Bitcoin’s value climbed again above $97,000 this week, supported by a sustained return of capital into US spot Bitcoin exchange-traded funds, information and market watchers say, suggesting a structural shift in demand after months of sideways buying and selling.

Because the begin of the yr, US spot Bitcoin (BTC) ETFs have collectively attracted practically $1.5 billion in web inflows, in response to information cited by Bloomberg ETF analyst Eric Balchunas. That complete displays a multi-day stretch of optimistic creation exercise amid renewed curiosity from bigger allocators, following a interval of muted ETF flows on the finish of 2025.

Balchunas stated in a put up on X that the sample of ETF demand “means that perhaps the consumers have exhausted the sellers,” a reference to Bitcoin breaking out of a chronic consolidation across the $88,000 stage.

Supply: Eric Balchunas

ETF consumers accounted for $843.6 million in web inflows on Wednesday alone, bringing the weekly complete to $1.07 billion and lifting the year-to-date determine. Whereas single-day inflows have grabbed consideration, the broader narrative is considered one of steadier demand returning after earlier rotation throughout the merchandise.

Associated: 5 Bitcoin narratives analysts are watching past value

Will establishments flip the Bitcoin script?

Bitcoin is rallying initially of a interval that has traditionally been more difficult for the asset. Market observers typically level to Bitcoin’s four-year cycles, that are loosely aligned with its halving occasions and have usually seen costs peak 12 to 18 months after every provide discount, a sample that might counsel the market could already be previous its cyclical excessive.

Whereas the four-year cycle will not be a rule, previous market habits has led many analysts to strategy this section with warning.

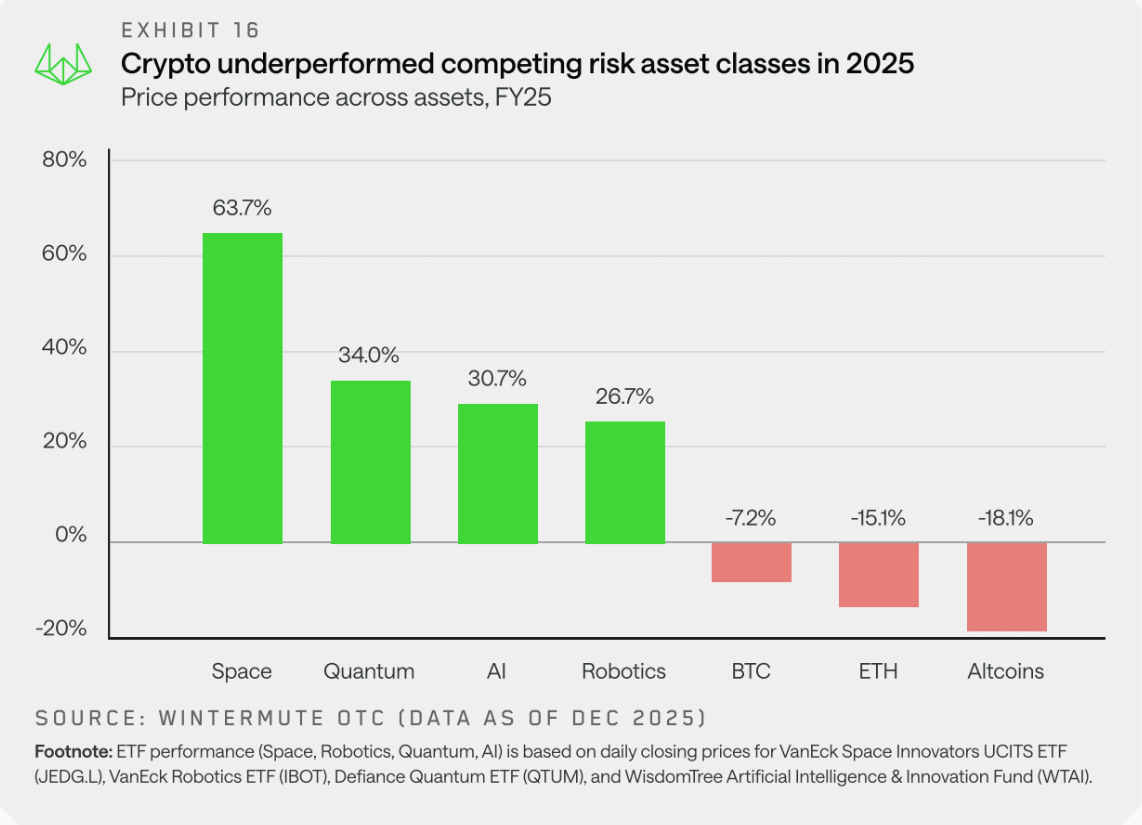

The present rebound follows a blended efficiency in 2025, when Bitcoin reached new all-time highs however didn’t maintain momentum throughout the broader crypto market. Regardless of headline value beneficial properties, the rally didn’t translate into a chronic “altcoin season,” leaving many buyers dissatisfied by the shortage of follow-through.

In line with Wintermute, a structural shift in Bitcoin markets could also be required to help a broader restoration heading into 2026. In a latest outlook, the market maker stated a market-wide rebound would seemingly rely on continued accumulation by exchange-traded funds and digital asset treasury firms, or an enlargement of their mandates past Bitcoin to different digital property.

Bitcoin failed to draw sustained retail inflows in 2025 as buyers explored new development themes round AI, robotics and house shares. Supply: Wintermute

Wintermute additionally pointed to the necessity for stronger, extra constant efficiency throughout main cryptocurrencies, together with Bitcoin, to generate a broader wealth impact.

Associated: Crypto’s 2026 funding playbook: Bitcoin, stablecoin infrastructure, tokenized property