Bitcoin latest worth momentum which led to a renewal of its all-time excessive (ATH) seems to have reignited curiosity in key metrics used to time market entries and exits.

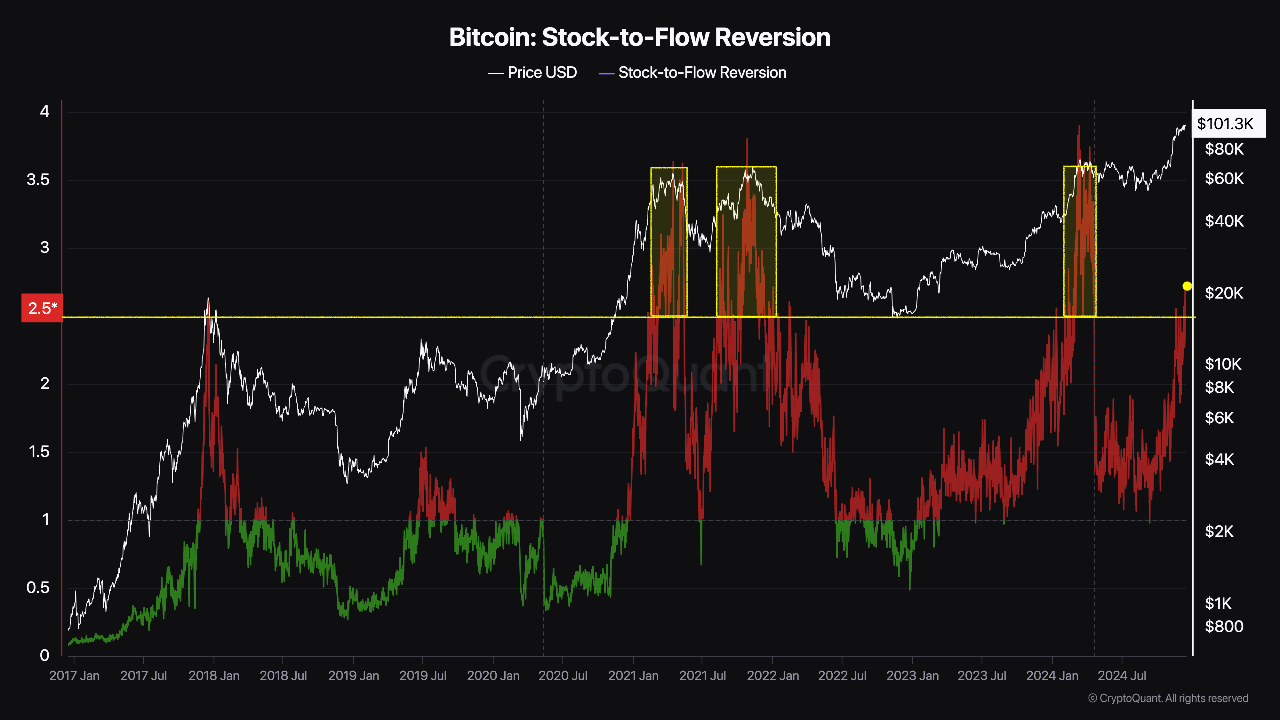

Amongst these, the Inventory-to-Move (S2F) reversion metric has been highlighted by a CryptoQuant analyst often known as Darkfost, who shared insights on its present implications for Bitcoin traders.

The metric, a measure of Bitcoin’s worth deviations from its anticipated worth based mostly on the S2F mannequin, has grow to be an vital instrument for a lot of merchants assessing market sentiment and figuring out potential profit-taking home windows.

When Ought to Money In Your Bitcoin Income?

Darkfost’s evaluation factors to September 11 as a major date, when the S2F reversion metric dropped under 1, signaling a possible purchase alternative as Bitcoin traded at $57,000.

Now, the analyst emphasizes a distinct crucial threshold—a price above 2.5—traditionally indicating a good time to safe average income. Ought to the metric attain a price above 3, it typically alerts market overheating, marking an opportune second for bigger profit-taking methods.

The S2F reversion metric presents a structured strategy to assessing Bitcoin’s worth cycles. Darkfost suggests a two-step revenue technique: traders ought to take into account securing smaller positive factors when the metric hits 2.5 and proceed to bigger profit-taking if it surpasses 3.

Darfost notably wrote:

A prudent technique when utilizing this indicator is to take average income as soon as the S2F reversion ratio hits 2.5 and to safe bigger income when the ratio exceeds 3, thereby balancing danger and reward successfully.

