Bitcoin’s worth slid early Monday, dipping beneath the $94,000 mark. Previously 24 hours, a mixed $271.22 million in crypto positions—each brief and lengthy—have been cleared out.

Bitcoin Slides Into the Crimson—South Korea’s Premium Returns

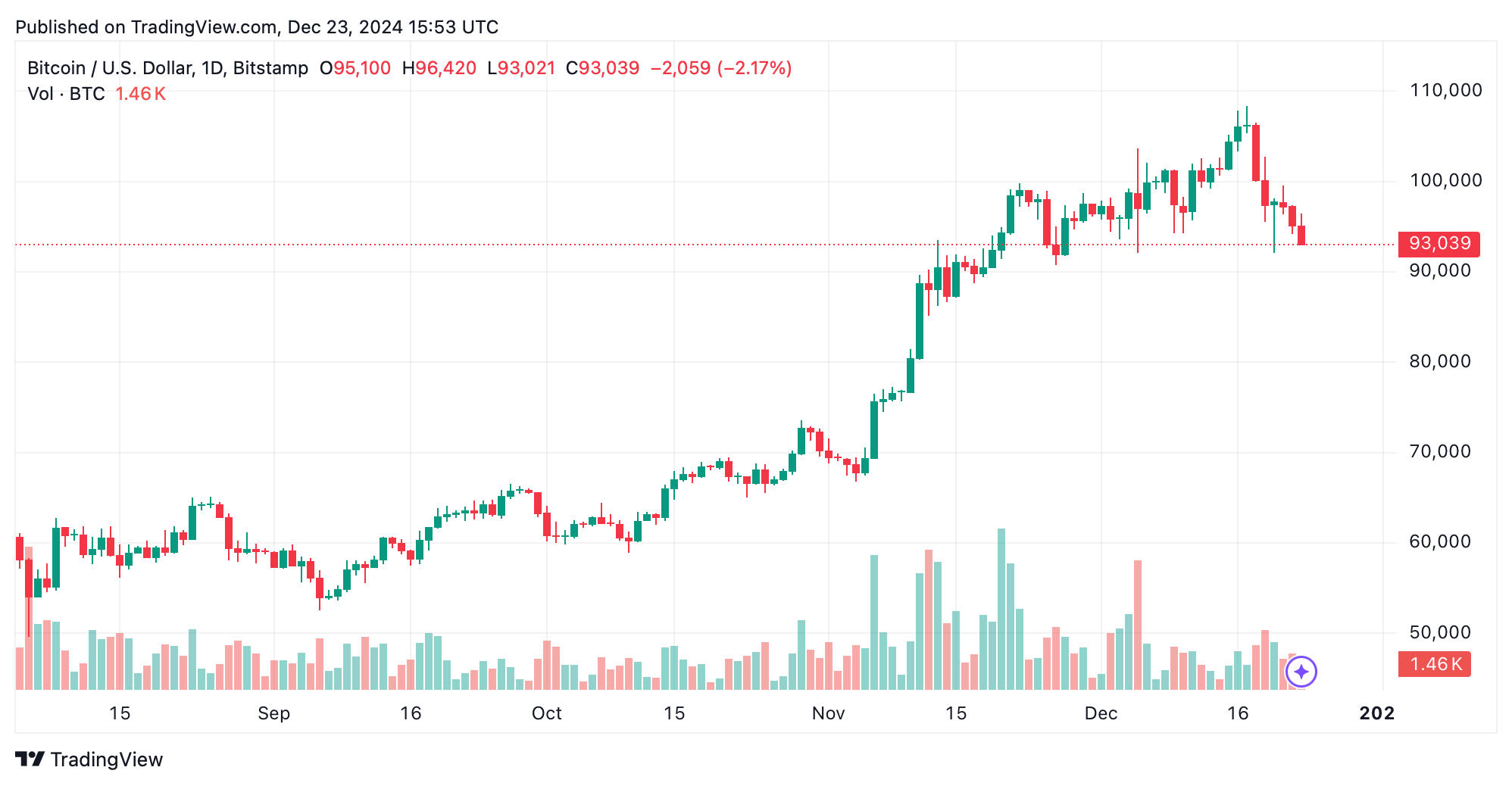

The main digital asset, bitcoin (BTC), has dropped 2.1% towards the U.S. greenback as of Dec. 23, marking an 11.5% decline over the previous week. On Monday, BTC’s market cap hovers at $1.84 trillion, making up 57% of the $3.24 trillion international crypto market. The two.1% dip shaved roughly $3,000 off BTC’s worth.

Exercise stays calm, probably reflecting the beginning of the vacation week, with bitcoin’s Monday morning buying and selling quantity settling at $57 billion. Throughout the crypto market, international commerce quantity has reached $155 billion. Key buying and selling pairs for BTC embrace tether (USDT), USD, FDUSD, USDC, and KRW.

At 10:45 a.m. ET on Monday, bitcoin trades at $93,235. Nevertheless, on South Korea’s Upbit alternate, BTC is priced at $97,729 per coin. Round 1.77% of BTC trades up to now 24 hours have been carried out in Korean received. In the meantime, the crypto derivatives market has witnessed $271.22 million in positions liquidated.

Bitcoin led the liquidation tally, with $63 million value of positions worn out up to now day. Of that, $44.4 million represented lengthy bets. Ethereum derivatives additionally noticed important motion, with $60 million liquidated, together with $40 million in lengthy positions. Total, longs accounted for $183.78 million of the $271.22 million cleared throughout the market.

Crypto lovers are buzzing with questions in regards to the market’s subsequent transfer. Etoro analyst Simon Peters shares the curiosity, posing the identical question in a market observe to Bitcoin.com Information. “The query now’s if we’ll proceed to see a deeper retracement in crypto markets because the feedback from Powell eventually week’s convention proceed to be absorbed,” Peters stated. “Or if traders will see this as a possibility to ‘purchase the dip’ and stay bullish on the long run outlook for crypto markets.”