Bitcoin’s value has lastly damaged its file excessive after a gradual uptrend over the past couple of months. Traders are actually questioning how far BTC can go.

Bitcoin Value Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

On the every day timeframe, it’s evident that the worth has damaged the earlier all-time excessive of $74K with appreciable power. With the market nonetheless buying and selling close to its 200-day shifting common, BTC can go a lot larger within the coming months. Subsequently, the $80K degree could possibly be a viable goal within the brief time period.

In the meantime, the RSI is displaying an overbought sign once more, which may level to a possible consolidation or short-term correction quickly.

But, so long as the market stays above the 200-day shifting common, which is positioned across the $64K degree, the general pattern stays bullish, and better costs could possibly be anticipated.

The 4-Hour Chart

Wanting on the 4-hour chart, issues look virtually related. A number of days in the past, the worth quickly rebounded from the $68K degree. This vital surge led to a bullish breakout from $74K, as BTC created a brand new all-time excessive.

In the meantime, the RSI additionally reveals an overbought sign on this timeframe. Subsequently, a pullback to $74K may happen quickly earlier than the market continues larger and towards the $80K mark.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Bitcoin Funding Charges

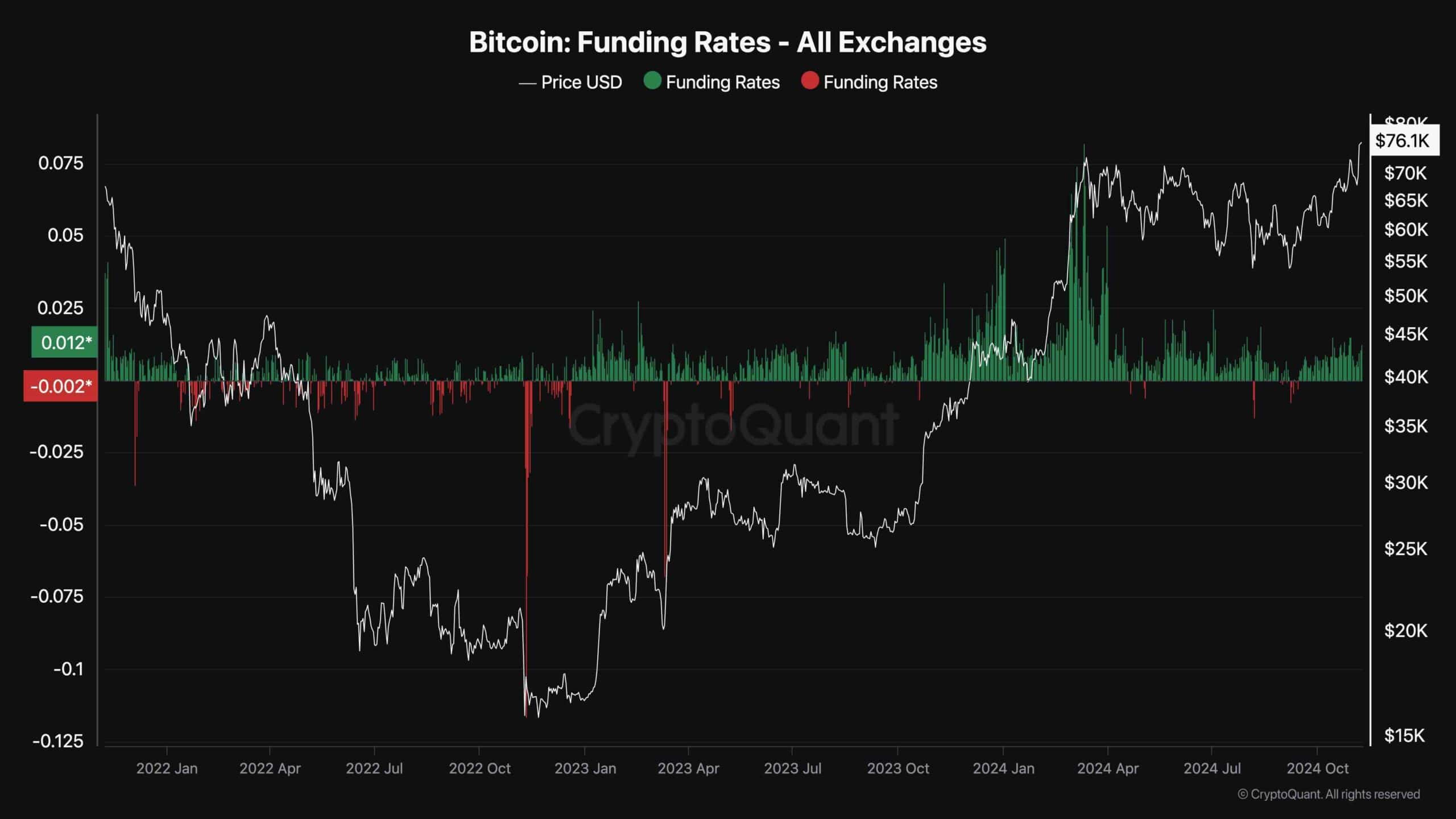

Whereas Bitcoin’s value has lastly created a brand new all-time excessive, market individuals are hopeful {that a} new rally has begun. On this state of affairs, analyzing the futures market sentiment could be very useful, because it considerably influences short-term value fluctuations.

This chart presents the BTC funding charges metric, which measures whether or not the consumers or the sellers are executing their orders extra aggressively. Optimistic values point out bullish sentiment and adverse ones are related to bearish market sentiment.

Because the chart suggests, the BTC funding charges have been constructive over the previous few weeks. But, whereas the market has created a brand new all-time excessive, the funding charge values are nonetheless a lot decrease than these witnessed over the past file excessive earlier this yr. Subsequently, it may be assumed that the futures market continues to be removed from overheating, and Bitcoin may nonetheless rise larger within the coming months.