With February now half method by way of, Bitcoin is on the verge of printing an unfavourable entry in its historical past e book. That is the primary 12 months in Bitcoin’s historical past the place each January and February to this point are within the purple. To ensure that Bitcoin to keep away from this situation, a month-to-month shut above $78.6K.

Nevertheless, with momentum turning towards the draw back over the previous 4 weeks, the rising chance of this sample breaking is elevating severe questions on whether or not it is a regime shift or only a momentary anomaly.

Q1 has to this point been unforgiving for the biggest and oldest crypto asset. From the beginning of the 12 months to at present, worth has fallen roughly -22%, marking the weakest begin to a 12 months since 2018. February specifically has carried the majority of the drawdown, with Bitcoin down 12.75% for the month. This makes it the third-largest February decline in Bitcoin’s historical past. The image appears to be like bleak on the floor as this provides to the concept one thing is structurally damaged in Bitcoin’s worth motion.

Nevertheless, zooming into seasonality traits alone misses the larger image. All through Bitcoin’s historical past, sharp drawdowns of over -75% publish all time highs are frequent. Presently, despite the fact that sentiment may’ve reached an all time low and on-chain flashing indicators of ache, Bitcoin sits at round a forty five% correction. The essential query right here turns into what forces are driving the present dump and whether or not this correction nonetheless suits throughout the vary of typical publish $ATH corrections, each by way of cycle period and on-chain behaviour.

How Uncommon is a Pink January and February?

The actual fact is Bitcoin has by no means registered two month-to-month purple candles at the beginning of the 12 months. The closest it received to printing such a sample was again in 2018 which finally went on to turn out to be a protracted bear market till December of that 12 months when $BTC bottomed at round $3100.

What’s completely different and fascinating this time round is the place we sit within the publish $ATH timeline. Bitcoin is already roughly 4 months right into a correction since posting the $ATH in October, which means this uncommon early-year weak spot is showing after an already ongoing correction. In distinction, the 2018 decline had solely begun following the December 2017 peak.

This distinction is essential as a result of traditionally, weak begins to the 12 months have usually appeared throughout late-cycle unwinds or through the transition into an extended bear part. The present situation, nevertheless, is noticeably completely different and therefore sits in an ambiguous center floor. Early-year weak spot is rising after a number of months of prior draw back, elevating the important thing query of whether or not the market remains to be progressing by way of a typical post-$ATH correction or already transferring nearer to the later levels of a bottoming out part.

February’s Historic Power Defined

A cause for why this sample is traditionally very uncommon is that February is normally a bullish month for Bitcoin for a myriad of causes. The reply lies much less in easy seasonality and extra in a mixture of positioning resets, liquidity cycles and, extra not too long ago, institutional flows.

One of the crucial influential components is the post-January positioning reset. January usually acts as a month for rebalancing portfolios and tax-driven promoting, particularly after a bullish quarter 4. This tends to entrance run volatility and revenue taking within the first few weeks of the 12 months and February normally turns into the interval the place promoting stress reduces and danger urge for food steadily returns.

One other issue that always comes into play is the Chinese language New 12 months Liquidity cycle. Traditionally, liquidity situations in Asia tighten forward of the vacation interval and start to normalize afterward. As buying and selling exercise resumes and capital flows return to danger belongings, Bitcoin has incessantly benefited from improved demand throughout February and early March. Whereas this impact is tough to quantify exactly, the sample has appeared persistently sufficient to turn out to be a broadly noticed seasonal tailwind.

