El Salvador’s Bitcoin (BTC) holdings have taken a success amid renewed cryptocurrency market volatility, with the asset dropping its $110,000 assist zone.

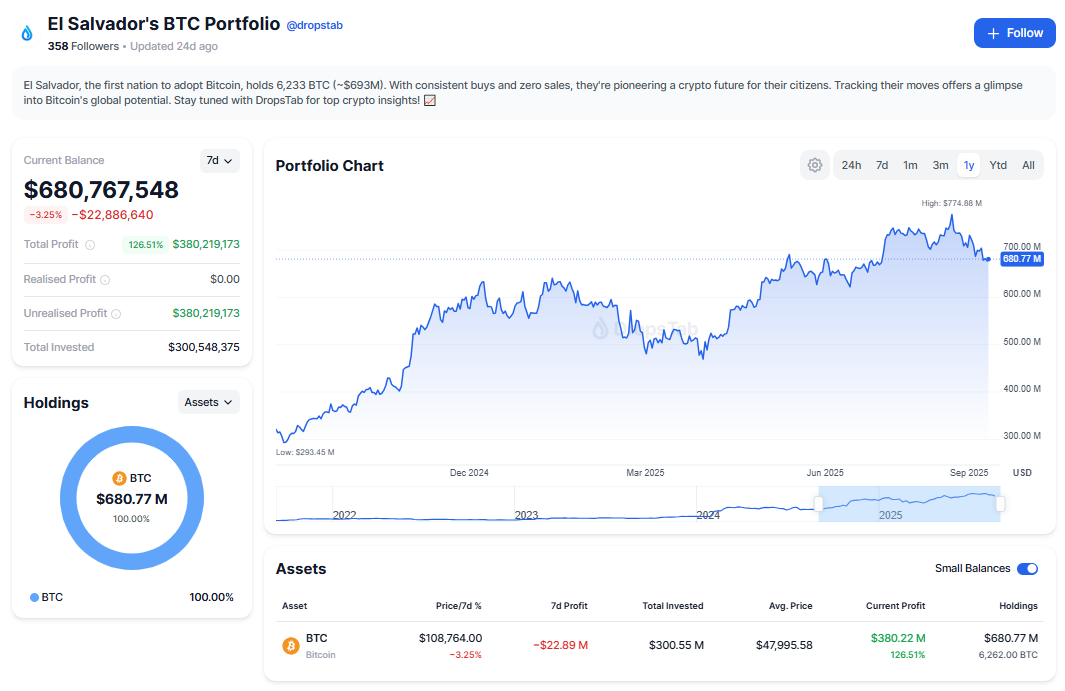

Particularly, the nation’s cryptocurrency portfolio shed greater than $22.8 million in worth over the previous seven days, in keeping with information retrieved from DropsTab on September 1.

The weekly decline displays a 3.25% drop in Bitcoin costs, which fell to round $108,764 per coin.

Regardless of the setback, El Salvador’s general Bitcoin funding stays in large revenue. The nation at the moment holds 6,262 BTC, valued at roughly $680.77 million. The determine represents a 126.51% acquire on its whole funding of $300.55 million, leading to an unrealized revenue of roughly $380.2 million.

El Salvador’s Bitcoin technique

Certainly, the portfolio has seen important swings since El Salvador grew to become the primary nation to undertake Bitcoin as authorized tender in September 2021.

After reaching a current excessive close to $774.9 million, the holdings have since pulled again by virtually $100 million.

Notably, President Nayib Bukele’s authorities has pursued a strict accumulation technique, constantly shopping for Bitcoin however by no means promoting, even throughout extended downturns.

The method is a part of a broader imaginative and prescient to combine cryptocurrency into the financial system, entice international funding, and broaden monetary inclusion for residents missing entry to conventional banking.

Nonetheless, critics argue the technique exposes nationwide funds to extreme market dangers, given Bitcoin’s historical past of sharp corrections. Supporters, nonetheless, spotlight the present $380 million in paper income as proof that persistence has to this point paid off.

Featured picture through Shutterstock