending or subsidies.

These insurance policies, aimed toward stabilizing development post-recessions or throughout slowdowns, have accelerated since 2020, with central banks worldwide including trillions to stability sheets to counter financial disruptions.

China’s financial growth performs an outsized position, with its M2 exceeding $44 trillion—greater than double the U.S. determine of about $22 trillion—fueled by efforts to bolster home development, help exports, and preserve monetary stability amid international commerce tensions.

This aggressive development, averaging over 8% yearly lately, contributes considerably to the worldwide enhance, as China’s insurance policies ripple by worldwide markets by way of commerce and funding channels.

Historic knowledge reveals a powerful correlation between M2 expansions and rising asset costs, together with shares, actual property, and cryptocurrencies like bitcoin, as extra liquidity seeks increased returns in riskier investments.

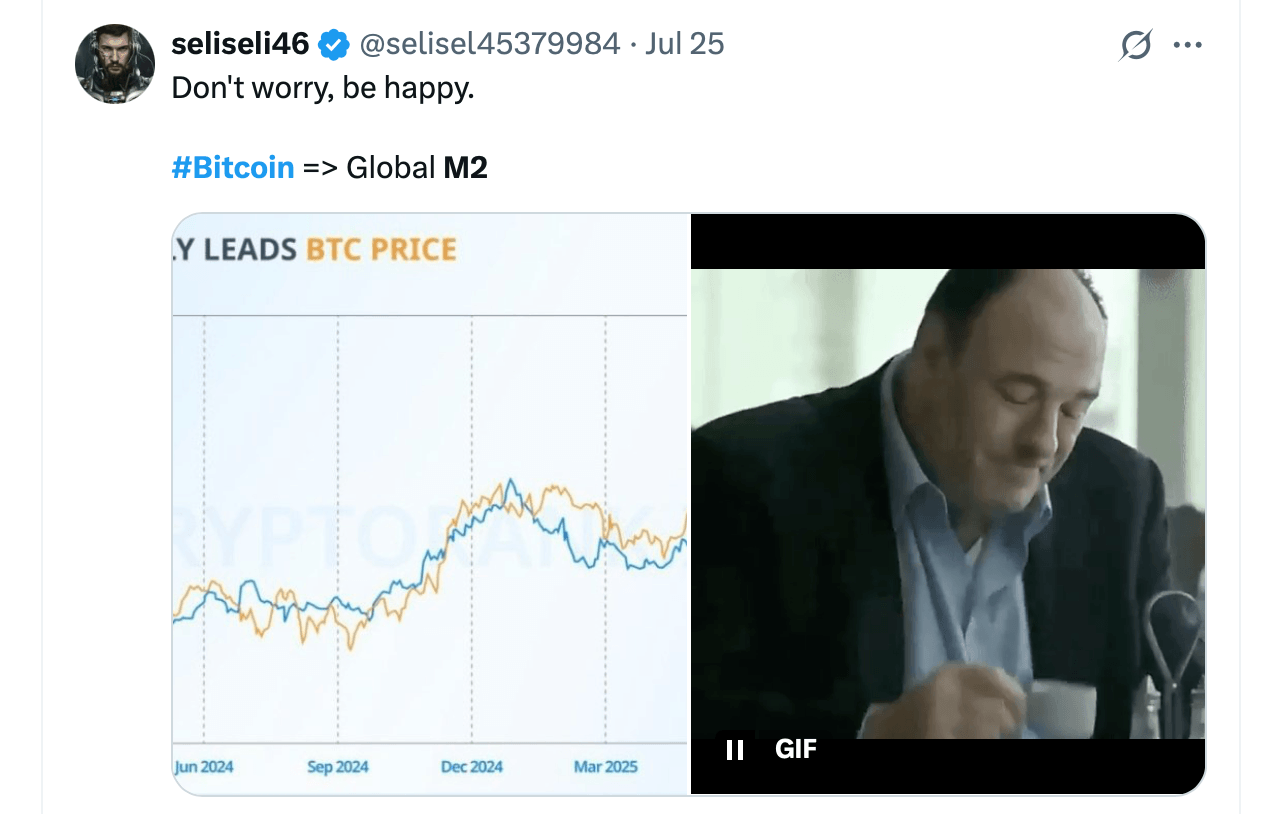

For bitcoin particularly, analyses present correlations averaging 0.65 to 0.89 with international M2 development, typically with M2 main worth actions by 12 to 90 days, as elevated cash provide erodes fiat buying energy and drives demand for scarce belongings like bitcoin, considered as a hedge in opposition to inflation.

Social media posts linking M2 development to bitcoin’s rise have been popping up throughout X. “International liquidity is surging,” one X person remarked on Saturday. “M2 provide exploding. Bitcoin’s chart is copying it step-by-step. Ignore the noise. Observe the liquidity. As a result of when liquidity floods in, BTC doesn’t wait. Liquidity leads. Worth obeys,” the X account added.

In 2020-2021, for example, international M2 surged over 25% amid pandemic stimulus, coinciding with bitcoin’s rally from beneath $10,000 to almost $69,000, illustrating how liquidity boosts speculative flows into fixed-supply belongings. With M2 sitting at report ranges, some crypto believers are calling for BTC to faucet $150,000 on the following flush of liquidity.

With international M2 now at an all-time excessive and projected to develop 8% to 10% yearly by 2025 amid ongoing easing, bitcoin may very effectively see amplified upside, as liquidity traditionally multiplies its worth sensitivity—doubtlessly including 1000’s per trillion in new M2. In the meantime, the Trump administration is pushing onerous for Fed charge cuts, hoping a dose of easing will jolt the financial system.

To many bitcoin proponents, this dynamic persists regardless of short-term volatility, as bitcoin’s capped provide of 21 million cash contrasts with increasing fiat, positioning it to seize a rising share of world liquidity in 2025.