Bitcoin is at the moment hovering round $102.6k after a risky begin to November. Whereas the worth motion stays uneven, it’s nonetheless respecting the important thing structural ranges regardless of heavy liquidations and sentiment shifts. The market is in a essential section, sitting close to mid-range help with weak bullish momentum and macro uncertainties looming. Patrons are holding the road for now, however there’s warning within the air.

Technical Evaluation

By Shayan

The Each day Chart

On the day by day chart, BTC is reacting to the 0.5 Fib retracement at $100.3k after being held on the sturdy demand zone at $100k. The asset continues to be beneath each the 100-day and 200-day transferring averages, each situated across the $110k mark, which alerts that momentum is tilted to the draw back within the broader pattern. The latest bounce didn’t reclaim the important thing provide zone at $106,000, which is now appearing as a resistance.

The RSI additionally sits round 41, nonetheless beneath the mid-level, confirming weak bullish conviction. If the bounce loses steam, the following key degree is the 0.618 Fib close to $94,250, adopted by a deeper retracement towards the $90k zone.

The 4-Hour Chart

The 4-hour chart reveals that the worth continues to be buying and selling inside a transparent descending wedge. Regardless of the latest bullish bounce from the $100k degree, the rejection from the $106k area signifies sellers are defending that degree aggressively. Till the wedge breaks to the upside with sturdy quantity, this stays a corrective bounce inside a broader downtrend.

Brief-term RSI can also be rebounding from oversold circumstances and now prints round 47, which is impartial however not but displaying power. If Bitcoin can flip $106K convincingly, it opens up a take a look at of the $110K degree. In any other case, one other sweep of the lows round $100K and even the $98K degree stays probably.

On-Chain Evaluation

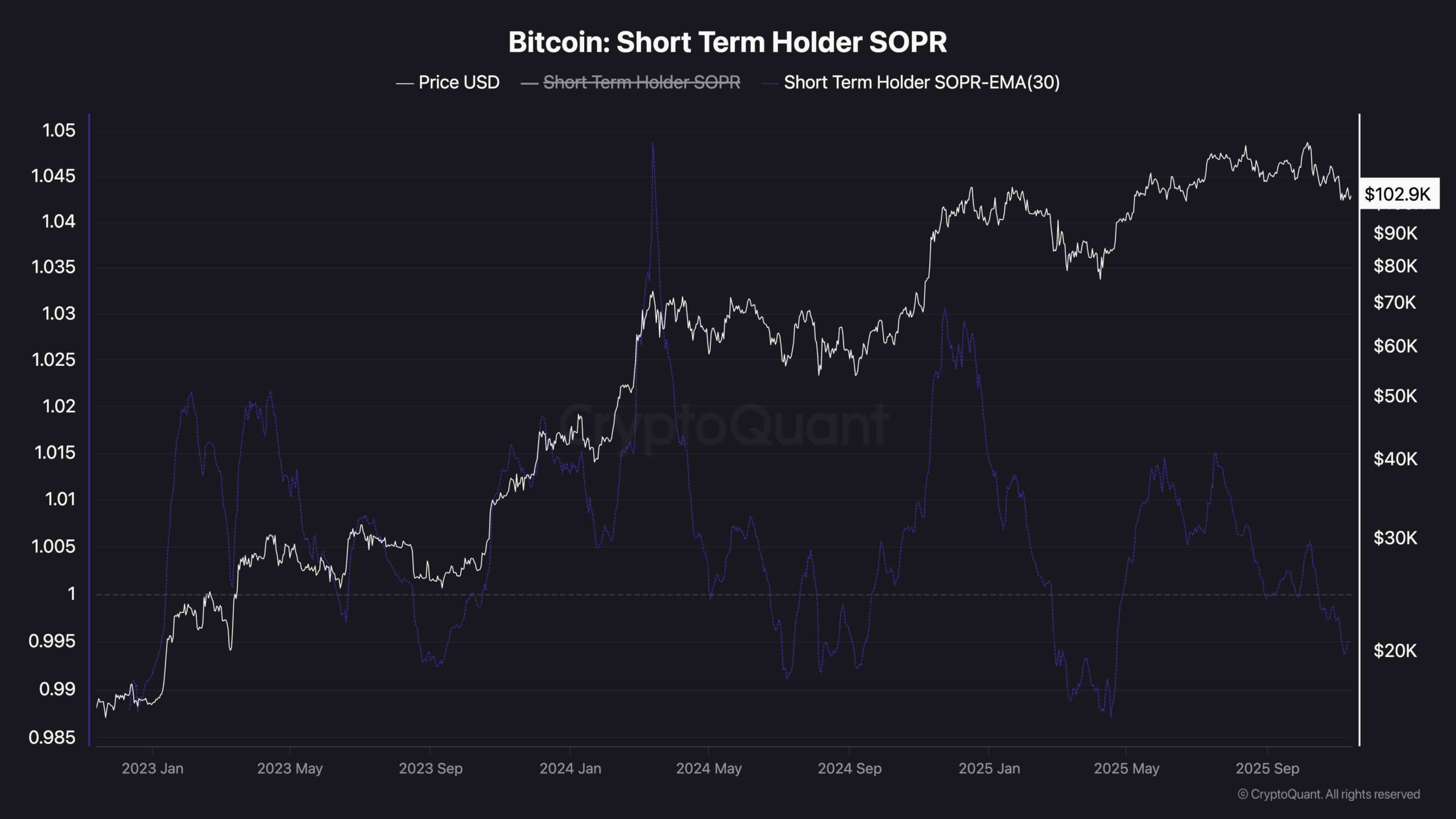

Brief-Time period Holder SOPR (30-Day EMA)

Brief-Time period Holder SOPR is as soon as once more buying and selling beneath 1. This reveals that latest patrons are promoting at a loss. Traditionally, when SOPR fails to reclaim 1 throughout a bounce, it alerts an absence of conviction available in the market and a possible for additional correction, as holders are promoting at a loss to stop larger ones.

Till this metric persistently exceeds 1, which signifies routine profit-taking, short-term panic promoting will probably persist on every bounce. This might overwhelm the market with extra provide, particularly if BTC drops decrease, which might result in much more draw back within the coming weeks.