Bitcoin’s newest slide has merchants evaluating in the present day’s construction to previous cycle turns, with two chart posts drawing essentially the most consideration. One flags a potential 8-month vary between $45,000 and $60,000, whereas one other says the 50% drawdown displays sellers overpowering patrons, not a single headline.

Dealer flags 2021-style bear sample, requires 8-month Bitcoin vary

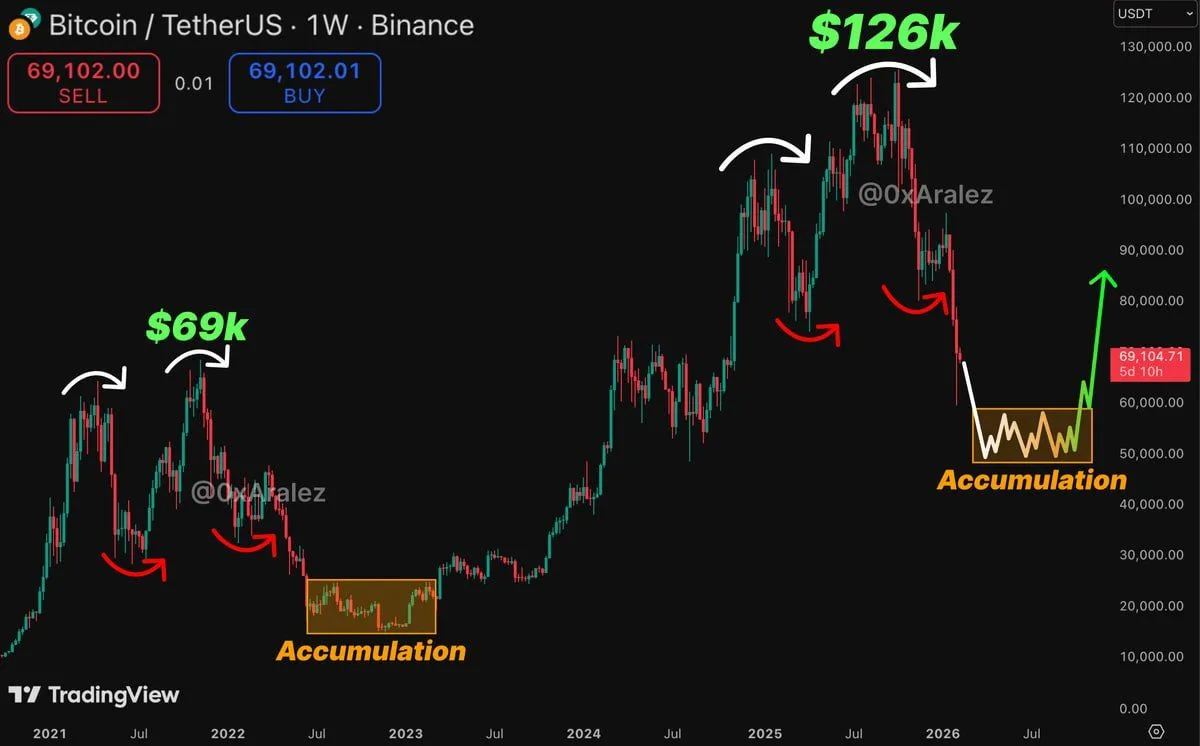

An X person posting as Aralez shared a weekly Bitcoin to Tether chart from Binance and mentioned the setup “predicted a large market drop,” whereas arguing value motion now repeats the 2021 bear cycle. Within the submit, Aralez pointed to Bitcoin buying and selling close to $69,100 and mentioned the subsequent section may very well be an eight-month accumulation band between $45,000 and $60,000.

Bitcoin 2021 Bear Cycle Repeat Chart. Supply: Aralez on X

The annotated chart highlights two cycle peaks and the selloffs that adopted. It marks Bitcoin’s 2021 prime close to $69,000, then reveals a steep decline into 2022, adopted by a boxed “accumulation” zone that sits across the low-$20,000 space. On the appropriate aspect, it labels a later peak close to $126,000 after which attracts curved arrows over successive swing highs and pullbacks, framing the drop as a repeat of the sooner cycle’s topping sequence.

After the newest decline, the chart tasks a second boxed “accumulation” space round $45,000 to $60,000, with a jagged line suggesting sideways buying and selling earlier than a possible transfer larger. The visible additionally features a inexperienced upward arrow close to the $80,000 degree, which means an eventual rebound after the vary. Nonetheless, the submit presents a state of affairs fairly than a confirmed final result, because the projection depends upon whether or not value stabilizes inside that band as an alternative of extending the selloff beneath it.

Daan Crypto Trades says Bitcoin drop passes 50% mark as chart maps selloffs to shifting narratives

Daan Crypto Trades mentioned on X that Bitcoin has fallen greater than 50% from its all time excessive, and due to this fact the present downturn feels more durable to purchase as a result of he sees no single headline driving it. He framed the transfer as a easy provide and demand imbalance, saying sellers outweigh patrons, whereas including that sentiment has deteriorated as a result of merchants battle to discover a clear constructive catalyst.

Bitcoin Selloffs and Market Narratives Chart. Supply: Daan Crypto Trades on X

In a TradingView chart dated Feb. 10, DaanCryptoTrades annotated a number of pullbacks throughout the broader uptrend and linked earlier drawdowns to particular episodes. The labels embrace “Financial institution Failures USDC FUD,” “2023 Submit Bear Market Restoration Chop,” “Submit ETF Promote Off,” “Submit ETF Mania Promote Off,” and “Gox Distributions,” every paired with a day rely that means how lengthy the droop lasted.

Later, the chart marks “Yen Carry Commerce Blow Up,” “Submit Inauguration & Tariffs,” and “Center Japanese Battle,” then highlights an extended stretch labeled “Cycle Ending Fears Robust Whale Promoting Huge Liquidation Occasion (46 days).”

The appropriate aspect of the chart factors to a different decline tagged “General Market Volatility Excessive Crypto Weak spot (23 days),” with a steep drop into early 2026. A value label on the chart reveals Bitcoin round $68,610, and the submit argues that this section lacks a dominant narrative that would soften the selloff in merchants’ minds.

DaanCryptoTrades mentioned that, with no clear outlook, many contributors look forward to momentum to return, and he described his method as transferring slowly and accumulating over time whereas staying ready for various outcomes.