BTC Market Efficiency

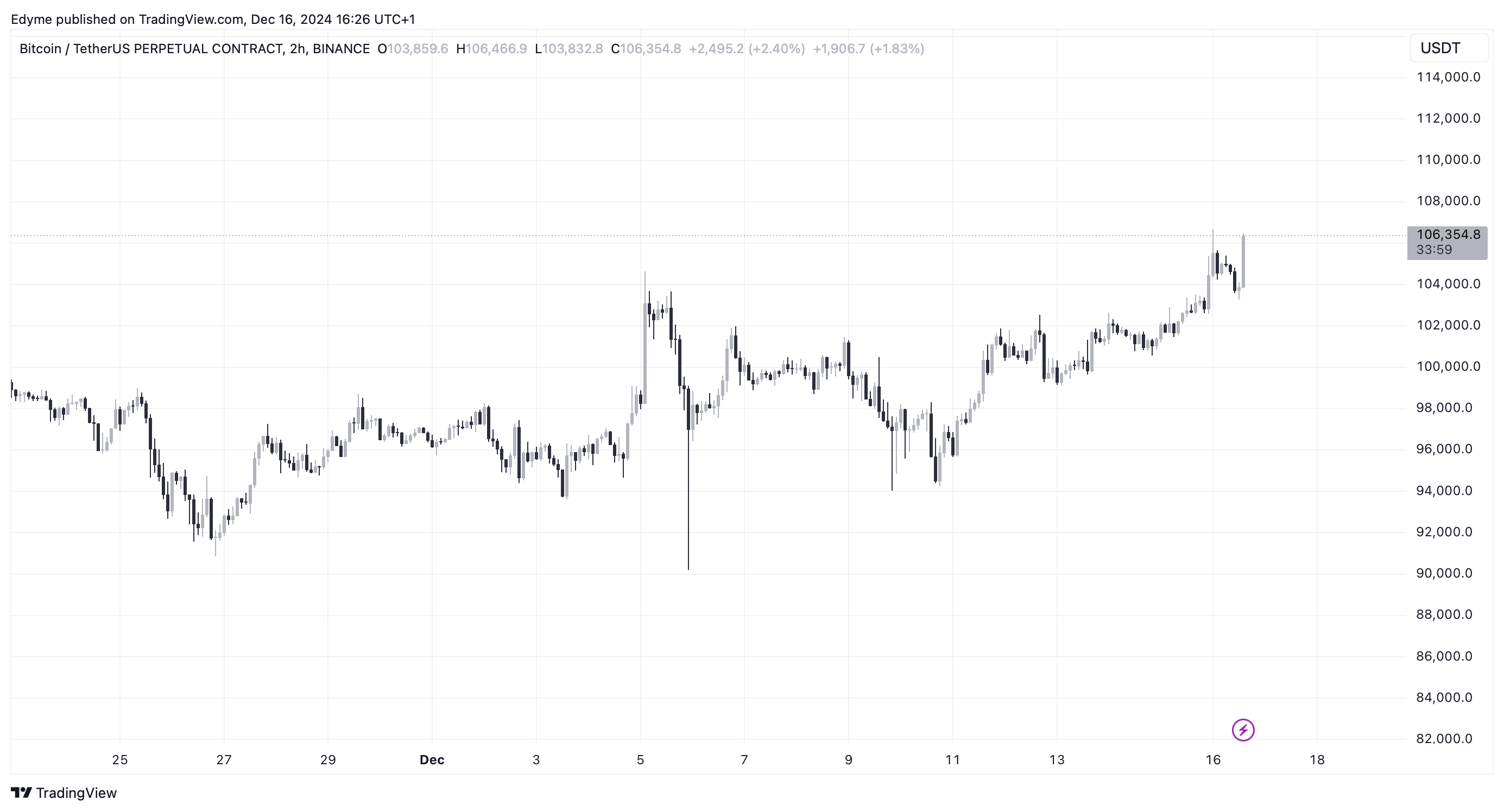

Whatever the advised indicator by Darkfost on when to take revenue, Bitcoin seems to not be slowing down in its upward momentum. To this point, BTC has created a brand new ATH after buying and selling as excessive as $106,352 within the early hours of Monday.

Though on the time of writing, the asset has seen a slight rebound at present buying and selling at a a worth of $105,942, nonetheless, BTC remains to be up by over 3% prior to now day greater than 10% prior to now two weeks.

Unsurprisingly, together with the rising worth, BTC’s market capitalization has additionally seen a major surge in its valuation now sitting at roughly over $2 trillion as of at this time. In the meantime, regardless of this optimistic momentum, BTC’s each day buying and selling quantity has seen fairly an reverse development.

Significantly, this metric as an alternative of seeing an increase amid the brand new ATH of BTC, has stay steady and decrease than final week’s each day buying and selling quantity. On the time of writing, BTC’s buying and selling quantity sits at $97.4 billion, a major decline from the over $140 billion quantity valuation seen final week on December 10.

Featured picture created with DALL-E, Chart from TradingView