Bitcoin’s current slide beneath $80,000 has triggered a wave of sleep disruption throughout the retail buying and selling group, in keeping with a brand new report from CEX.io.

The flagship digital asset has since rebounded to about $88,000, however the roughly 31% drawdown from its current peak left many traders monitoring costs by the night time.

This conduct has moved past easy anxiousness, as almost 70% of surveyed merchants attribute execution errors and “unhealthy trades” on to sleep deprivation, making a situation the place bodily fatigue is compounding portfolio losses.

Late-night monitoring

CEX.io’s survey factors to a hanging shift in conduct: 68% of respondents say they examine costs after going to mattress nearly each night time or each night time, whereas solely 8% say they by no means do.

This sample highlights how market swings more and more affect every day routines and nighttime habits.

Furthermore, the info means that sleep loss is turning into normalized in crypto buying and selling.

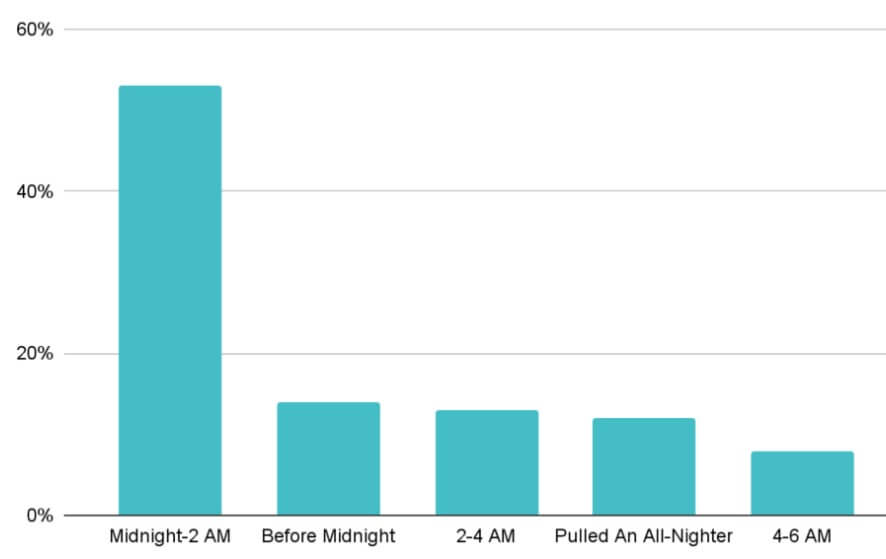

In accordance with the report, greater than half of the surveyed contributors mentioned they’ve stayed awake till at the very least 2 A.M. due to market strikes, and one other 33% mentioned they continue to be awake till 4 A.M. or later. In whole, 81% reported dropping sleep whereas ready for a good setup or a key occasion.

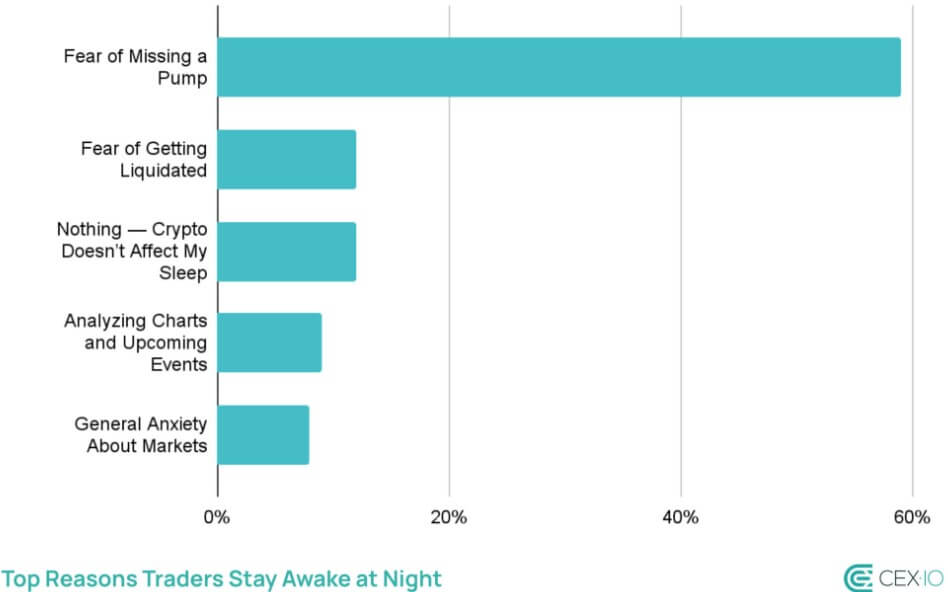

In the meantime, the psychological drivers of this conduct point out a market more and more pushed by emotion somewhat than technical evaluation.

The first wrongdoer for sleeplessness will not be worry of liquidation, however the Worry of Lacking Out (FOMO), cited by 59% of respondents.

This aligns with findings that sleep high quality is inextricably linked to market path: 64% sleep higher in bull markets, in comparison with simply 10% in bear markets.

BTC’s Nighttime volatility

CEX.io argued that this insomnia will not be merely a response to cost, however to a shift within the timing of volatility.

The agency, citing Blockworks Analysis information, famous that probably the most violent value swings have shifted to the in a single day window.

The information reveals the very best realized volatility clustering between 18:00 and 06:00 UTC. This timeline coincides with a thinning of institutional order books as US liquidity suppliers go offline.

So, with lowered market depth throughout the Asian-Pacific crossover, comparatively smaller order flows are triggering outsized strikes.

For retail merchants in EMEA time zones, this volatility window overlaps straight with relaxation durations, forcing a binary alternative between sleep and energetic danger administration.