Analysts imagine a bitcoin rally to $127,000 is feasible if the cryptocurrency closes above the $120,000 mark with robust quantity, however they warn of a possible retest of the $114,000 to $116,000 vary if the rally is rejected.

BTC Enters ‘Wait-for-Affirmation’ Part

Bitcoin (BTC) broke previous the $122,000 mark late on Aug. 10, marking the primary time it has examined that stage since July 14. The highest cryptocurrency’s surge, which has rekindled hopes of one other milestone-setting rally, got here simply days after it briefly dropped beneath $113,000 for the second time in August.

Though it subsequently retreated to simply above $120,000 a couple of hours later (7:18 a.m. EST on Aug. 11), some analysts imagine BTC can nonetheless maintain a rally that may probably attain a brand new all-time excessive. Digital asset platform Bitunix Analyst asserted {that a} high of $127,000 is feasible, supplied one key situation is met.

“ BTC is at the moment in a wait-for-confirmation part. If BTC can get away with quantity and shut above 120k on the each day chart, the following targets might be 124,000 and 127,000. If it will get rejected at 120k or varieties a protracted higher wick at highs, a retest of 116k–114k is feasible,” the Bitunix analyst said within the newest suggestion.

To arrange customers for potential volatility, Bitunix advises setting a strict restrict on potential losses for every particular person place, with stop-losses saved inside a predetermined vary of 5% to eight% of their whole capital. This technique prevents a single unsuccessful commerce from inflicting catastrophic injury on a whole portfolio. Buyers are additionally inspired to make use of scaled entries and apply trailing stops, which ensures losses are manageable and predictable.

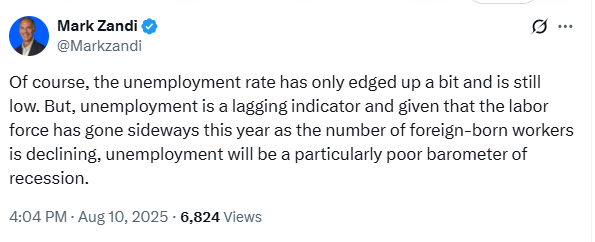

In the meantime, Bitunix’s suggestion additionally urges buyers to observe for the CPI knowledge, which is about to be launched on Aug. 12, and Moody’s follow-up experiences. In a latest submit on X, Mark Zandi, chief economist with Moody’s Analytics, repeated his warning concerning the U.S. economic system being on the precipice of a recession however concluded by stating that “we aren’t there but.”

The final CPI knowledge, launched by the Bureau of Labor Statistics (BLS), confirmed total inflation had risen to 2.7% in June. The stronger-than-expected inflation knowledge solidified the market’s view that the U.S. Federal Reserve wouldn’t collapse to President Donald Trump’s demand for an rate of interest reduce.

In response to the Bitunix analyst, these occasions have the potential to shift market sentiment; therefore, buyers should be aware of them.

“Intently monitor tomorrow’s CPI launch and Moody’s follow-up experiences, as sudden macro headlines might immediately shift market path,” Bitunix said.