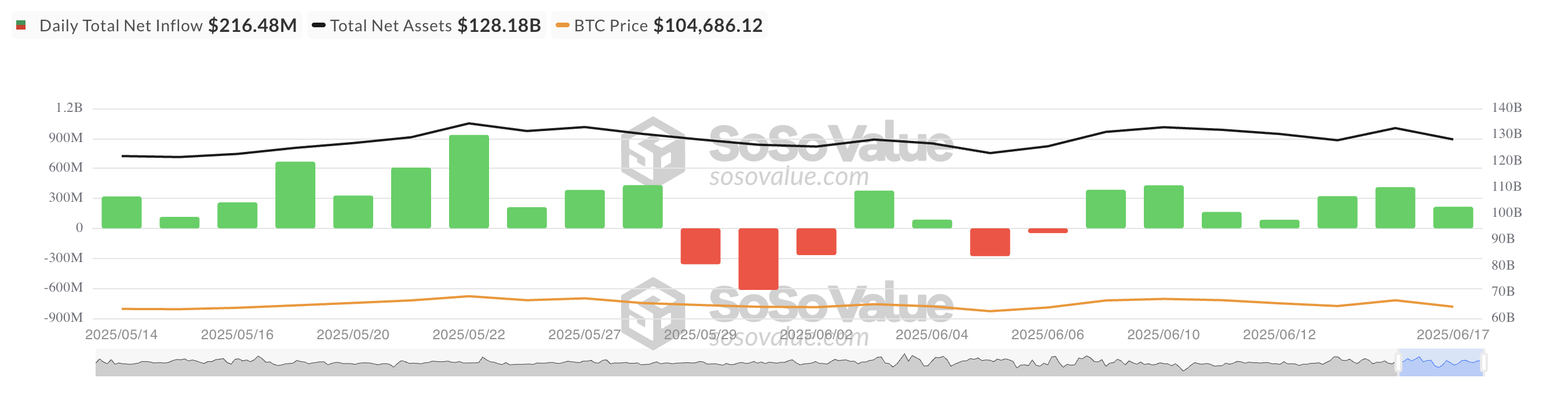

On Tuesday, Bitcoin exchange-traded funds (ETFs) recorded over $200 million in inflows. Whereas this marked a internet constructive influx into these funds, it additionally represented a pointy drop from the $421 million seen the day earlier than.

The cooling curiosity comes as BTC slid to an intraday low of $103,371 on Tuesday, signaling rising warning amongst traders. If the decline persists, ETF inflows might weaken additional, as institutional sentiment continues to take a success.

BTC ETFs See Droop in Each day Inflows

On Tuesday, US-listed spot Bitcoin ETFs recorded internet inflows of $216.48 million, indicating that investor curiosity stays intact. Nonetheless, this marked a steep 47% drop from the $412 million posted the day earlier than, signaling a slowdown in momentum.

Complete Bitcoin Spot ETF Internet Influx. Supply: SosoValue

The dip in inflows coincided with BTC’s worth decline in the course of the day’s buying and selling session. It fell to an intraday low of $103,371 amid weakening demand. The downturn has weighed on market sentiment and seems to have stalled recent capital from coming into BTC-linked ETFs.

Yesterday, BlackRock’s IBIT led the pack with the very best every day inflows, totaling $639.19 million, bringing its complete historic internet influx to $50.67 billion.

However, Constancy’s FBTC witnessed the biggest internet outflow amongst these ETFs, with $208.46 million exiting the fund.

BTC Faces Renewed Stress

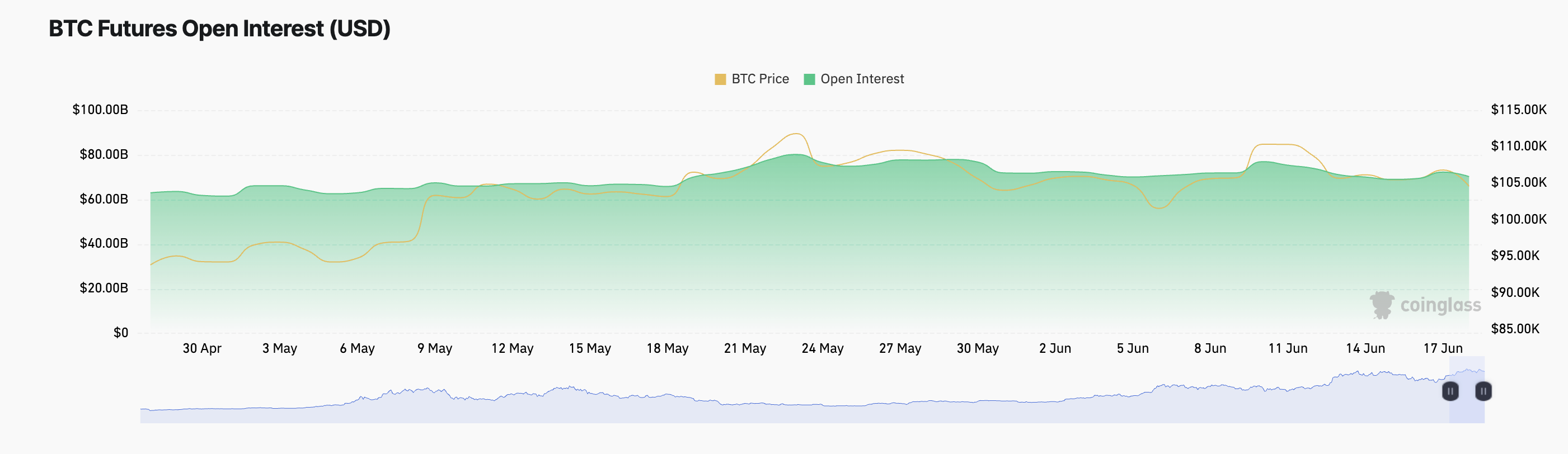

At present, BTC has prolonged its downward pattern, shedding one other 2% because the broader crypto market faces renewed promoting stress. The worth decline has been accompanied by a dip within the coin’s futures open curiosity (OI), suggesting a slowdown in leveraged buying and selling exercise.