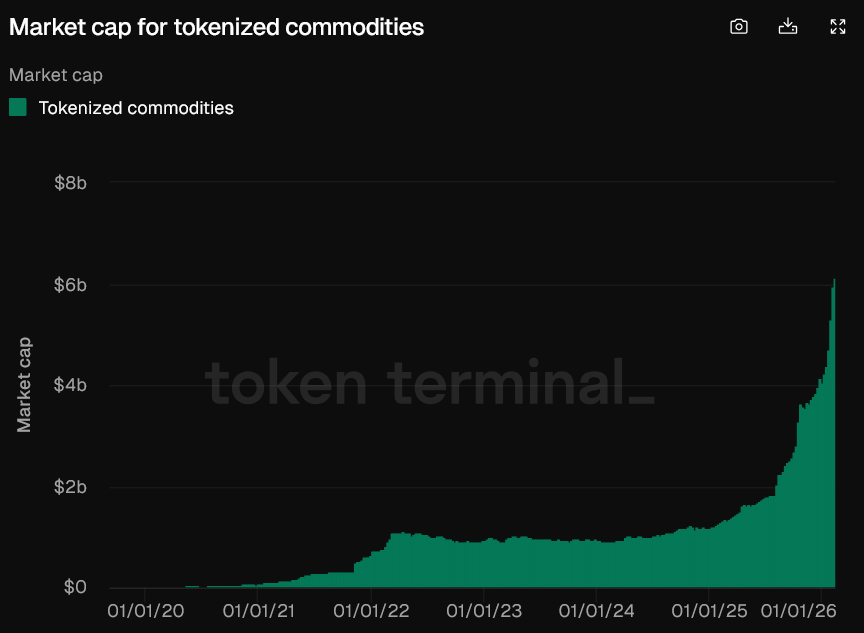

The trendy market construction with institutional adoptions add one other new layer to this dynamic. With the arrival of spot Bitcoin ETFs in January 2024, early-year efficiency has more and more been influenced by institutional allocation cycles. Q1 of 2024 noticed roughly $12.13 billion in web inflows, adopted by $922.09 million in Q1 2025. This 12 months, nevertheless, the pattern has sharply reversed. The market has already recorded roughly $2.28 billion in web outflows this quarter, coming after vital withdrawals in November and December. This shift in ETF move dynamics represents a significant departure from the supportive early-year demand that helped underpin prior February power.

That stated ETF flows are just one a part of the story. To know why there’s been such a decline, we have to take into account the confluence of headwinds weighing available on the market.

When Seasonality Breaks, Macro Normally Dominates

Seasonality tends to work greatest when the macro backdrop is impartial or supportive. Presently this isn’t the case. Elevated rates of interest, uncertainty round inflation and tighter monetary situations have traders opting towards safer, yield-bearing belongings. Bitcoin has entered a maturation part the place it’s more and more interconnected with conventional markets, and whereas that is beneficial for accessibility and adoption, it additionally comes with the asset class now transferring in step with danger sentiment.

This total macro atmosphere has had a visual affect on market behaviour. Liquidity has tightened, leverage has unwound and realised losses have shot up because the finish of January as weaker arms proceed to exit positions and add promote aspect stress. Due to this fact, this weak begin to the 12 months is far more than a easy seasonal deviation however a part of a broader risk-off atmosphere brought on by macro uncertainties.

Is that this a Bear Continuation Sign?

A weak first quarter for Bitcoin, nevertheless, doesn’t definitively sign a continuation of bearish worth all year long. For instance, in 2020, $BTC printed a -10.83% Q1 after which went on to rally near 240% till 12 months finish. Equally, in 2015 and 2016, $BTC began with a weak Q1 and ended the 12 months within the inexperienced.

That stated, it’s essential to grasp that Bitcoin bottoms are a course of and never an occasion. In different phrases reaching a cycle backside can take time to play out. From a pure timeline perspective, Bitcoin is to this point following the four-year cycle to a T.

Once we take a look at the prior two cycles, it took Bitcoin roughly 1060 days to hit a brand new all time excessive from cycle lows. Within the newest cycle, this was 1050 days, exhibiting a powerful alignment taking part in out. Now if we invert this and study the time from cycle highs to lows, the final two cycles reached a backside nearly round 370 days from earlier all time highs. If we have been to extrapolate that information, that will level to a possible backside in October of this 12 months.

