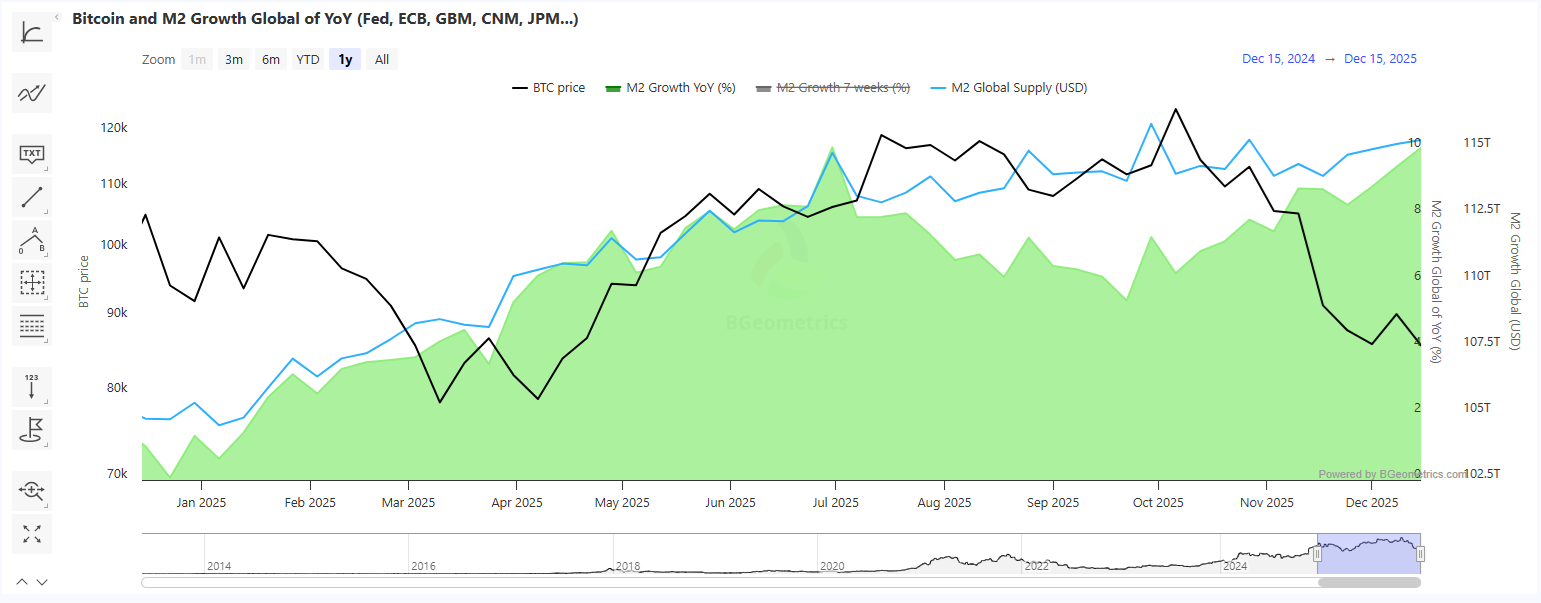

The narrative of BTC being tied to M2 cash provide growth broke down in 2025. A sample emerged the place the expansion of BTC lagged behind and decoupled from the expansion of the worldwide cash provide.

BTC value growth didn’t observe the features of the worldwide M2 cash provide. Over the previous 12 months, BTC ended up with a small web acquire, underperforming conventional belongings.

The M2 cash provide expanded in 2025, however BTC decoupled from the expansion, as liquidity shifted to shares and treasured metals. | Supply: BGeometrics

The M2 narrative was a part of the setup for crypto, which was anticipated to have a year-end rally. Nonetheless, BTC stalled at $126,000 in October, breaking right down to a decrease vary since then.

The BTC rally in 2025 additionally lagged behind the tempo of growth of M2. Traditionally, BTC rallies three to 6 months after financial growth, however this time, different elements broke down the development in This fall.

M2 cash provide reaches a brand new file

Previously 12 months, the worldwide cash provide expanded from $104T to over $115T, extending the tempo from the previous few years. The availability development exceeded the 2024 growth.

The expansion tempo additionally resembled the post-pandemic situations of 2020. The US cash provide additionally grew prior to now 12 months, rising to $22.5T in October, up from $21.4T in December 2024.

This time round, the growth of AI and knowledge middle shares, together with the expansion of treasured metals, meant the extra funds weren’t chasing crypto belongings.

BTC was additionally extra mainstream, and had an extended value historical past, and buying and selling in 2025 was achieved with extra warning and skepticism. BTC failed to interrupt the anticipated value ranges for the previous 12 months, and the crypto market didn’t break to a brand new all-time peak.

Can BTC recuperate its development?

The M2 cash provide narrative has principally labored for BTC in earlier market cycles. This time, the surplus cash inflows didn’t chase BTC blindly. Consumers and accumulation have been extra strategic.

The Chinese language cash provide expanded much more, by round 8% prior to now 12 months, from 311T to 336T yuan. Nonetheless, the nation didn’t contribute to the expansion of BTC instantly, and even Asian merchants remained cautious.

One of many expectations is that BTC could meet up with the M2 provide. A catchup rally units an much more bullish goal for BTC, with the potential to interrupt above $220K per coin.

On the identical time, BTC continues to unwind, with indicators of institutional promoting and divestment at every native excessive. BTC has did not recuperate above $90,000 for weeks, as every rally is met with promoting. The market is anticipated to take months, whereas nonetheless needing to beat destructive sentiment.