With the previous couple of months being shaky for Bitcoin (BTC), prediction markets are usually not totally satisfied that the flagship cryptocurrency goes to hit a brand new all-time excessive (ATH) by December 31.

Specifically, knowledge from crypto-based prediction market Polymarket as of December 9 means that simply 1% of the people betting on the platform now consider that Bitcoin might climb to $130,000, surpassing the $126,000 ATH reached in October this yr.

Curiously, nonetheless, the 1% who consider it may hit a brand new peak have wagered practically $10 million on the $130,000 worth goal. Additionally notable is that thrice as many bets are on the Bitcoin worth crashing to $65,000, a worth not seen since October final yr, though solely $392,000 is on the road right here.

Nearly all of the merchants (61%) see Bitcoin climbing to $95,000 at greatest by the top of the yr, however the betting quantity is as soon as once more low, approaching $581,000.

The info means that a few of the extra bullish Bitcoin guess charges started to say no quickly simply earlier than November, when the final rays of “Uptober” hope began to fade.

For instance, crypto markets set odds of Bitcoin claiming $130,000 at 56% on October 27, once they had been solely 8% decrease than they had been when the bets went reside. By press time, nonetheless, they’d plummeted to nearly negligible ranges.

Bitcoin worth outlook

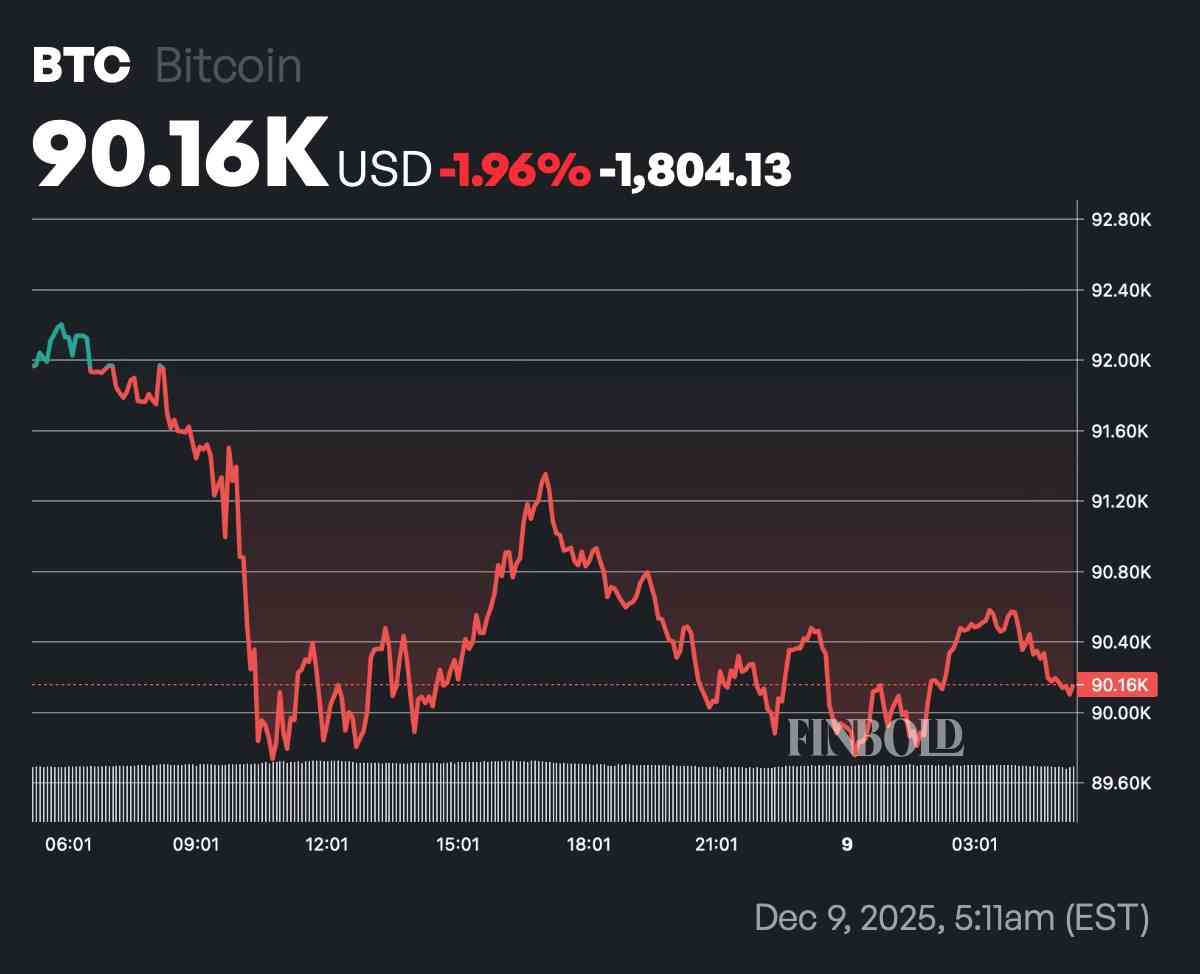

Bitcoin is down practically 2% on the every day chart on the time of writing, but it surely’s nonetheless holding above the $90,000 mark.

With the broader crypto market additionally down 1.85% forward of the Federal Reserve determination tomorrow and “digital gold’s” weakening technicals, Polymarket bets look that rather more affordable.

The asset has slipped under its 30-day easy transferring common (SMA) at $92,383 and was rejected on the 50% Fibonacci retracement degree close to $94,044, signaling weakening momentum.

Failure to reclaim $92,000 might verify a bearish pennant sample pointing towards an $86,000 goal and even decrease, to $80,000, the percentages of which taking place are 31%, as per the information reviewed above.

Featured picture by way of Shutterstock