Bitcoin’s current battle to carry the $100,000 stage has revived acquainted doubts about whether or not institutional demand is sturdy.

Nonetheless, in a brand new submitting with the US Securities and Trade Fee, BlackRock alerts the other conclusion, saying its conviction in Bitcoin’s long-term relevance stays intact regardless of short-term market weak spot.

The agency frames Bitcoin as a decades-long structural theme formed by adoption curves, liquidity depth, and the declining credibility of legacy financial programs.

Whereas this view acknowledges volatility, it argues that Bitcoin’s strategic worth is accelerating quicker than its value suggests. That tone contrasts with a market the place every pullback typically renews questions on institutional endurance.

The paradox of slowing costs and rising institutional demand

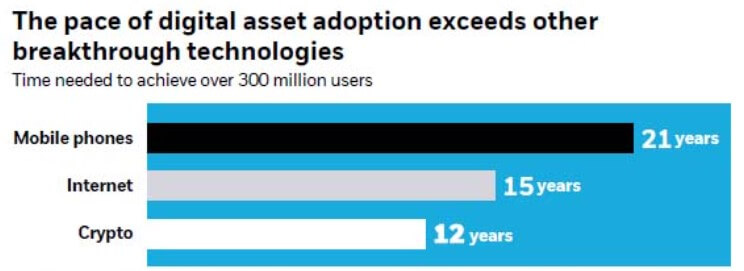

A central pillar of BlackRock’s argument is Bitcoin’s network-growth profile, which it describes as one of many quickest seen in any fashionable expertise cycle.

The submitting cites adoption estimates exhibiting that Bitcoin surpassed 300 million international customers roughly 12 years after launch, outpacing each cell phones and the early web, which every took considerably longer to succeed in related thresholds.

For BlackRock, this curve is greater than a knowledge level. It reframes Bitcoin as a long-duration asset whose worth displays cumulative community participation moderately than month-to-month value strikes.

The agency additionally features a decade-long efficiency matrix exhibiting that, regardless of wild swings in particular person years, which regularly place Bitcoin at both the highest or backside of annual return tables, its cumulative and annualized efficiency nonetheless exceeds that of equities, gold, commodities, and bonds.

That framing positions volatility as a built-in price of publicity moderately than a structural flaw.

For an asset supervisor whose merchandise are designed for multi-decade allocations moderately than short-cycle momentum trades, non permanent stagnation seems much less like a warning and extra like a well-known characteristic of Bitcoin’s cyclical rhythm.

The submitting additionally emphasizes that the asset’s present slowdown has not dented institutional participation. If something, BlackRock argues, Bitcoin’s underlying fundamentals of digital adoption, macroeconomic uncertainty, and the growth of regulated market infrastructure proceed to strengthen whilst spot costs cool.

