Bitcoin (BTC) seems poised to finish 2024 on a excessive notice, with historic patterns suggesting the maiden digital asset is destined for a file excessive in December.

Based on crypto buying and selling knowledgeable Ali Martinez, there are placing parallels between Bitcoin’s present value motion and its December 2020 rally, hinting that the asset might attain $135,000 by December 2024, as per evaluation shared in an X put up on November 20.

Martinez’s prediction highlighted similar value buildings and Relative Power Index (RSI) ranges between December 2020 and November 2024, suggesting a continuation of the bullish development.

In each instances, Bitcoin has shaped a sequence of upper highs and better lows, supported by an upward RSI trajectory.

Martinez anticipates a rally to $108,000 within the close to time period, adopted by a short correction to $99,000 earlier than Bitcoin climbs to $135,000. This outlook aligns with Martinez’s earlier prediction that Bitcoin will seemingly climb to $138,000 earlier than experiencing a pullback.

Bitcoin’s path to $100,000

This projection has gained credibility because the probability of Bitcoin hitting $100,000 has elevated after the asset breached its $94,000 all-time excessive.

CrypNuevo’s evaluation additionally recommended Bitcoin might method $96,000 however cautioned towards anticipating a clear breakthrough of the psychological $100,000 mark on the primary try.

The analyst predicted a reversal within the mid-to-high $90,000 vary, presenting a possibility for a wholesome pullback. The main target will then shift to figuring out the following optimum shopping for zones throughout this retracement earlier than the asset pushes towards the $100,000 milestone.

“Not anticipating to interrupt $100k within the first try so on the lookout for a reversal from mid-high $90ks, round $96k zone. Then, give attention to the following shopping for alternatives throughout the pullback,” the knowledgeable mentioned.

Bitcoin’s bullish momentum is backed by the constructive outlook following Donald Trump’s election. The continued shopping for stress has propelled the asset to grow to be the world’s seventh-largest asset, with a market capitalization of roughly $1.8 trillion.

Nonetheless, the push towards $100,000 may face challenges. CryptoQuant information signifies that Bitcoin’s Realized Cap is now not growing, suggesting inadequate new cash inflows and potential indicators of weak spot.

Amid these issues, different on-chain metrics level to additional development potential towards the $100,000 stage.

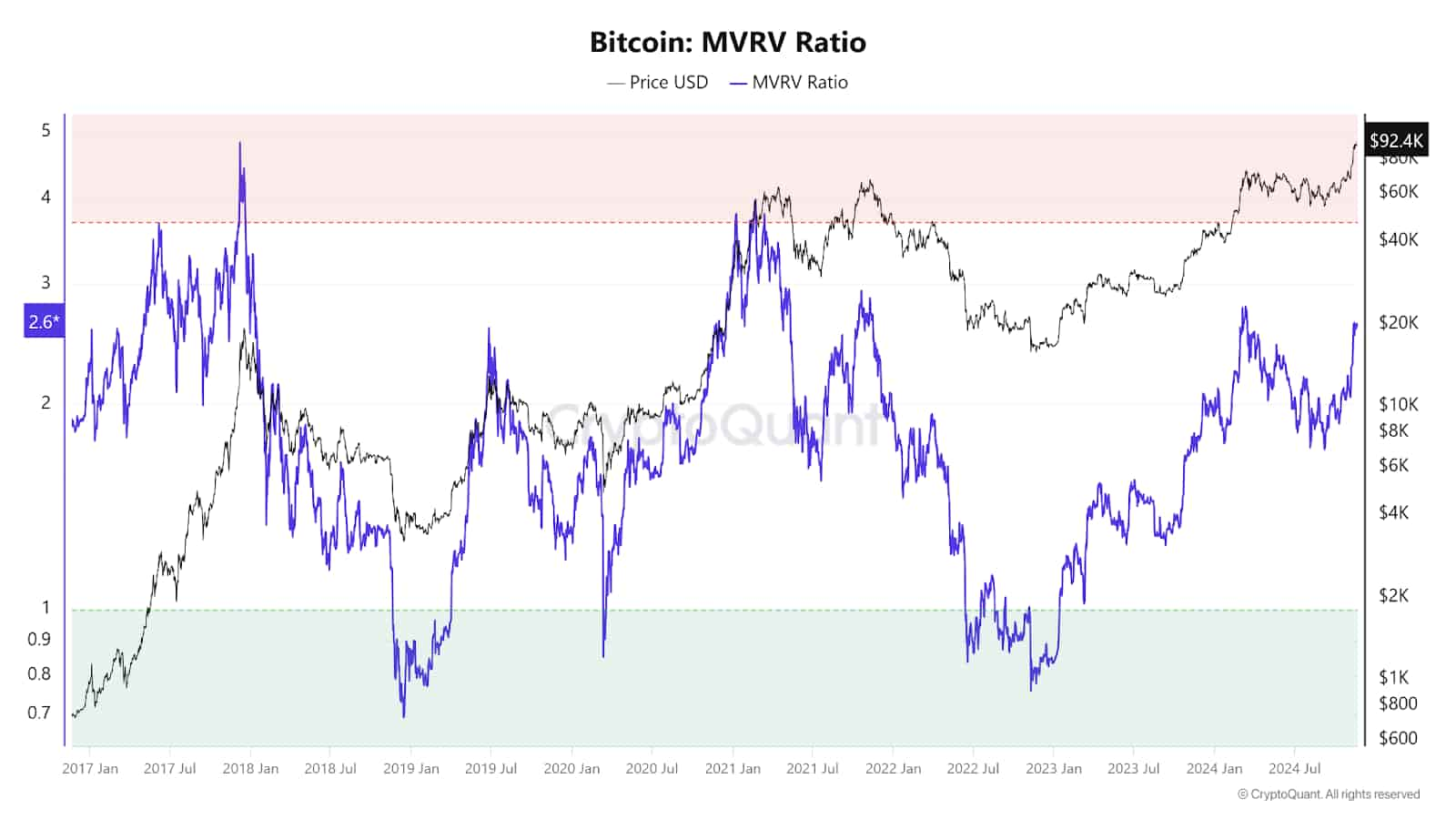

Particularly, Bitcoin’s Market Worth to Realized Worth (MVRV) at the moment stands at 2.6, indicating notable unrealized earnings. Traditionally, an MVRV of 4 alerts a possible market peak.

Bitcoin value evaluation

At press time, Bitcoin was buying and selling at $93,821, up practically 1% within the final 24 hours. On the weekly chart, Bitcoin’s consolidation above the $90,000 stage is clear, with the asset gaining about 1.6%.

Contemplating all elements, Bitcoin is displaying potential for a bullish continuation. Nonetheless, the asset must decisively declare the $95,000 resistance zone to pave the way in which towards the $100,000 goal; whilst optimism stays excessive, a $200,000 milestone will likely be attainable.

Featured picture by way of Shutterstock