Bitcoin continues to hover inside a consolidation part after its sturdy rebound from the $107K zone. Whereas indicators of bullish momentum are rising, the subsequent transfer will largely rely on whether or not the value can break by means of close by liquidity ranges or face rejection and pull again for renewed accumulation.

Technical Evaluation

By Shayan

The Every day Chart

On the each day timeframe, BTC is buying and selling inside a well-defined vary between $107K assist and $123K resistance. The latest inflow of consumers on the decrease boundary fueled a pointy rebound, permitting the asset to reclaim the 100-day transferring common and advance towards the vary excessive.

This construction displays renewed demand, as members defend key helps. The decisive set off now lies on the $123K higher boundary. A breakout above this degree wouldn’t solely mark a brand new all-time excessive but in addition affirm bullish continuation for the broader development.

The 4-Hour Chart

Zooming into the 4-hour chart, Bitcoin has rallied near the $117K swing excessive, the place notable buy-side liquidity is positioned simply above. Whereas the bullish construction stays intact, a brief pullback into the decision-point demand zone at $110.7K–$113.1K can’t be dominated out.

This space has beforehand attracted sturdy shopping for curiosity, and a profitable retest would reinforce the bullish case. If consumers defend this zone and reclaim momentum, the liquidity above the swing excessive might act as a magnet, probably fueling a continuation transfer towards increased ranges.

On-chain Evaluation

By Shayan

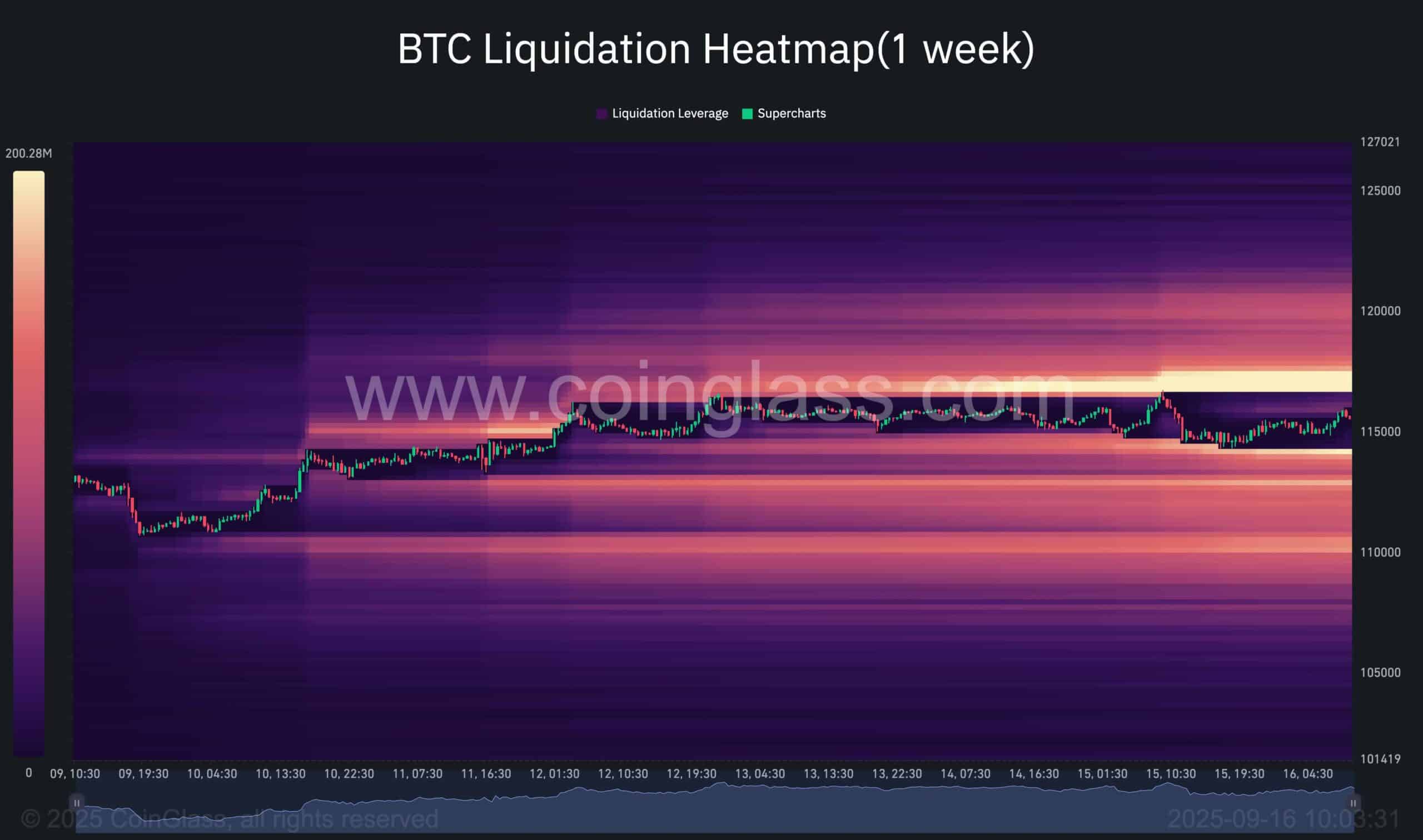

The 1-week Bitcoin liquidation heatmap highlights a dense cluster of liquidations sitting simply above the latest swing excessive, aligning with the liquidity mentioned within the 4-hour chart.

Markets usually speed up into such zones, as cease orders and compelled liquidations amplify momentum. A clear push by means of the swing excessive would probably set off this cascade, forcing shorts to cowl and driving value increased.

This reinforces the outlined state of affairs: whereas a short pullback into demand stays potential, the trail of least resistance more and more factors towards liquidity absorption above the swing excessive, a setup that might function a catalyst for continuation towards new highs.