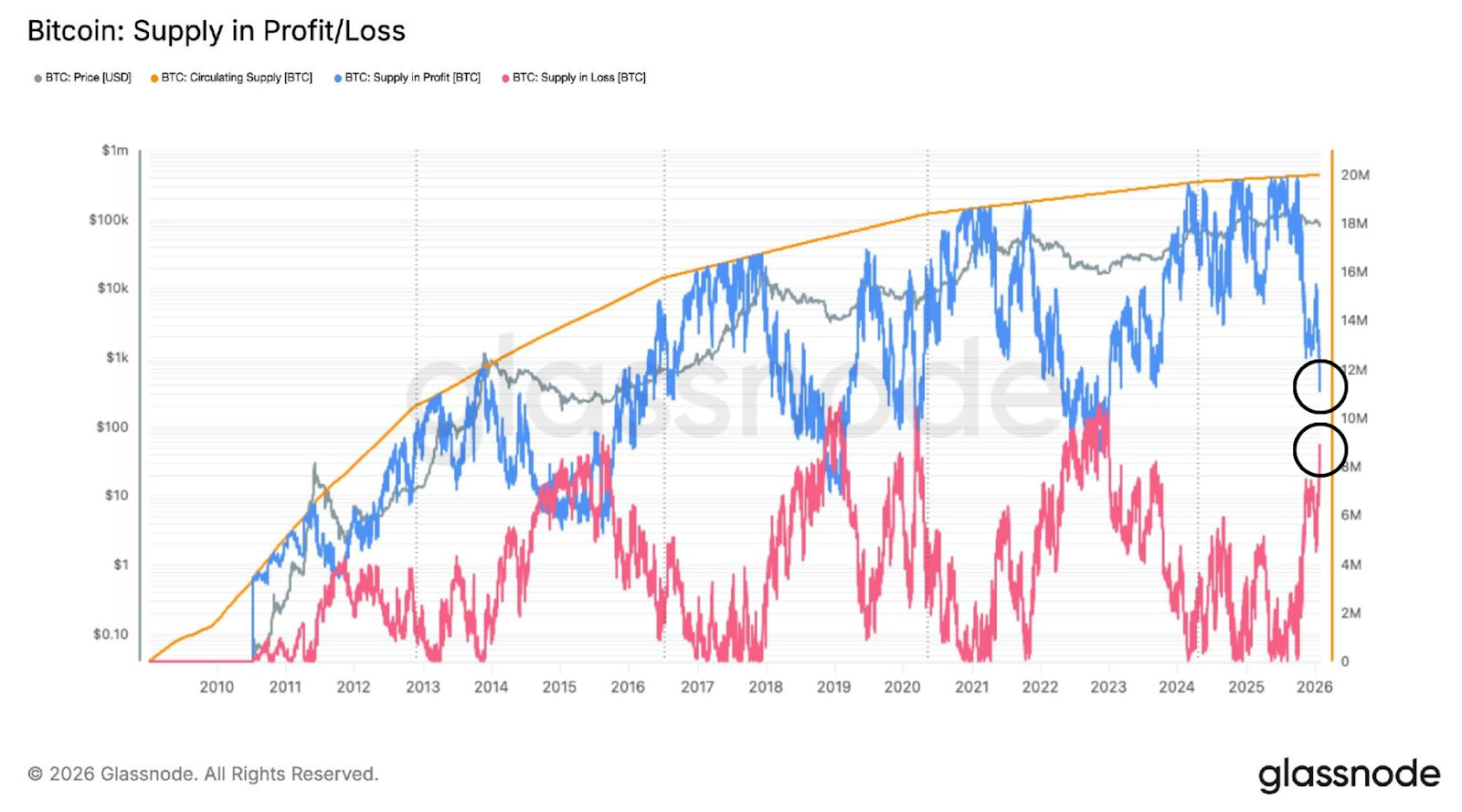

This isn’t to say that this has to play out once more, however the cyclical nature of Bitcoin suggests it’s broadly following its common course, and it could be unwise to disregard it. On-chain alerts such because the share of holder provide in revenue versus loss, are additionally reaching ranges solely seen throughout bear market lows. That stated, it’s essential to notice that the crossover between these two cohorts takes time to develop and kind a base, however nonetheless nonetheless alerts an opportunistic interval for accumulation.

In the end, how shortly a backside types will rely upon macro situations and whether or not an easing of uncertainty can drive contemporary demand and a return to sustained ETF inflows.