Bitcoin is buying and selling virtually $11,000 beneath its Aug. 14 file, in line with CoinDesk knowledge, however FalconX’s head of analysis says the market’s inside construction nonetheless seems to be “extraordinarily bullish.”

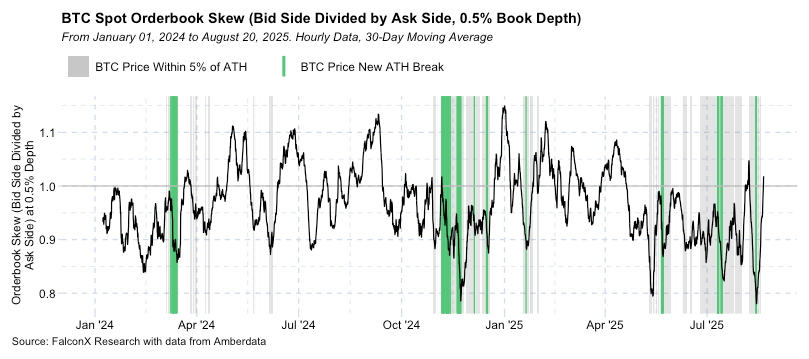

In a submit on X Wednesday, analyst David Lawant pointed to what occurs in bitcoin’s order guide — the stay file of purchase and promote gives on exchanges — when the value pulls again barely from highs.

He defined that after these small dips, promote orders shortly disappear and purchase orders take over, a dynamic he described because the order guide “flipping” from the promote aspect to the bid aspect.

In plain phrases, Lawant is saying that sellers aren’t sticking round to push the market down after modest declines. As a substitute, sturdy demand steps in virtually instantly, and patrons crowd out sellers.

That sample suggests long-term gamers with deeper pockets — resembling establishments and well-capitalized funds — are utilizing transient downturns as shopping for alternatives. Quite than signaling weak point, the absence of sustained promoting signifies confidence in bitcoin’s longer-term trajectory.

FalconX Analysis knowledge reveals buy-side demand shortly overwhelms sellers after value pullbacks.

The chart Lawant shared reinforces this interpretation. It reveals durations the place bitcoin slipped barely from file ranges, just for purchase orders to shortly surge forward of promote orders.

This repeated shift towards the bid aspect is a trademark of a bullish market construction, because it demonstrates that demand is ready within the wings to soak up any provide that involves market. For merchants, the takeaway is that bitcoin’s resilience after dips factors to sturdy underlying help.

Whereas bitcoin remains to be beneath its Aug. 14 peak of $124,481, the sample highlighted by Lawant — sellers vanishing shortly and patrons reasserting management — continues to underpin bullish sentiment amongst analysts who see dips as alternatives reasonably than warning indicators.

Technical Evaluation Highlights

- In line with CoinDesk Analysis’s technical evaluation knowledge mannequin, between Aug. 19, 17:00 UTC and Aug. 20, 16:00 UTC, bitcoin fluctuated inside a $1,899.78 vary, buying and selling between a low of $112,437.99 and a excessive of $114,337.77.

- Round 13:00 UTC on Aug. 20, the value fell to $112,652.09 amid liquidation stress earlier than staging a robust rebound.

- The restoration was supported by excessive buying and selling exercise: 14,643 BTC modified arms, in comparison with a 24-hour common of 9,356 BTC.

- This surge established $112,400–$112,650 as a key volume-backed help hall.

- Within the last hour of the evaluation interval (15:47–16:46 UTC), bitcoin rose from $113,863.05 to $114,302.43 earlier than closing at $113,983.06.

- The rally broke by resistance at $113,500, $113,650 and $114,000, aided by elevated volumes of 250+ BTC per minute, signaling the beginning of a short-term uptrend.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial crew to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.