How IBIT modified Bitcoin’s market construction

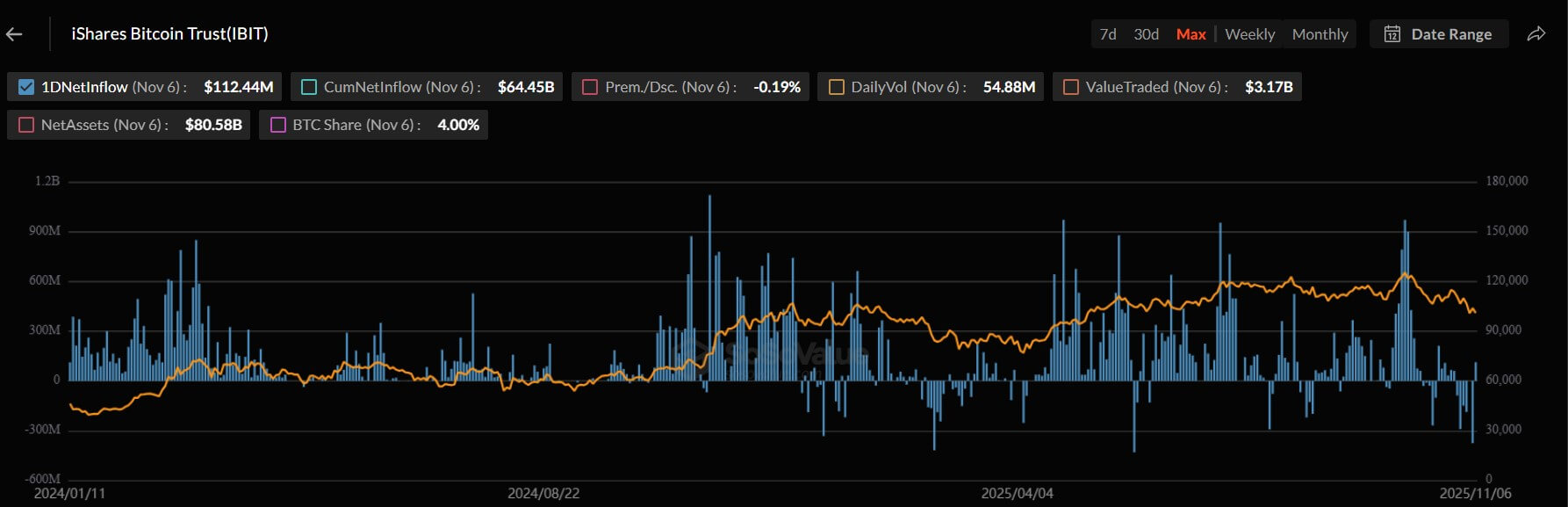

A second theme within the submitting is the argument that BlackRock’s personal product, the iShares Bitcoin Belief (IBIT), has reshaped entry to the asset in ways in which help deeper institutional involvement.

The agency highlights three areas, together with simplified publicity, enhanced liquidity, and the combination of regulated custody and pricing rails.

BlackRock said that IBIT reduces operational frictions by permitting establishments to carry Bitcoin by means of a construction they already perceive.

In line with the agency, custody dangers, key-management points, and technical onboarding, which have traditionally been limitations for establishments, are abstracted away in favor of conventional settlement channels.

On the similar time, BlackRock additionally highlighted liquidity as one of the vital impacts IBIT has had available on the market.

Since its launch, the product has grow to be probably the most actively traded Bitcoin ETF, contributing to tighter spreads and deeper order books. For big allocators, execution high quality acts as a type of validation: the extra liquid the product, the extra institutionally acceptable the underlying asset turns into.

Furthermore, BlackRock additionally highlighted its multi-year infrastructure work with Coinbase Prime, regulated value benchmarks, and strict audit frameworks as proof that Bitcoin publicity can now be delivered with requirements akin to equities or mounted revenue.

Due to that design, the agency has processed greater than $3 billion in in-kind transfers — an indication, it says, of institutional and whale confidence in its custody structure.

Notably, IBIT flows reinforce all the factors above. Since its launch, IBIT has emerged because the dominant Bitcoin ETF product out there, with cumulative web inflows of $64.45 billion and over $80 billion in property beneath administration.

Actually, IBIT’s inflows for this yr have outpaced all the mixed flows recorded by the opposite 10 Bitcoin merchandise out there, in accordance with K33 Analysis knowledge.

Bitcoin as a worldwide financial various

Probably the most assertive part of the submitting is labeled “international financial various.” BlackRock describes Bitcoin as a scarce, decentralized asset positioned to profit from persistent geopolitical dysfunction, rising debt burdens, and long-term erosion in fiat credibility.

The agency doesn’t body Bitcoin as a direct substitute for sovereign currencies, however the implication is obvious: the asset’s relevance will increase as conventional financial programs face stress.

BlackRock additionally situates Bitcoin inside a broader technological transition. As probably the most extensively adopted cryptocurrency, Bitcoin features as a proxy wager on the mainstreaming of digital-asset infrastructure, together with blockchain-based funds, settlement programs, and monetary market rails.

On this context, Bitcoin has two intertwined identities as a financial hedge and a technological publicity.

This twin narrative helps clarify BlackRock’s sustained bullishness. One pillar of the thesis is macroeconomic, tied to inflation dynamics, fiscal trajectory, and geopolitical fragmentation. The opposite is structural, tied to the continuing international growth of blockchain networks.

Contemplating this, the current sluggish value motion doesn’t meaningfully disrupt both thesis.