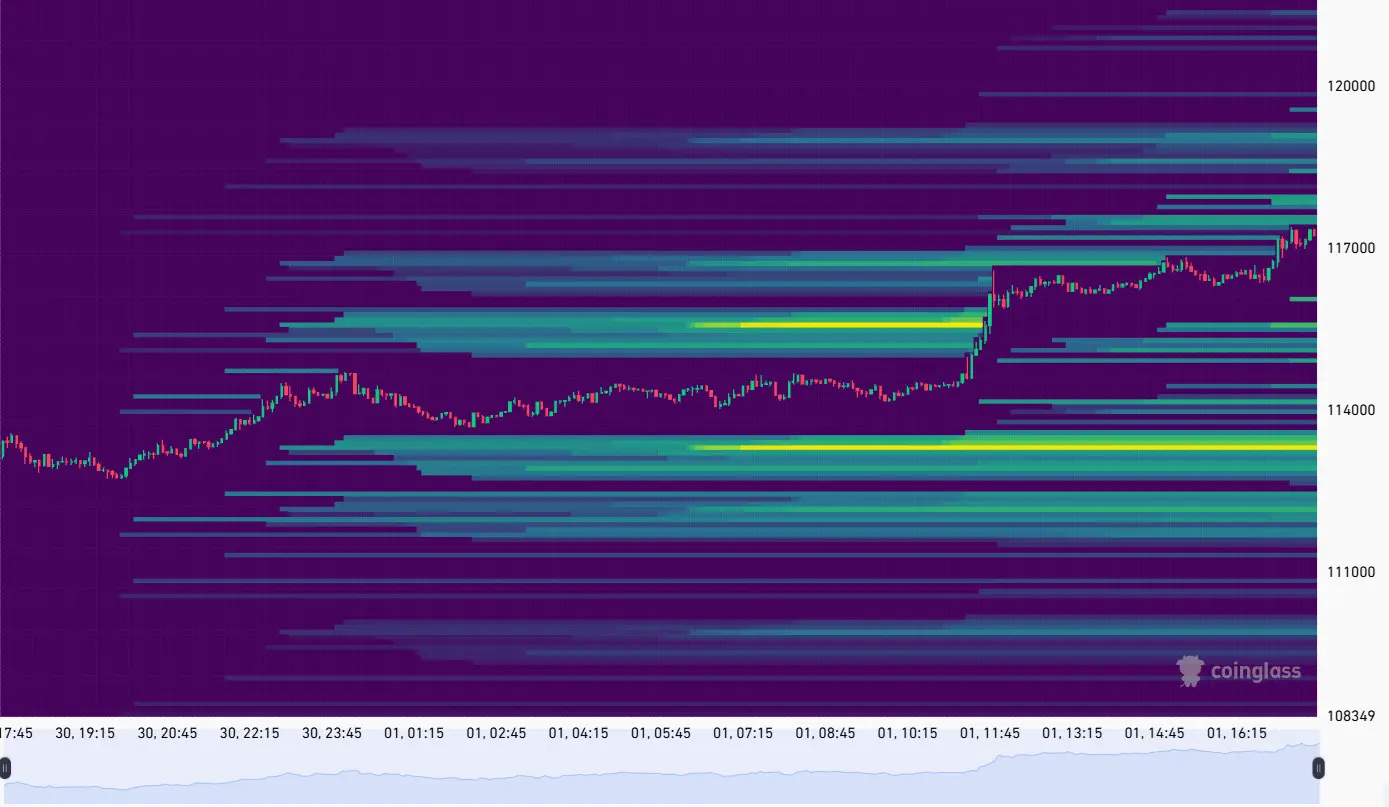

BTC switched to brief liquidations, wiping out $15.79M in brief positions inside an hour. General, brief liquidations reached a one-week excessive of over $268M.

BTC recovered above $117,300 in a fast shift of sentiment. The transfer erased over $15.79M in brief positions for only one hour. Over $178M in BTC shorts have been liquidated previously day. Primarily based on different methodologies, crypto liquidations have been counted as over $600M for the previous day.

BTC recovered the $117,000 stage, inflicting a wave of brief liquidations | Supply: Coinglass

Sentiment on crypto markets quickly modified path following per week of lengthy liquidations. This time round, BTC merchants had the selection to dip to the $107,000 vary, however the worth motion moved into liquidating brief positions.

Primarily based on the latest repositioning, BTC has rebuilt lengthy positions at round $113,000 to $112,000, forming a brand new zone of resistance. Nonetheless, the present sentiment for ‘Uptober’ could also be added to the liquidations to drive BTC larger.

The buying and selling sentiment stays impartial, suggesting the latest rally is probably not sustainable and could also be a focused try and de-leverage. The opposite chance is a rush to crypto belongings as a precaution towards the US Authorities shutdown and the weak spot of the US greenback.

Traditionally, authorities shutdowns have led to BTC rallies, adopted by fast corrections. The week of peak lengthy and brief liquidations might decide the worth path for the final quarter of a bull market 12 months. Beforehand, BTC has proven its function as a safe-haven asset, however the early October rally is seen as a possible lure for over-eager merchants.

BTC retains its dominance, ends altcoin season

BTC additionally confirmed energy on a number of markers, with its market cap dominance rising to 57%. The latest BTC rally meant altcoin season ended formally.

Nonetheless, the BTC energy additionally permits for particular altcoin rallies. The latest BTC restoration additionally boosted the costs of main cash. ETH recovered above $4,300, BNB stood at $1,022, and SOL returned to $220.

A collection of older cash and tokens from earlier bull markets additionally proceed their re-awakening rallies. ZEC, an early privateness coin, broke above $89.

ETH additionally stands at a liquidations crossroad

ETH liquidity additionally has a setup which will push the worth in both path. A hike to $4,400 might liquidate as much as $1B in brief positions, except merchants shut them. Much more liquidity has been increase for lengthy liquidations at $4,200. The short-term fluctuations of ETH are utilized by strategic whales to compound positive factors, as Cryptopolitan reported not too long ago.

The liquidity might shift, and the precise liquidations might change. In the course of the newest market upturn, ETH noticed a lot smaller liquidations in comparison with BTC, at round $8M within the four-hour time-frame, and $152M for the previous day.

Each ETH and BTC have enough assist from long-term holders and spot consumers. The latest market indicators present BTC could also be trying to find an area backside, establishing one other year-end rally.