This stands at $70.24 billion at press time, dropping by 3% over the previous day. This pullback alerts that merchants are lowering their publicity and probably closing out positions, a pattern reflecting rising market warning.

BTC Futures Open Curiosity. Supply: Coinglass

Open curiosity refers back to the complete variety of excellent futures contracts that haven’t but been settled. When it falls throughout a worth dip like this, it signifies that merchants are exiting positions moderately than opening new ones. This can be a signal of weakening conviction and diminished speculative urge for food amongst BTC futures merchants.

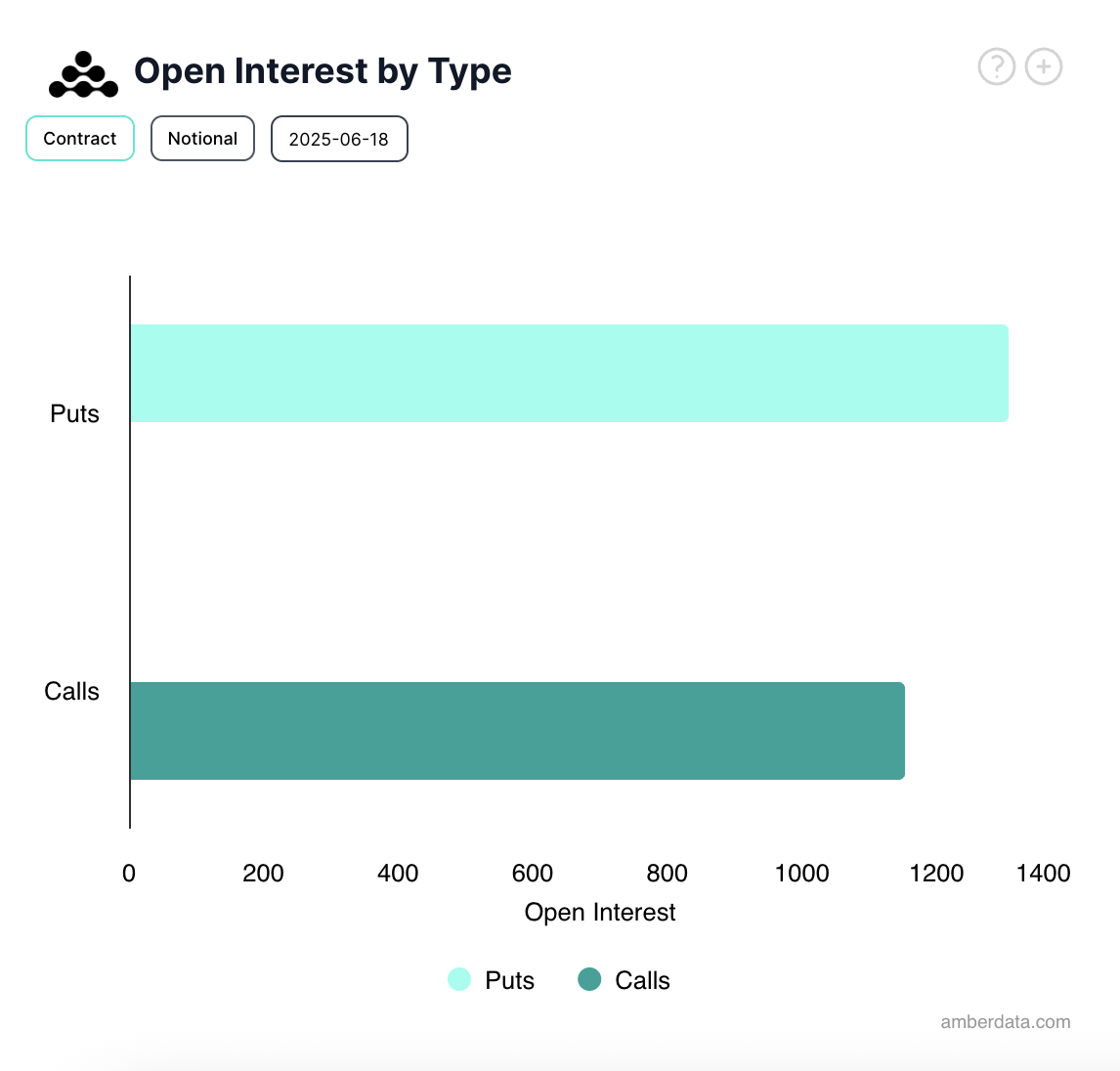

Moreover, bearish sentiment continues to dominate the choices market, as evidenced by the heightened demand for put contracts over calls, per Deribit. This imbalance suggests {that a} rising variety of merchants are positioning themselves to revenue from additional draw back in BTC’s worth.

Bitcoin Choices Open Curiosity. Supply: Deribit

The mixture of cooling ETF inflows, declining open curiosity, and a bearish tilt within the choices market means that whereas institutional curiosity has not vanished, the drop in capital flows and buying and selling habits means many traders are gearing for additional draw back, or at the least ready for clearer alerts earlier than re-entering the market.