Bitcoin is fighting the midline of its extended ascending channel across the $92K mark, teetering on the sting of a possible breakdown.

Regardless of this, the cryptocurrency has a number of key help ranges forward, fueling optimism for a potential bullish restoration within the close to future.

Technical Evaluation

By Shayan

The Each day Chart

Bitcoin has just lately confronted a notable correction, with the value at the moment stabilizing on the ascending channel’s center trendline close to the $92K mark. This degree acts as a important help zone, traditionally representing a major space of demand. Regardless of this help, sellers have exerted appreciable stress, threatening to interrupt under this key threshold.

Within the occasion of a profitable breach, Bitcoin may expertise a cascade of lengthy liquidations, doubtlessly driving the value downward towards the 100-day shifting common of $81K. This MA represents a strong dynamic help, prone to appeal to substantial shopping for curiosity and mitigate additional draw back momentum. Conversely, a rebound on the present degree may see Bitcoin regain bullish momentum, aiming to retest the $108K higher boundary of the channel within the mid-term.

The 4-Hour Chart

On the decrease timeframe, Bitcoin has breached the center trendline of its multi-month ascending channel, signaling elevated distribution amongst members. This bearish improvement coincides with rising market uncertainty as traders anticipate potential volatility surrounding President Trump’s inauguration on January 20, 2025.

At present, Bitcoin hovers close to a important help vary outlined by the $90K threshold and the Fibonacci retracement ranges at 0.5 ($87K) and 0.618 ($82K). This area is a formidable barrier to additional promoting stress and is anticipated to set off a market reversal.

On-chain Evaluation

By Shayan

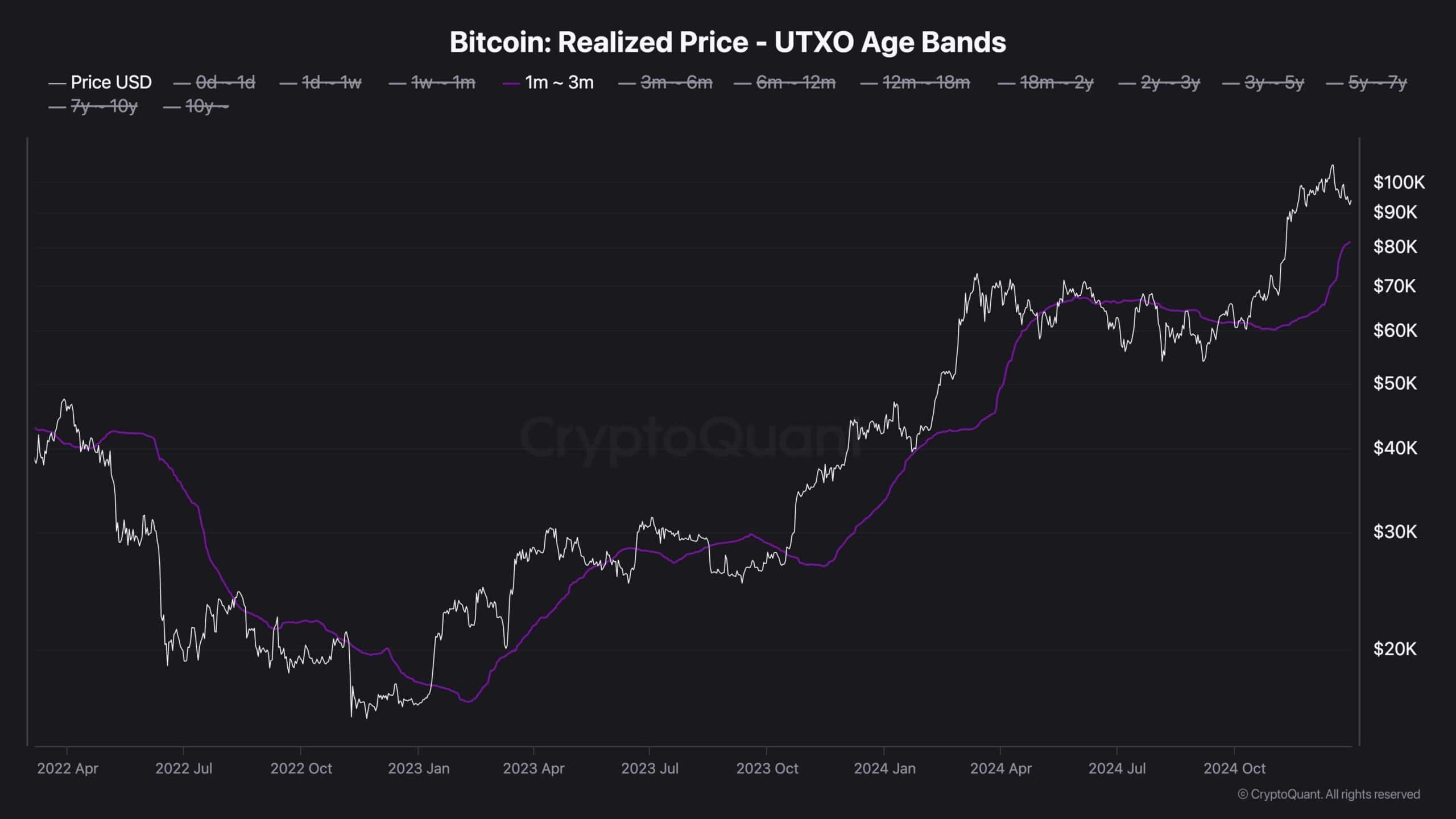

Bitcoin market members stay unsure concerning the continuation of the bullish development, with hypothesis revolving round whether or not greater costs are imminent or if the rally has concluded. A important on-chain metric offering perception into this habits is the realized worth UTXO age bands, notably for the 1-3 month (short-term) cohort.

The realized worth for this cohort acts as a dynamic threshold, reflecting the common worth at which these current patrons acquired their holdings. When BTC sustains above this realized worth, it indicators rising bullish momentum, indicating that new patrons are assured sufficient to carry regardless of elevated ranges. Quite the opposite, a worth drop under this threshold suggests a heightened threat of a sell-off, as these members enter loss territory and will resort to panic promoting, rising downward stress available on the market.

At present, the realized worth of the 1-3 month cohort resides on the $81K area, marking it as a important help zone. This degree is considered as the first protection line for patrons within the long-term outlook, with its means to carry seemingly figuring out the broader market’s route.