Bitwise Asset Administration has launched a brand new exchange-traded fund (ETF) designed to hedge towards forex debasement, underscoring how digital belongings are more and more being integrated into broader macro funding methods following the success of spot Bitcoin ETFs.

On Thursday, Bitwise unveiled the Bitwise Proficio Foreign money Debasement ETF, which trades on the NYSE below the ticker BPRO. The actively managed fund seeks to deal with the declining buying energy of fiat currencies by means of a portfolio that features Bitcoin (BTC), treasured metals and mining equities.

In contrast to spot Bitcoin ETFs, BPRO permits for discretionary allocation throughout crypto and commodity-linked belongings. The construction seems geared toward wealth managers searching for Bitcoin publicity with out committing to a single-asset crypto product, notably amid persistent inflation issues.

The fund maintains a minimal allocation of 25% in gold always and carries an expense ratio of 0.96%.

Moderately than emphasizing upside potential, the fund is positioned round capital preservation, a framing that displays how crypto narratives are evolving in institutional markets.

Bob Haber, chief funding officer at Proficio Capital Companions, stated that regardless of its long-term efficiency, “gold stays a ghost within the fashionable portfolio,” citing analysis from Goldman Sachs exhibiting that gold ETFs account for under a fraction of 1% of personal monetary holdings.

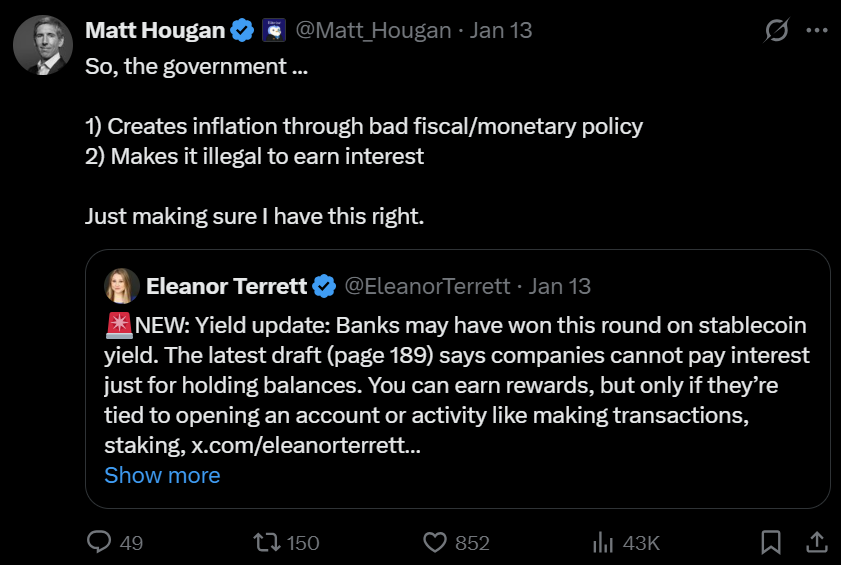

Supply: Matt Hougan

Associated: Bitwise recordsdata with US SEC for 11 single‑token ‘technique’ crypto ETFs

Debasement captures crypto’s creativeness and funding fashion

Fiat forex debasement, the gradual erosion of buying energy over time, has lengthy been a foundational concern throughout the Bitcoin neighborhood.

Bitcoin has continuously been promoted as a long-term hedge towards debasement, given its mounted provide and powerful efficiency since inception. Nonetheless, regardless of these attributes, Bitcoin has lately underperformed gold, elevating questions on its effectiveness as a hedge towards debasement within the present macro atmosphere.

In a latest evaluation, funding specialist Karel Mercx of Dutch advisory firm Beleggers Belangen argued that Bitcoin has didn’t ship as a dependable hedge towards forex debasement.

In keeping with Mercx, essentially the most putting sign got here when Bitcoin underperformed whilst US President Donald Trump publicly undermined the Federal Reserve’s independence.

Political strain on a central financial institution can elevate issues about financial credibility and longer-term inflation dangers, that are circumstances which have traditionally benefited belongings seen as shops of worth. Whereas gold responded to these alerts, Bitcoin didn’t, weakening its case as a near-term hedge towards forex debasement.

Associated: Bitcoin mining’s 2026 reckoning: AI pivots, margin strain and a battle to outlive